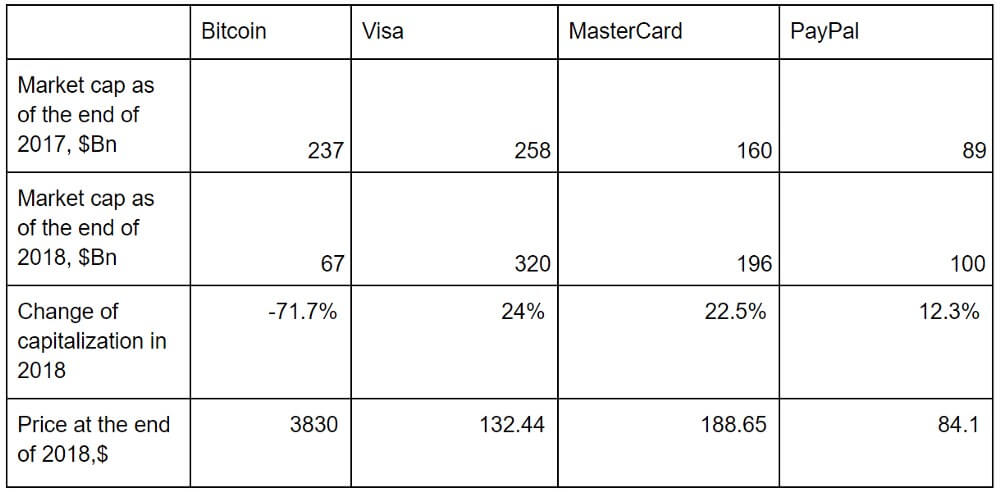

DataLight, a cryptocurrencies data analytics platform issues a report that compared Bitcoin, Visa, MasterCard, and PayPal as a method of payment. The report weighs traditional financial indicators including annual price changes and changes in capitalization.

As per the analysis, the traditional payment systems have observed over 10% growth and Bitcoin showed a sharp decline in comparison. Check out the table below for the comparison of economic indicators for Bitcoin, Visa, MasterCard, and PayPal

At the time of the famous Bitcoin bull that occurred in late 2017, the token’s capitalization increased from $25 billion to $240 billion, following Visa’s market cap movement. As and when the bear market kicked in 2018, Bitcoin’s average daily volatility was three times higher than the 6% volatility rate of its competitors.

The research further elaborates over the total number of transactions per year on the platform. Visa led the race with 124 billion transactions and PayPal secures the last place with 10 billion transactions. Bitcoin grabbed the second highest level of transactions per year with 81 billion and Mastercard is at the third position, with 74 billion yearly transactions.

In terms of total transaction and payment volume, BTC manages to surpass PayPal with $3.4 trillion, versus PayPal’s $57 billion. As for Visa and Mastercard, the duo leads the race with $11.2 trillion and $5.9 trillion transaction and payment volume respectively.

With the staggering total of $3.4 trillion transferred with Bitcoin last year, we decided to compare Bitcoin with traditional payment systems and the results are very surprising.

Follow the link below to read the full study! https://t.co/QxAjZrzeyb— DataLight (@DataLightMe) April 1, 2019

Transactions

Bitcoin’s average transaction was the highest among the four payment methods with an average sum of $400,000, which is 450 times larger than Visa’s. The figures imply that Bitcoin’s network may be more suitable for larger payments. The report states:

“When transferring sums below $100, it is more reasonable to use Visa and MasterCard, but if the sum increases, Bitcoin begins to look better. Its $0.20 fee (as of the end of 2018) is the same for all transactions, even those worth millions of dollars. In this case, the fee percentage is even lower, especially compared to classic payment systems. That is why the average transaction volume differs so much: it is more profitable to transfer large sums with a fixed rate rather than a percentage of the transferred sum.”