The cryptocurrency market continues its bout of profit-taking on Saturday. As of press time, Bitcoin and most Altcoins were posting slight to significant losses. Bitcoin traded to lows of $34,635 while Ethereum was seen recovering from intraday lows of $2,258. The week had been quite mixed for Altcoins following the El Salvador Bitcoin adoption news which boosted BTC price.

On a 7 day basis, top Altcoins such as Binance Coin (BNB, -14.17%), Cardano (ADA, -13.18%), XRP (-11.00%), Uniswap (UNI, -15.91%), Chainlink (LINK -20.69%), Polygon (MATIC -19.53%), Shiba Inu (SHIB, -30.39%), Sushiswap (SUSHI, -26.78%) recorded significant declines in comparison to Bitcoin’s weekly loss of 0.87%.

Concerns from China continue to be a major drawback while the news of El Salvador’s adoption of crypto and of Twitter likely to integrate lightning network remains some of the positive highlights for the week.

In recent news, Jack Dorsey hinted that Twitter may likely integrate the Bitcoin layer 2 payments Lightning Network. The Twitter founder in a tweet had voiced his appreciation for Lightning Network-powered messaging app Sphinx Chat, prompting a follower to ask for the network to be integrated into BlueSky or Twitter to which he replied “Only a matter of time,”.

Crypto investor, Constantin Kogan believes the recent mix of news developments is leaving traders without a true market direction. However selected tokens such as Prometeus (PROM, + 18.97%), Waves (WAVES,+ 4.13%) , KEEP (+ 16.41%), HEX (+ 15.47%), Nervos Network (CKB, +7.30%), Energy Web Token (EWT,+ 4.73%), Bitcoin Diamond (BCD, +11.88%), Utrust (UTK, +11.26%), Quant (QNT, +9.30%) Stellar (XLM, +4.10%) recorded a spike in value during Saturday trading.

Chainlink, now the 15th largest cryptocurrency has been in a downside consolidation after the declines from the May 10 all-time highs of $53 while the barriers at $26 and $34 continue to cap upside movement.

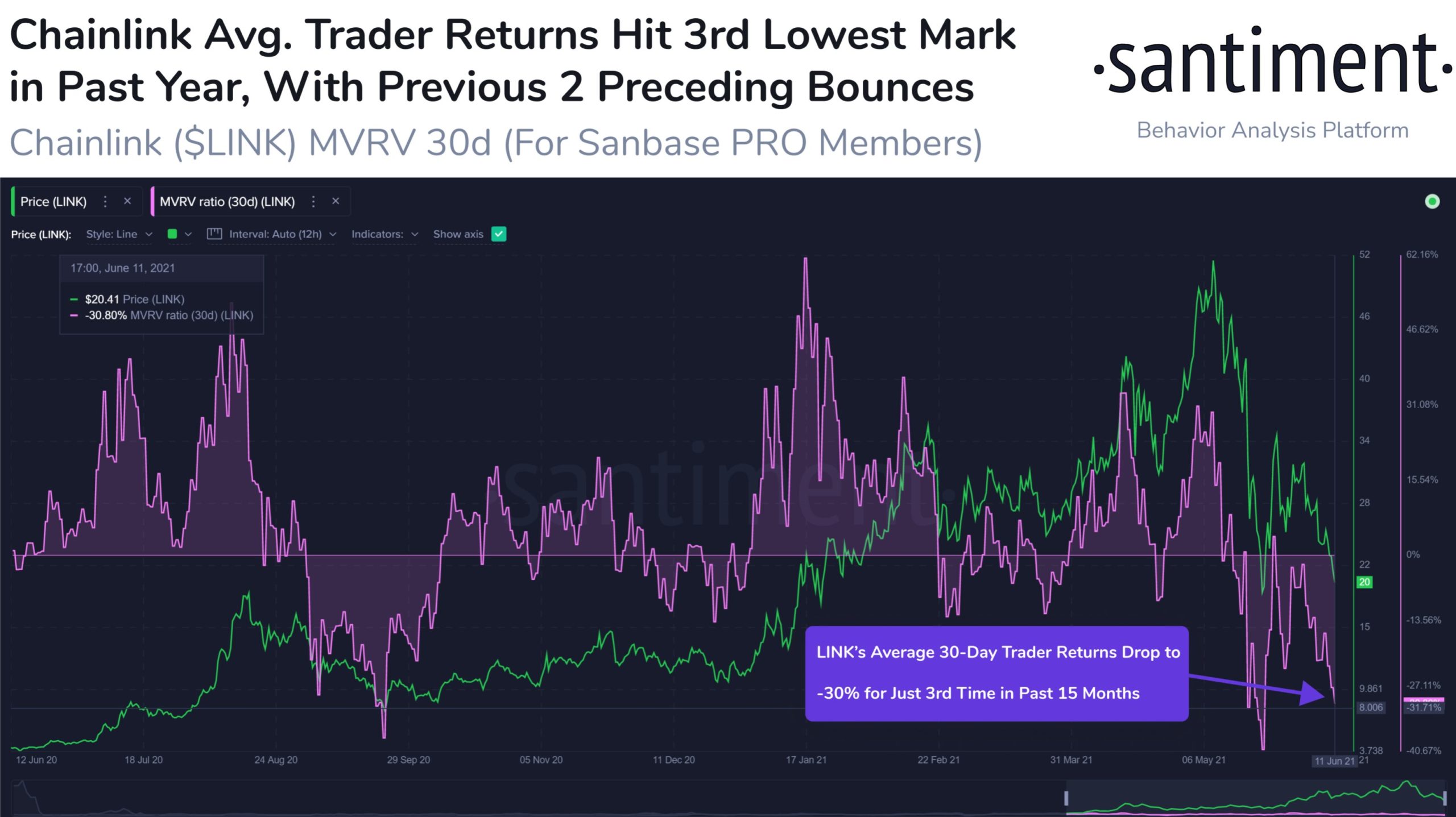

However, the Chainlink average trader returns give a ray of optimism, suggesting a bullish reversal on the Chainlink price. On-Chain data analytics, Santiment noted that LINK trader returns hit the 3rd lowest mark in the past year which historically is a bullish signal.

MVRV 30d, Courtesy: Santiment

MVRV 30d, Courtesy: SantimentSantiment stated:

Chainlink holders have watched the price drop from $52.20 to $25.27 (a -51.6% drop from last month’s #AllTimeHigh). However, the previous times that $LINK trader returns dropped this low in 30 days, there were major bounces that followed.

Chainlink was trading at $22.45 as of press time, up 3.60% on the day.

Image Credit: Santiment, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.