As 2020 comes to an end, it may be necessary to have a brief throwback and also reflect on what the year 2021 holds for the cryptocurrency market, Bitcoin (BTC), Ethereum (ETH), and decentralized finance.

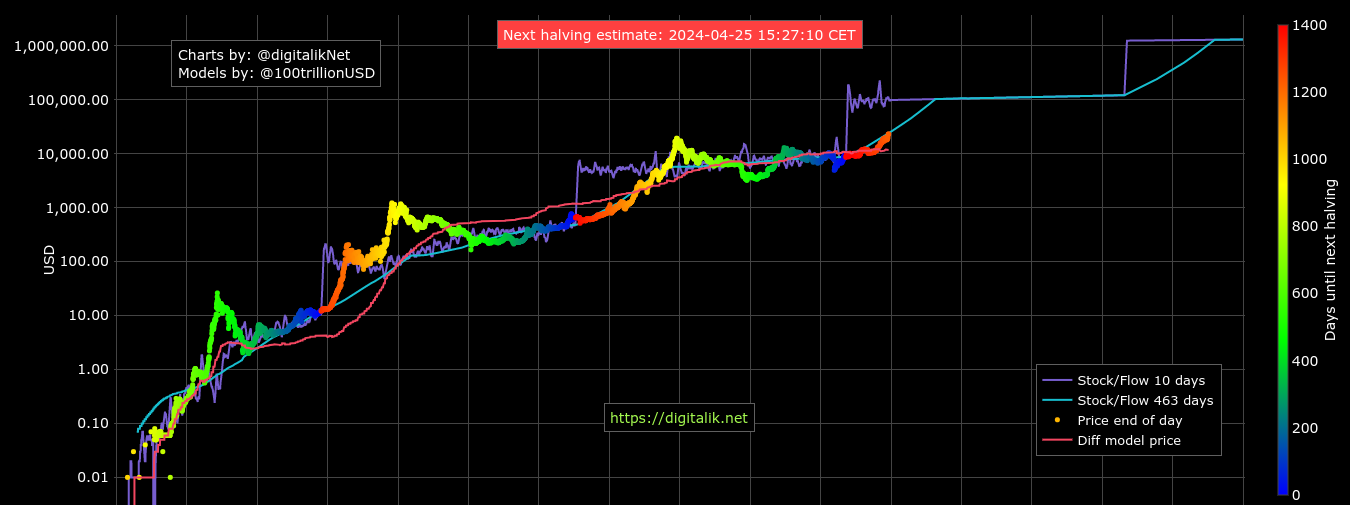

The year 2020 was a historic one for Bitcoin as it cracked the $20,000 for the first time, subsequently entering uncharted territory. Bitcoin had its third halving on May 11, 2020. Halving is considered as a bullish event as the price of Bitcoin increased by 5,500% averagely after the prior halvings.

The DeFi boom, increasing institutional interest in ETH, and the successful launch of ETH 2.0 all made 2020 a year to remember for Ethereum (ETH).

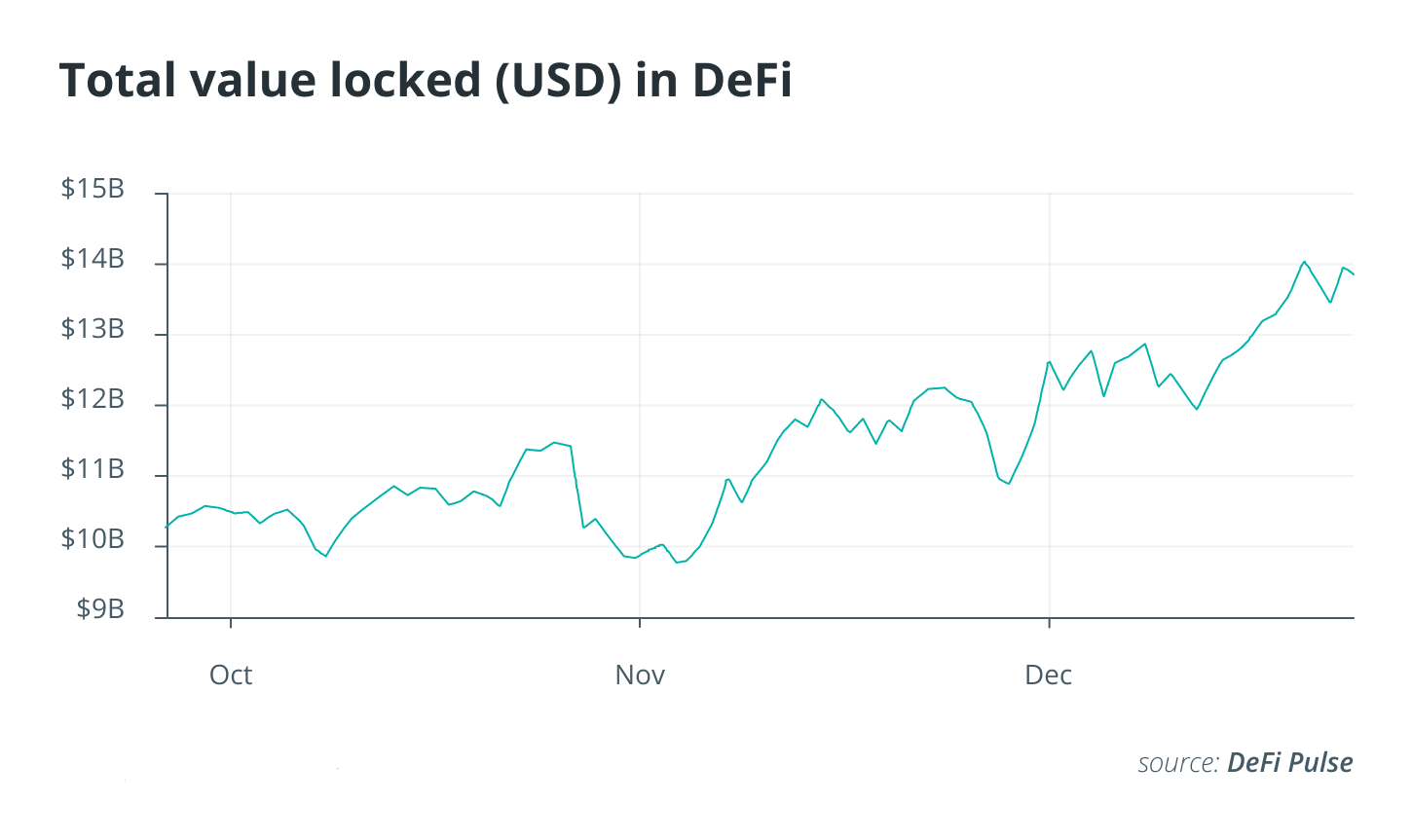

In 2020, DeFi’s historic rise in total value locked surpassed $16 billion making the sector one of the most discussed topics.

1) Bitcoin to Hit $100,000 by the End of 2021

Based on price increases from previous halvings and If history rhymes, it is predicted that Bitcoin may most likely hit the $100,000 mark by the end of 2021.

Bitcoin stock-to-flow historical chart. Courtesy: Digitalik

Bitcoin stock-to-flow historical chart. Courtesy: DigitalikThe Stock-to-Flow model, which is based on halvings and the BTC supply puts Bitcoin at a potential target of $100,000 by the end of 2021.

2) ETH Discovery and Investment Options

Unlike BTC, ETH is about 60% beneath its ATH indicating there is room to the upside. Since the start of 2020, the number of ETH addresses holding for over a year increased from 17.7 million to nearly 29 million. In 2021, it is predicted that institutional players will continue discovering ETH and its investment features.

3) ETH Mining Will Be Bye-Gone

Mining will be officially disabled on Ethereum blockchain in 2021 as ETH 2.0 which will make Ethereum purely a Proof-of-Stake (PoS) consensus is to be fully rolled out.

4) ETH Will Decouple From BTC

Ethereum has been seen to mirror Bitcoin price actions. It is predicted that this narrative might change due to the massive institutional inflow into Bitcoin which may cause a decoupling between BTC and ETH, other Altcoins inclusive.

5) The Rise of NFT

NFTs or non-fungible tokens encompass things like digital art, gaming assets, and other digital artifacts. These tokens are based on the Ethereum blockchain. Considering that the benefits associated with NFTs are being brought to bear gives the market opportunity to grow in 2021.

6) DeFi Will Continue to Thrive

Though there are concerns about regulatory onslaught against DeFi, the sector will continue to thrive in 2021. Also, it is predicted that there will be increased DeFi adoption by the traditional financial industry.

Courtesy: defipulse.com

Courtesy: defipulse.com7) DeFi Innovations Will Spread Their Tentacles Into Non ‘Financial’ Sectors

Dan Simerman of the IOTA Foundation predicts that In 2021, DeFi core innovations such as pool lending and liquidity mining will permeate into applications that weren’t considered ‘financial.’

8) Emergence of New DeFi Platforms

Michael Zochowski, head of DeFi at Ripple predicts that New DeFi platforms will emerge. Stating –

‘Expect more sidechain projects, bridges between networks, and smart contracts building momentum on new networks. With Eth2 still years away, I anticipate at least 25% of the value deployed in DeFi by the end of 2021 to be on networks besides Ethereum’

9) Transition From DApps to ZApps, Better Handling of DeFi Risks

Paul Brody of Ernst & Young blockchain technology predicts –

‘we will see DeFi contracts mature, but we will also see a transition from DApps towards something we are calling Zapps — zero-knowledge applications, smart contracts are going to be hacked and exploited, and we’re going to learn how to manage those risks while creating value’

10) More Regulatory Pressure Will Lead to Anonymous Dev-Founded Projects and Independent Stablecoins

Meltem Demirors of CoinShares predicts ‘We expect to see more regulatory pressure, and therefore more anonymous dev-founded projects, as well as the emergence of Stablecoins that don’t have any single point of control, like Empty Set Dollar (ESD) or Basis Cash (BAC). We expect to see more assets to be “wrapped,” i.e., securitized, and made available as collateral on-chain’

Image Credit: Digitalik, DeFiPulse, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.