The second-largest cryptocurrency, Ethereum (ETH) rose to fresh all-time highs of $2,646.20 on Apr. 22, while the crypto market struggles to recover from previous declines. Bitcoin and the majority of Altcoins traded in red at the time of writing, while Ethereum stole the spotlight of the show.

The resurgence of interest in decentralized finance (DeFi) is giving selected DeFi tokens such as Maker (MKR), Compound (COMP, +12.22%), Solana (SOL, +17.42%) a market boost. The growth in the DeFi sector is reflected in a nearly 20% increase in the crypto market cap since the last 24 hours with a recent value of $108.14 billion.

A recent report from data aggregator Messari indicates that lending protocols in Q1 2021 saw an explosion in growth as DeFi continues to gain widespread adoption. It also noted that during the quarter, lending deposits across major lending protocols surpassed $25 billion which represents a 2.8 fold increase from the end of Q4 2020. Summarizing this rapid growth, it stated that ‘Lending protocols had their best quarter in DeFi’s short history’

It states:

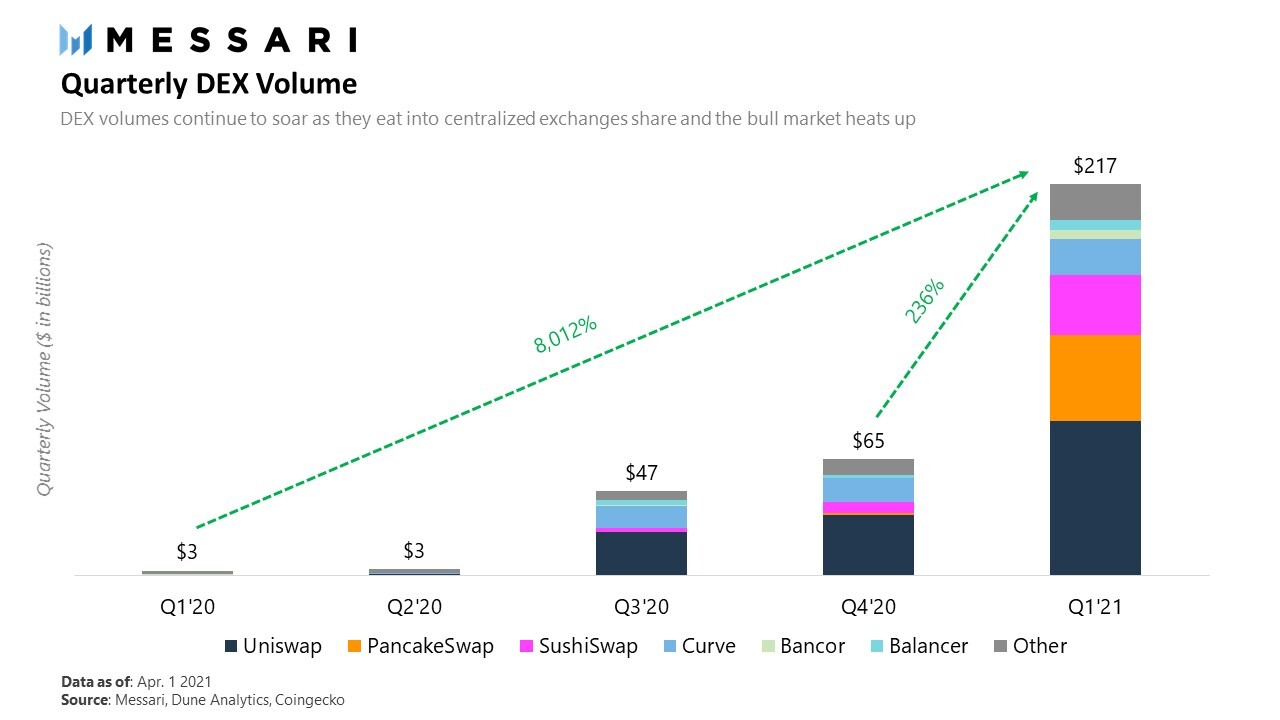

‘Simply noted, DeFi is booming. In Q1 2021, DEX volumes went parabolic reaching over $217 billion this quarter, up 236% from Q4 2020, and a whopping 8,012% from Q1 2020. UniSwap led the pack, with a few following behind @PancakeSwap, @SushiSwap, @CurveFinance.

Quarterly DEX Volume, Courtesy: Messari

Quarterly DEX Volume, Courtesy: MessariNotable DEXs have also recorded historical milestones in Q1 such as PancakeSwap becoming one of the largest DEXs by volume, THORChain cross-chain liquidity protocol going live in April, and Bancor’s resurgence with the V2.1 launch.

Crypto analyst and trader, Rektcapital @rektcapital tweeted on Apr. 22 regarding the ETH/BTC chart standing

‘Altcoins are on the cusp of something truly historic.’

Against Bitcoin, ETH has climbed higher in the last three days, reaching 0.048 the highest ever seen since August 2018. Real Vision CEO Raoul Pal noted this and stated in a tweet:

‘To be brutally honest, I stare at the chart of ETH/BTC and I see an enormous rounded bottom with potentially huge breakout just above’.

He also hinted at how ETH is fast becoming the currency of the digital world “When you price anything up in DeFi, NFT, community tokens or even metaverse worlds, everything is priced in ETH, including designers time. ETH is rapidly becoming the currency of the digital world and BTC is the pristine collateral and base layer.”

A reducing Bitcoin dominance is also buoying Altcoins’ bullish prospect as analysts have noticed that each time Bitcoin loses the 50% mark, Altcoins rapidly move in to fill in the opening, often led by Ethereum (ETH). As of press time, Bitcoin dominance was standing at 50.0%.

This loss of ground in Bitcoin dominance often sparks ‘the Alt season narrative — a phenomenon that is part of the market cycle where Altcoins rally in their BTC and USD pairings.’ This often cools down when Bitcoin starts to pick up the pace again, which was the case in both mid-2017 and early 2018.

Should history repeat itself, then Altcoins could be on the cusp of something monumental, as stated by the crypto trader @ rekt capital who claims that Ethereum’s breakout to new all-time highs is going to serve as fuel for the next step of Altcoin rallies.

Presently, Bitcoin and the majority of Altcoins are seeing pullbacks in their USD pairings, the trader believes that given the number of years it has taken for Altcoins to develop and form the macro price positioning and market structures they presently have, therefore ‘A pullback on Altcoins here or there won’t affect the inevitable macro uptrends that lie ahead.’

Image Credit: Messari, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.