The first and largest cryptocurrency by market capitalization Bitcoin (BTC) soared to new yearly highs of $13,250. Bitcoin’s stay at $13,000 was however short-lived owing to price rejection. Formidable support kept the selling pressure in check while bulls eye the ultimate lift to $14,000.

$14,000 has been noted in past times as a major resistance level for BTC in mid-2019. In June 2019, when BTC hit $13,970, it immediately retreated to lows of $10,525 within 24 hours. In the 21 days that followed, BTC declined to $9,252, recording a 35% drop. It is been said that there is little resistance between $14,000 and $20,000 due to the previous bull cycle in 2017 ending abruptly, but that doesn’t mean BTC will have a smooth sail to a new ATH.

After the historic climb past $13k on October 22, Bitcoin consolidated within $12,700 and $13,037. Some analysts think that BTC may experience a short term pullback before a climb higher while Denis Vinokourov of crypto exchange Bequant, believes that in the near term, at least, consolidation would lead to a healthier uptrend for BTC rather than an exponential upsurge. This he said:

“Overall, markets are approaching territory that doesn’t offer much in the way of price discovery potential but, for healthy markets, one would expect consolidation as opposed to exponential one-way traffic.”

BTC/USD Daily Chart

BTC/USD Daily ChartBitcoin (BTC) is presently trading at $12,974.

There are likely chances that BTC would see a continuation of its ongoing rally after a short consolidation period. Data from Skew indicates that all Bitcoin markets, including spot, derivatives, and options, are showing a high level of demand after the PayPal news.

Analysts expect the next consolidation range of BTC to be between $12,500 to $13,500 in the upcoming months before the next breakout.

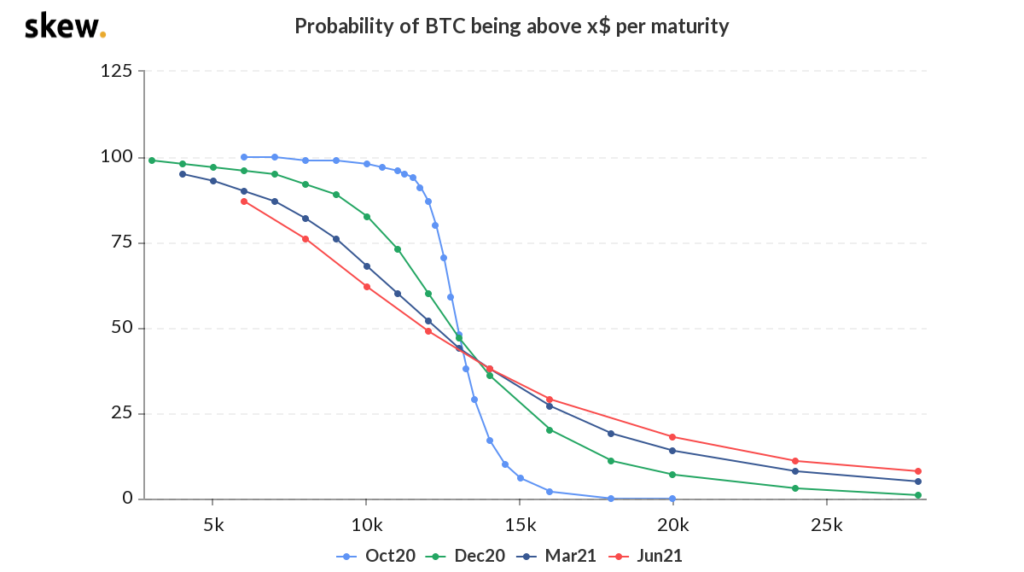

Bitcoin options price probability chart. Courtesy: Skew

Bitcoin options price probability chart. Courtesy: SkewRecent data from Skew indicated a 7% bet of BTC hitting or even surpassing its $20,000 ATH by the end of 2020. 11% betted for $18,000 while 14% indicated that Bitcoin would have reclaimed $20,000 by March 2021, bets for June 2021 stood at 18%.

A group of analysts however believe that Bitcoin will continue its ascent to the upside in the days and weeks ahead, especially due to fundamentals. Vinny Lingham, CEO of Civic and a partner at Multicoin Capital said:

“I haven’t been this bullish on #Bitcoin since 2016. Macro events are teeing us up for another bull run. BTC could go 3-5X in the next 12 months, no coincidence that this period is during the US election. Expect high volatility, but BTC likely won’t drop below $12k during this period.”

And with on-chain and market data continuing bullish signs for Bitcoin (BTC), top analysts believe that a 2017-style rally may be imminent.

According to a recent report by an online comparison resource finder which features 30 crypto experts, Bitcoin’s price is likely to reach $14,283 by the end of the year. While their average prediction stands at $14,283 by the end of 2020, other predictions point to a much higher price tag, for instance, S2F model creator PlanB.

An analyst sees BTC being in the first stage of an inverse Head & Shoulder breakout which may cause its price hitting $19,030 in the coming sessions. The Inverse Head & Shoulder is a bullish indicator that predicts a downtrend reversal.

The analyst noted that Bitcoin is now aiming for $13,829 after which it may climb higher towards the $16,510 level. This move would bring BTC closer to the 2017 structure at $19,030. This may somewhat be another confirmation that a 2017-style rally may be on the way.

Image Credit: Skew, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.