Bitcoin and the majority of Altcoins succumbed to a fresh market selloff on Friday. Bitcoin traded to fresh lows of $35,127 as most Altcoins especially in the top 100 suffered significant losses.

Chainlink (LINK,-20.96%) Polygon (MATIC,-22.60%), Terra (LUNA,- 20.73%), Solana (SOL,-16.27%), and others in the Altcoin category posted double-digit losses. However, selected tokens such as THETA Fuel (+13.59%) and MaidSafeCoin (MAID) managed to suppress the selling pressure a little by trading in the green as of press time.

Friday’s drawdown comes despite hopes of more inflation-boosting U.S. stimulus to come. On May 28, President Joe Biden is reportedly set to release his first full budget, seeking $6 trillion in federal spending for the fiscal year 2022 and $8.2 trillion by 2021. The proposal shows more liquidity could be pumped into the system which remains a potentially bullish signal for Bitcoin and Altcoins.

BTC/USD Daily Chart

BTC/USD Daily ChartAt the time of writing, Bitcoin was trading at $36,772.

Increasing concerns about the environmental impact of cryptocurrency mining and China’s recent regulatory announcements could be attributed as likely reasons why Bitcoin and Altcoins prices had failed to make further advances. The recent ban on Bitcoin mining in Iran took its toll as Iranian President Hassan Rouhani announced in a television address on Wednesday that an immediate ban on all Bitcoin mining should take effect until September.

Also, Iranian authorities are reportedly offering 200 million rials ($873) as a reward for anyone who comes forward with a successful tip regarding the location of illegal Bitcoin miners. In another news, UK police were said to have uncovered an illegal Bitcoin mining facility while searching for a cannabis farm, seizing 100 ASICs.

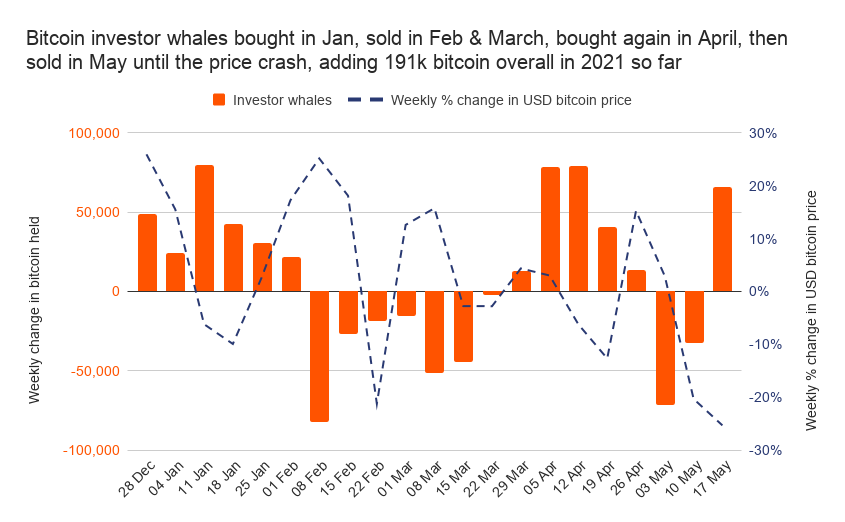

Courtesy: @philip_gradwell/Chainalysis

Courtesy: @philip_gradwell/ChainalysisOther factors such as increased volatility and whale selling may have contributed in a way to Bitcoin’s sell-off. Bybt.com indicated in a recent report that Bitcoin’s 30-day volatility had reached yearly peaks. Philip Gradwell, chief economist at Chainalysis noted that whales sold in may before the price crash. This he indicated from the chart of whale movements for 2021. Stating:

”Bitcoin investor whales bought in Jan, sold in Feb & March, bought again in April, then sold in May until the price crash, adding 191k Bitcoin overall in 2021 so far”.

Matthew Dibb, co-founder, and COO of Stack Funds noted that retail interest seemed to be slowing down while regulatory concerns and china FUD took center stage. Economist cum cryptoanalyst, Alex Kruger tweeted:

“Environmental concerns will get bigger with time. This will represent a major long-term headwind for Bitcoin, and help push dominance down,”

Generally, analysts expect Bitcoin to see sideways trading in the near term while believing that the recent drawdown will be temporary as investors buy the dip.

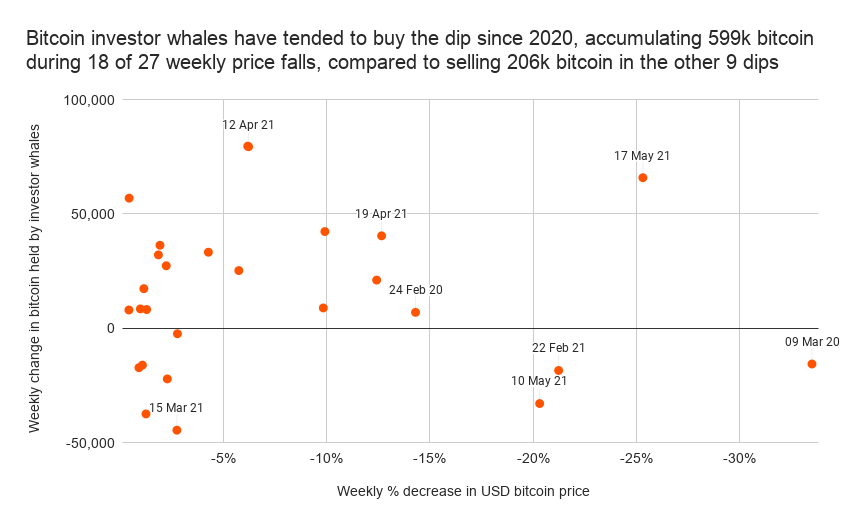

Courtesy: @philip_gradwell/Chainalysis

Courtesy: @philip_gradwell/ChainalysisPhilip Gradwell, chief economist at Chainalysis in an analysis on May 28 indicated that Investor whales tend to buy dips. He tweeted:

”Had a lot of interest in data on whales buying the dip so here is more! The Bitcoin price has fallen from start to end of the week in 27 of the 72 weeks since the start of 2020. Investor whales tend to buy dips, buying 599k BTC in 18 of the 27 dips & selling 206k BTC in the other 9”

Image Credit: @philip_gradwell/Chainalysis, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.