The first and largest crypto asset by market capitalization, Bitcoin (BTC) in a bullish move that kickstarted in the prior week smashed the $12,000 key level to hit highs of $13,250. Bitcoin revved up its engine after Paypal announced its support for cryptocurrencies. BTC bullish momentum was however paused as it confronted a resistance at $13,250.

After a brief consolidation stint, Bitcoin breached above the resistance mounted at $13,250 to set fresh yearly highs of $13,767 today. Bitcoin bulls seem to have been energized by the recent news that a Bank was entering the crypto space.

Although yet to be confirmed, news has it that Singapore Bank DBS had decided to build a cryptocurrency exchange and offer crypto custody services with full regulation from the Monetary Authority of Singapore (MAS).

BTC/USD Daily Chart

BTC/USD Daily Chart At the time of writing, Bitcoin(BTC) is trading at $13,721, up by nearly 5% since the day’s start. This is the most crucial moment for BTC as it approaches $14k. The $14,000 level has been noted in past times as a major resistance level for BTC in mid-2019. In June 2019, when BTC hit $13,970, it immediately retreated to lows of $10,525 within 24 hours. In the 21 days that followed, BTC declined to $9,252, recording a 35% drop.

1) Bitcoin Bulls Seem Unstoppable

From a technical angle, Bitcoin sustaining its move above $13,250 would mark the close of the BTC consolidation phase and the beginning of a new bullish wave. If Bitcoin flips this previous resistance into support, there may be little or no impediment on BTC’s path to $15,000.

This is substantiated by on-chain metrics as The In/Out of the Money Around Price (IOMAP) model reveals that there are no significant barriers above the present price, while the downside is clustered with substantial obstacles.

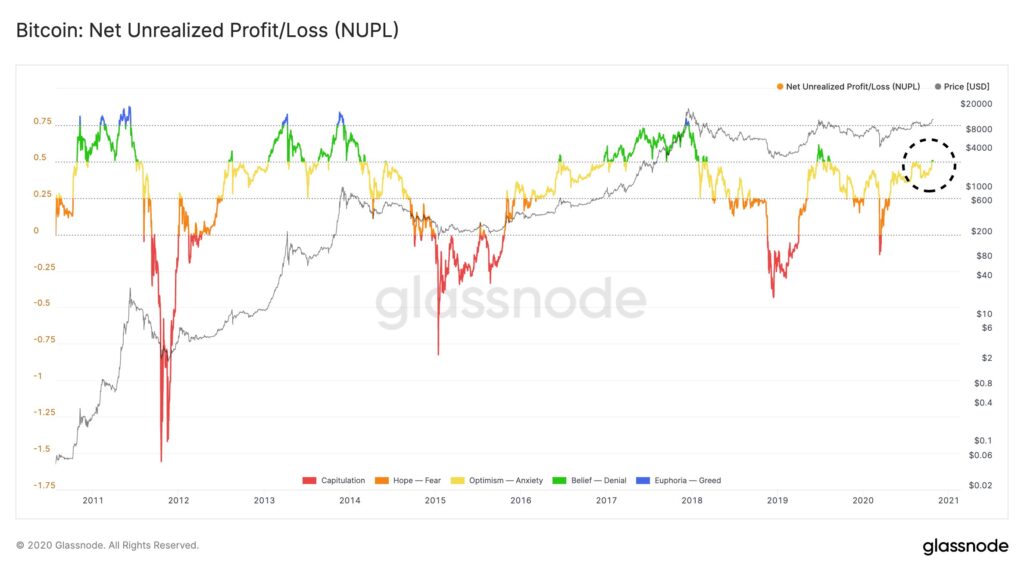

The NUPL of Bitcoin on top of its historical daily chart. Courtesy: Glassnode

The NUPL of Bitcoin on top of its historical daily chart. Courtesy: GlassnodeGlassnode’s Net Unrealized Profit/Loss (NUPL) which measures how many Bitcoin holders are in profit or at a loss entered the ‘belief zone’ today. This has been historically linked to the start of massive rallies. Bitcoin jumped by almost 80% the subsequent month when the indicator flashed in June 2019.

2) Analysts Anticipate Increased Volatility From Options Expiry

The October futures contract expires on Oct. 30 due to all CME monthly Bitcoin futures contracts expiring on the last Friday of every month. Analysts expect a volatility spike on the BTC options market approaching a huge $750 million expiration also coupled with rising open interest.

After the last options expiry on September 25, the Bitcoin price increased from $10,686 to $11,720 after 16 days.

3) Bitcoin Sets New Historic Landmarks

On October 26 following its weekly candle close, Bitcoin officially marked its first completed weekly candle above $13,000 since January 2018. If BTC stays above $13,000 into November, it would confirm its first monthly candle close above $13,000 in nearly 3 years.

4) Analysts Maintain BTC Technical Structure Is Bullish

A trader who remained incognito as Bitcoin Jack stated this:

“BTC 200-day average (green) trending above all-time average (orange) around the time of halving has never failed to induce a supply void driven rally. This is fundamentally programmed into Bitcoin and as long as demand is present, won’t break Last I checked, demand is present.”

The steady climb in Bitcoin price seems to suggest new demand is flowing into the market despite indications of Miner sell-off.

5) $14K Maybe Beckoning and Ultimately New All-Time Highs

A Bitcoin bull, Raoul Pal of Real Vision believes the upward drive has come to stay and more upside gains are likely to be seen more than ever before. This he stated:

“There are only two resistances left on the #bitcoin chart – 14,000 and then the old all-time high at 20,000, I fully expect new all-time highs by early next year at the latest ”.

Image Credit: Glassnode, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.