The first and largest cryptocurrency, Bitcoin (BTC) price wasted no time in 2021, as barely two days into the year, the flagship asset surged to set record highs of $32,500.

Notably, the region just a hair below $30,000 had proven to be a source of intense selling pressure in the last few days. Crypto analyst and statistician Willy Woo, was noted to reemphasize that “The main bull phase is here. Capital inflows have gone nuts.”

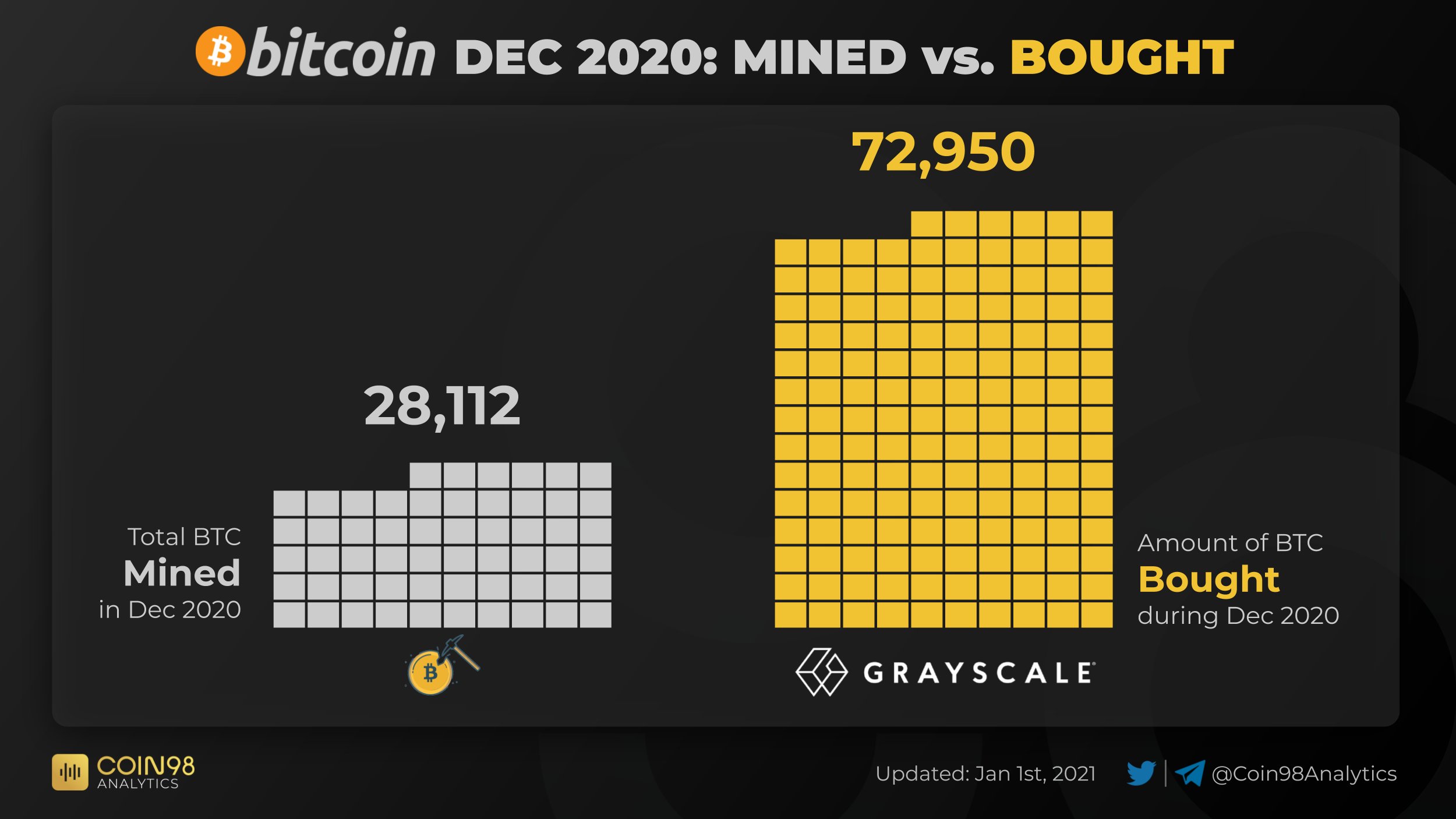

Data analysis resource Coin98 Analytics indicated that Grayscale investments bought up nearly three times the BTC mined in December. Coupled with increased demand from PayPal, Cash App, and the likes, there is an ongoing liquidity squeeze in Bitcoin.

BTC mined vs. bought by Grayscale in December 2020. Courtesy: Coin98 Analytics/Twitter

BTC mined vs. bought by Grayscale in December 2020. Courtesy: Coin98 Analytics/TwitterThe analyst further stated:

“If you’re looking for an entry to HODL Bitcoin long term, don’t nickel and dime an entry. You’re not going to sweat a few thousand dollars of non-perfect entry when it’s $100k, $200k, $300k in a year,”

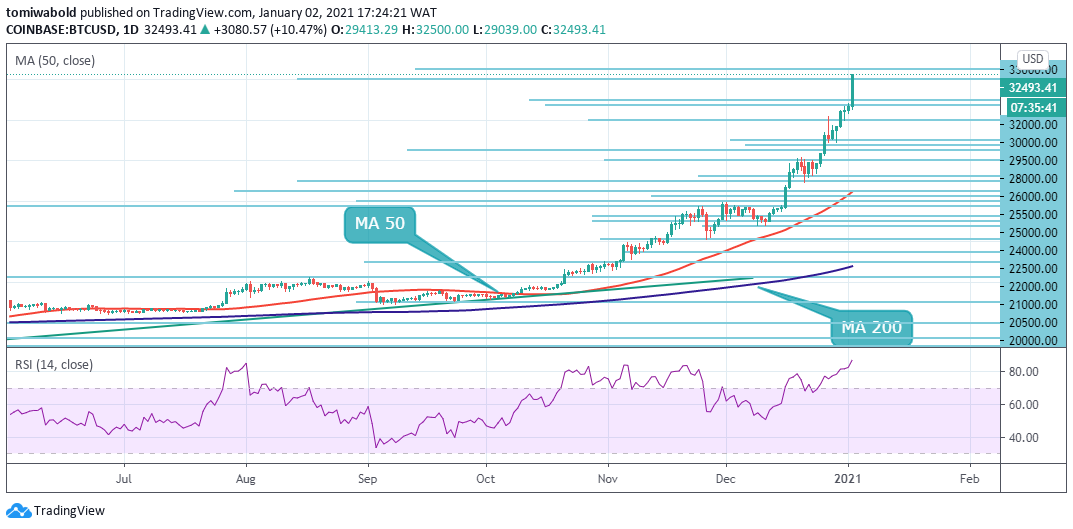

Several metrics have also indicated that Bitcoin will seek to extend its gains in Q1 2021. Bitcoin (BTC) trades presently at $32,493 after setting highs of $32,500. Bitcoin has gained 10.10% which is more than $2000 in the last 24 hours.

BTC/USD Daily Chart

BTC/USD Daily ChartA pseudonymous trader with the moniker “Loma” earlier stated:

“BTC either blows through $30,000 over the next few days into the $31-33k territory or we front-run and reject at like $29,800. Basically what I’m saying is, if you’re shorting $30k, there’s a very good chance you’re going to be ran over.”

Analysts noticed that despite the recent rally, the futures funding rate on Coinbase and other major exchanges have remained at around 0.01% or even less, depicting that traders in the Bitcoin futures market aggressively shorted Bitcoin near $30,000. Data from Tradingview indicated that $100 million of shorts were liquidated in BTC’s recent surge.

In contrast, retail investors in the Bitcoin spot market, which is a non-derivative and no leverage exchange, have been accumulating BTC. On Dec. 31, analysts at Santiment noticed an increase in on-chain movements which may indicate retail accumulation.

Stating:

“As #Bitcoin’s markets opened on 2021 for the first time about 30 minutes ago (UTC), prices have jumped, Active addresses are on the rise in recent hours to support this push.”

Looking ahead, analysts predict that increased demand for a fixed supply of “new” Bitcoins from miners will only serve to create a liquidity crisis and raise prices. Sellers already faced tough buyers’ resolve in December 2020 when BTC didn’t see significant long pullbacks after setting new highs.

Bitcoin’s recent rally also rubbed off on some Altcoins. Dogecoin (DOGE) is up by 81.19% in the last 24 hours at its present price of $0.009. Ethereum (ETH) also traded at highs of $774 in the course of the day.

Image Credit: Coin98 Analytics/Twitter, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.