The flagship cryptocurrency, Bitcoin (BTC) found itself enmeshed in a web of indecisiveness as in the last one month after its price trend seems to have flattened off while it remained stuck in a consolidation bout of about $1,000 trading range.

While analysts have stated that it may be a daunting task to predict where Bitcoin (BTC) is headed next until it breaks below the key support area or trades past the critical resistance barrier, IntoTheBlock metrics give an idea of where these important levels could be.

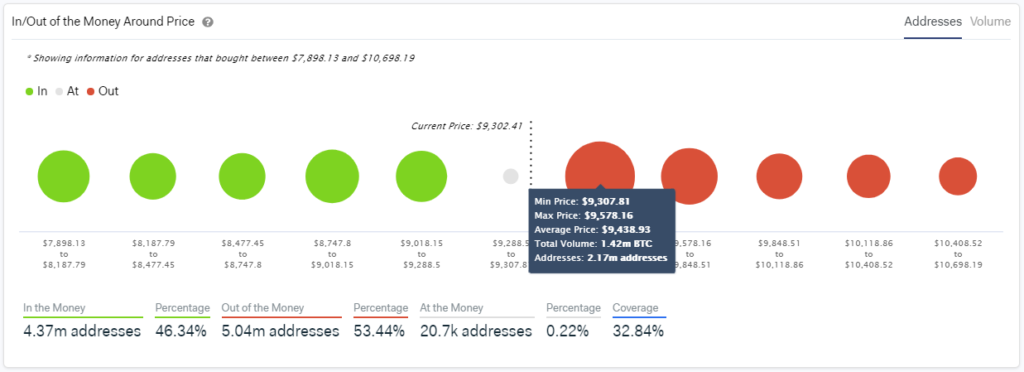

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model indicates that the range between $9,300 and $9,600 could constitute a huge resistance, as above 2 million addresses had previously bought 1.42 million BTC, thereby creating a massive supply wall around this range.

Analysts specifically urge Bitcoin users to pay keen attention to the $9,600 resistance level.

Bitcoin Has Strong Resistance Ahead. (Source: IntoTheBlock)

Bitcoin Has Strong Resistance Ahead. (Source: IntoTheBlock)IOMAP also gives the range between $9,000 and $9,300 as an area of strong support indicating that almost 1 million BTC holders had previously purchased a total of 560,000 BTC. In this scenario, the massive supply wall created will have the propensity to act as strong support to bounce prices above this level.

A prominent analyst, Michaël van de Poppe of Amsterdam stock exchange voiced out the possibility of Bitcoin retesting its June 1 high of $10,400 in the near term as Bitcoin (BTC) in the last few days had been constricted slightly above $9,250-$9,300 range. Also, a significant technical metric from Glassnode, Bitcoin Puell Multiple is giving buyers a go ahead as it flashes green, the first time since the middle of May.

BTC/USD Daily Chart

BTC/USD Daily ChartBitcoin (BTC) is currently trading at $9,310.

Michaël van de Poppe, a prominent trader cum analyst voiced out the possibility of Bitcoin (BTC) testing the $10,400 in the near term due to its constriction slightly above or within $9,250-$9,300. He noted this as a strong support area referring back to 2019 when Bitcoin hit $14,000. He stated that this key support was significant enough to push prices back then in 2019 however if history repeats itself then BTC bulls may resume an uptrend to hit $10,400 resistance level.

Earlier in June, BTC bulls had attempted to push the price past $10,400 but were met with stiff resistance which plunged price to as low as $8,895.

However, in a quick wit, Bitcoin (BTC) rebounded to trade sideways within the key support area. Michaël van de Poppe sees Bitcoin advancing towards $9,550 before further trading upwards to $10,400.

In an event reversal, a school of thought opined that BTC may plunge to as low as $8,600 before a rebound and consequent testing of $10,400 to $10,500.

The Puell Multiple Flashes Buy Signal. (Source: Glassnode)

The Puell Multiple Flashes Buy Signal. (Source: Glassnode)Glassnode’s Bitcoin Puell Multiple, a technical metric that weighs the supply of BTC Miners and their revenue, flashes green for the 1st time since Middle may.

The plunge as indicated is suggestive of the fact that newly mined BTC per day may be “undervalued” in its value rating when compared to historical measure.

Glassnode further stated that the 0.5 line has historically served as great entry points into Bitcoin.

Image Credit: Glassnode, IntoTheBlock, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.