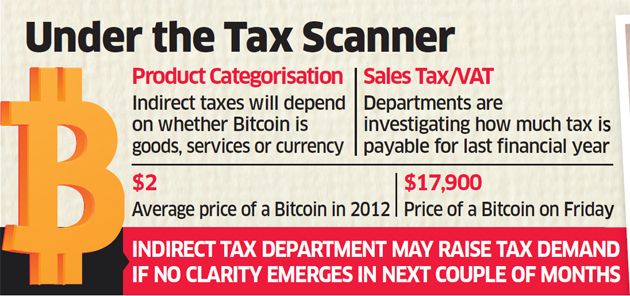

An investigation has been launched by the indirect tax department of India to look into the Indian Bitcoin exchange plying local markets for ascertaining their taxability under the GST regime.

This was revealed by two insiders having in-depth subject knowledge regarding the same. This development occurred just days after the Income Tax department officials visited top Bitcoin exchanges in India including Unocoin, Zebpay and Coinsecure . The indirect tax officials revealed that the probe had begun about one month back with top bosses of the crypto exchanges directed to divulge about their business model and the optimum rate of tax levy on the revenue garnered in the previous fiscal.

An insider was quoted as saying that,

“There is ambiguity around how much sales tax is applicable on revenues of these startups as the product they deal in is not defined by the current tax laws. No satisfactory answer is yet provided by any of these Bitcoin startups.”

It was confirmed by a senior official belonging to one of the seven top Indian Bitcoin exchanges that the company have been facing subsequent questioning in the hands of direct and indirect tax officials in regards to its taxability and business model. The unnamed official also said that,

“While the indirect tax department has been calling senior executives since mid-November, the direct tax officials started reaching out to us two weeks back.”

The best thing about Bitcoins is that it allows users to enter into seamless financial transactions without having to go through any financial institution or other middlemen. The demand for such cryptocurrencies have also been on a constant rise given its greater acceptance by business houses all over the globe. However, it must also be noted that these currencies which are devoid of any government regulation allows for anonymous transactions and are susceptible to extreme volatility. Irrespective of its limitations, Bitcoin has taken the shape of an ultimate craze amongst investors who just can’t get enough of its meteoric rise by 1200% in 2017. At the time of publishing this article, the price of Bitcoin was INR 13,87,000

Source- Economic Times of India

The Indian tax department is also confused about the classification of Bitcoin under the currency, goods or services category. The final definition of the product would determine its ultimate taxation.

Pratik Jain the national leader of indirect tax at PwC says:

“Bitcoin may not qualify as currency or money as it is not a legal tender for Indian indirect tax laws. Therefore, VAT (value-added tax) or GST implications may arise. In case it is sold to overseas customers from India it may qualify as “export”.

However, Jain feels that the likelihood of the businesses entered into by Bitcoin exchanges in being classified as a ‘service’ becomes all the more likely if a fee or commission is earned by entering into the transaction. “There are several grey areas which need to be investigated, in light of the precedence and guidance available under laws of other countries.”

Price arbitrage, commission and transaction fee are the three main sources of revenue generation of the Bitcoin players. The magnets of Indian crypto industry were asked about the same on Wednesday. On being asked, no response was received from CoinSecure and Zebpay however Unocoin replied to Economic Times stating that, “Given that we have not received any notice, none of your questions are relevant.”

Thus, it seems from their revelation that tax notices have not yet been issued till now which is possible once the exact tax applicable has been determined after concluding the investigation. An insider source revealed that Bitcoin exchanges shall be issued demand letters by the indirect tax department within the first quarter of 2018.

“The sales tax department and VAT authorities would be well within their rights to issue arbitrary demand orders (for 2016-17, before the implementation of GST),” said the person.

GST came into action on 1st of July. VAT authorities of Karnataka, Maharashtra and Gujarat have enquired separately about the taxation of Bitcoin exchanges. Tax experts feel that calculating the amount of indirect tax levy on the revenue garnered by Bitcoin start-ups will be tough given the lack of clarity around the provisions regarding ‘place of supply.‘

A report published by Economic Times on Monday hinted at the ambiguity in the payment structure of income tax by Indian holders of Bitcoin and other similar cryptos. People having direct knowledge regarding the matter revealed that direct access to data about the Bitcoin holders in India and the profit figures attained by each were demanded by the tax authorities. The extraordinary growth trajectory of Bitcoin in 2017 have caused experts and investors such as JP Morgan’s CEO Jamie Dimon and Warren Buffet in terming the same as a price bubble.

Three warnings have been issued till date by the Reserve bank of India against Bitcoins. The first one was issued in 2013, the second one in this February and the last one just one week back. Apart from the highly popular Bitcoin, Ethereum, Bitcoin Cash, Ripple, Dash and Litecoin, there exists 1600 more types of currency options in crypto space based on the same blockchain architecture.

KryptoMoney.com publishes latest news and updates about Bitcoin, Blockchain Technology , Cryptocurrencies and upcoming ICO’s.

Subscribe to our newsletters and join our Telegram Channel to stay updated.

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.