Bitcoin and the cryptomarket are recording losses during early Friday trading. Bitcoin traded to lows of $36,250 while Ethereum traded to lows of $2,587. Bitcoin had climbed to highs of $39,000 on June 3rd.

Most Altcoins traded in red with tokens such as Dogecoin (-13.72%), Zilliqa (Zq,-17.77%), Cosmos (ATOM, -10.42%), Elrond (EGL,-12.91%) posting double digit returns. As of press time, selected tokens such as Internet Computer (+3.76%), Filecoin (+26.31%), Nano (+9.37%), UMA (+5.19%), NuCypher (NU,+26.17%) MCO (+28.08%) SUN (+19.50%) are trading in green as of press time.

Some analysts who spoke along the lines on BTC’s rebound on June 3rd stated that a weekly close on Sunday above the previous short-term high of $40,904 may be necessary to regain the confidence of a resumed “uptrend.” They also pointed that the rally seemed to be a low-leverage, spot-driven move as funding rates remained close to zero, according to data provider Glassnode. A high funding rate is taken to represent excess leverage on the bullish side.

Thus, the question remains if this is the end of the Bitcoin-driven rally since the past year? New York-based MRB Partners, a boutique investment research firm believe that the rally in Bitcoin (BTC) since the previous year may be coming to an end.

In a May 25 report, the analysts cited growing concerns with cryptocurrencies’ environmental impact, possible regulatory risks, negative technical trends, and a future reduction in monetary stimulus as among the many reasons Bitcoin may see choppy price action in the days ahead.

On the contrary, Justin Sun, founder of Tron (TRX), believes that the crypto bull market is still intact and that a new rally is just around the corner. The CEO stated in a Bloomberg interview that there will be a “price adjustment” in June before a rally is experienced in July and August. He stated:

“I believe June is just a price adjustment and we will see bull markets in July and August. I still believe the bull market is still there and we will continue to see developments of cryptocurrency.”

Bitcoin was trading at $36,500 as of press time.

Bitcoin dominance which refers to Bitcoin’s market share in the total crypto market cap has declined steadily since its January 3rd high of 73, recording lows near 40 as of May 18 before the massive crypto market crash. Bitcoin dominance picked up on May 19 market crash and has now settled around 42.58 seen as of press time.

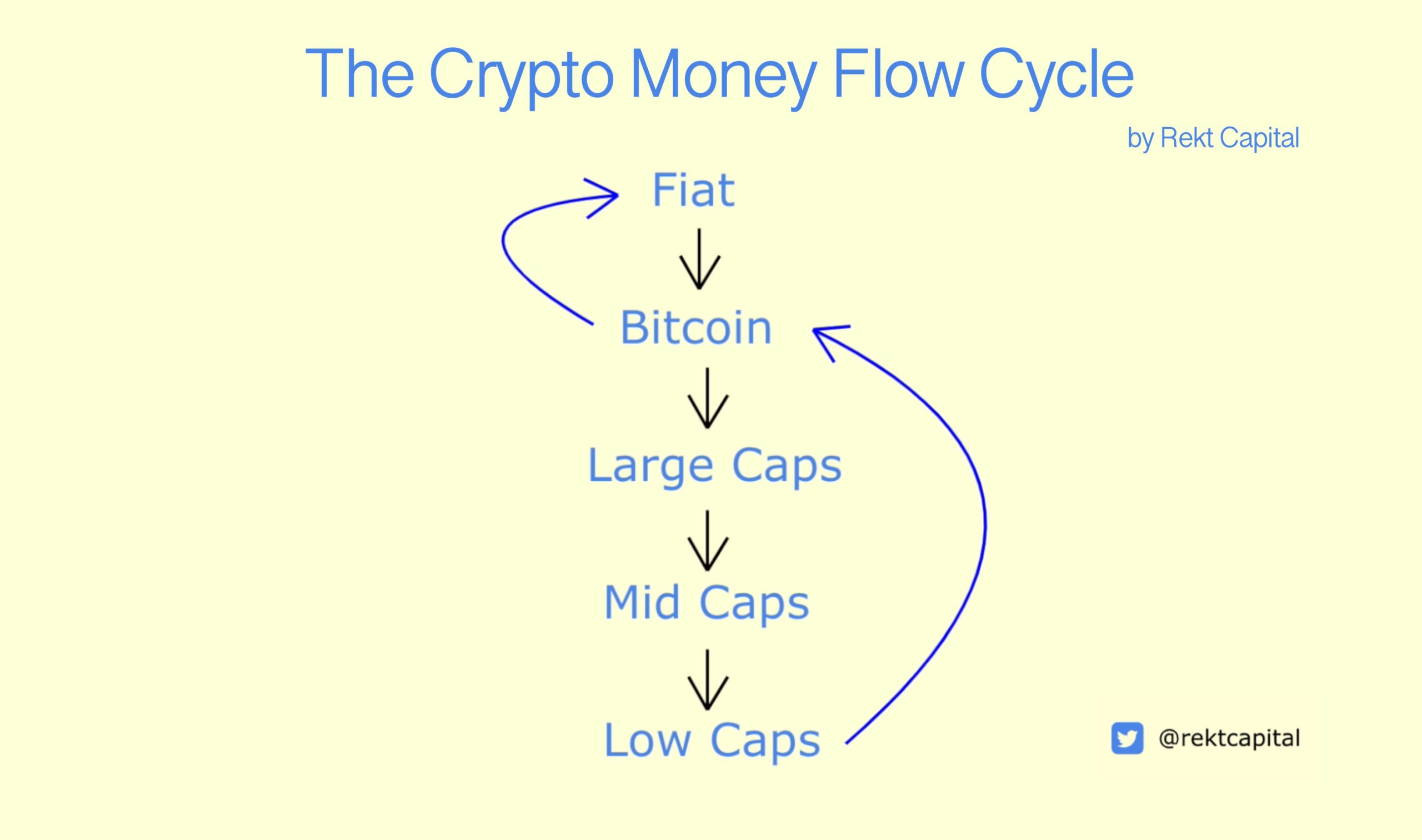

Some analysts believe that the present Bitcoin dominance cycle resembles that of the 2017 crypto rally. If the markets repeat, then Altcoins may be gearing for further upside rallies. The money flow model remains one potential predictor of where the markets could go. The model states that money moves from fiat into Bitcoin, and then down from large caps, through mid-caps to small-cap Altcoins before redirecting back to BTC and, ultimately, back to fiat.

Crypto Money Flow, Courtesy: @rektcapital

Crypto Money Flow, Courtesy: @rektcapitalWhile the performance seen during May may not offer many hopes in this regard, there’s also nothing yet to indicate that Bitcoin and Altcoins won’t perform according to long-term trends.

Cryptotrader and analyst @rektcapital puts in a word of advice to investors ”Short-term dips shouldn’t distract you from your long-term investing strategy and vision”. The trader had stated this before the start of May’s massive declines ”Many Altcoins are on the cusp of breaking out from market structures that took years to form. Any short-term fear or uncertainty over the next few days is unlikely to change these long-term formations and structures.”

Image Credit: @rektcapital, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.