The growth of fundamental bitcoin on-chain metrics after the market crash in March this year allows counting on “the largest take-off in history.” Such conclusions are contained in a new report by the analytical company Coin Metrics.

“Bitcoin is known for its volatility and has experienced many crazy price spikes in its history. But this time something has changed. The cryptocurrency grew in such parameters that we did not observe in the previous phases of growth, ”analysts write.

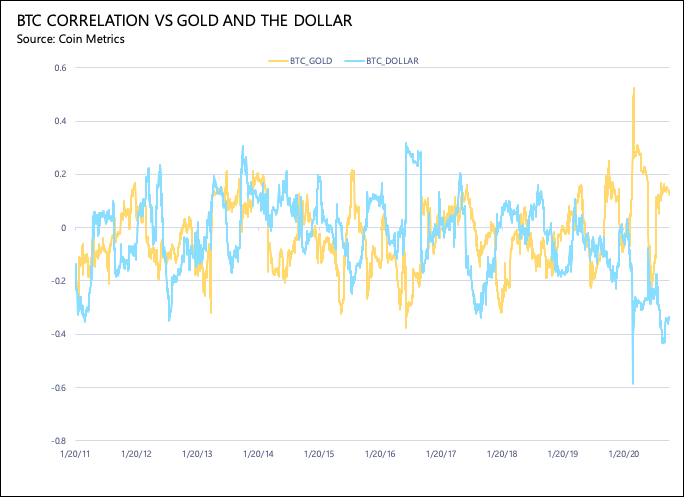

Researchers are paying attention to the change in the correlation of the first cryptocurrency with gold and the US dollar. This manifested itself on March 12, when Bitcoin crashed along with other markets in light of the panic caused by the COVID-19 pandemic. Coin Metrics notes that this parameter with gold remains close to record values, while with the dollar – not far from historic lows.

Correlation of bitcoin with gold (highlighted in orange) and the US dollar (blue). Source: Coin Metrics.

It also mentions recent investments in bitcoin as a reserve asset of companies such as MicroStrategy and Square. According to Coin Metrics, this reinforces the thesis that the first cryptocurrency is increasingly perceived as digital gold.

Read also: Forex vs Stocks vs Cryptos — Pros & Cons

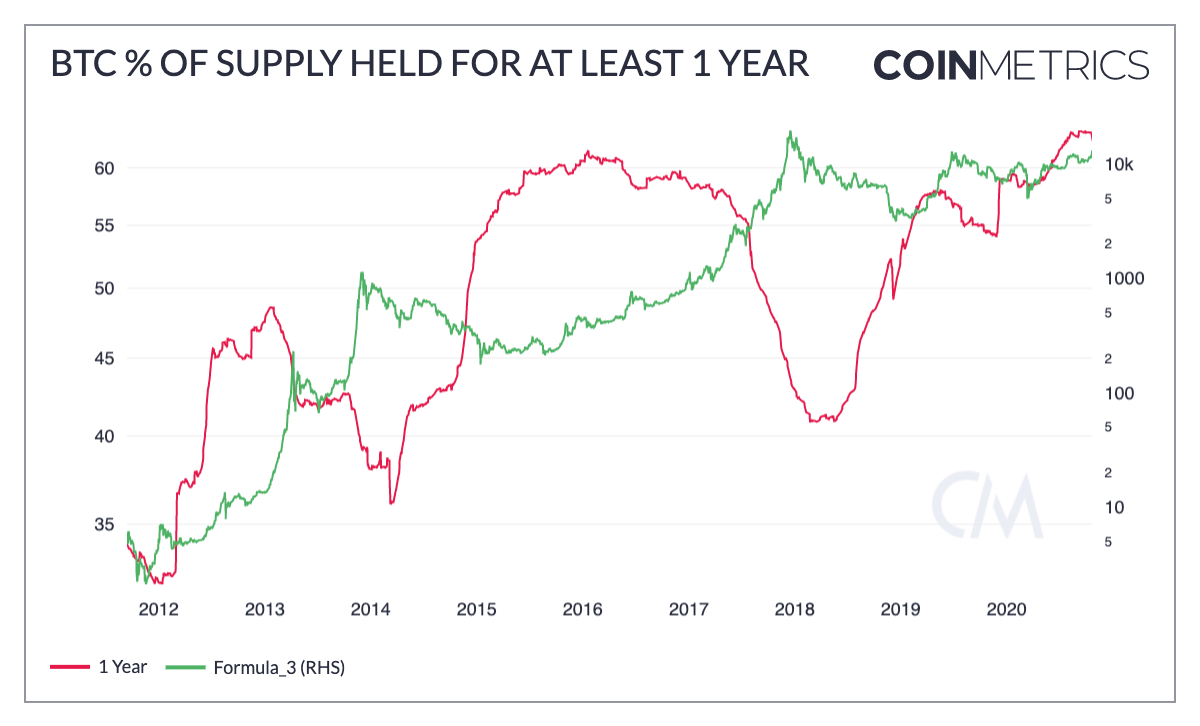

Experts have noted the growing trend for long-term storage of bitcoin, which confirms its perception as a means of preserving capital on a par with gold.

On October 25, the share of coins that did not move for more than a year reached 62.5%, which is not far from the absolute highs. Previously, a similar situation arose every time at the moment of the formation of price lows in the first cryptocurrency.

The share of bitcoins that have not moved in over a year. Source: Coin Metrics.

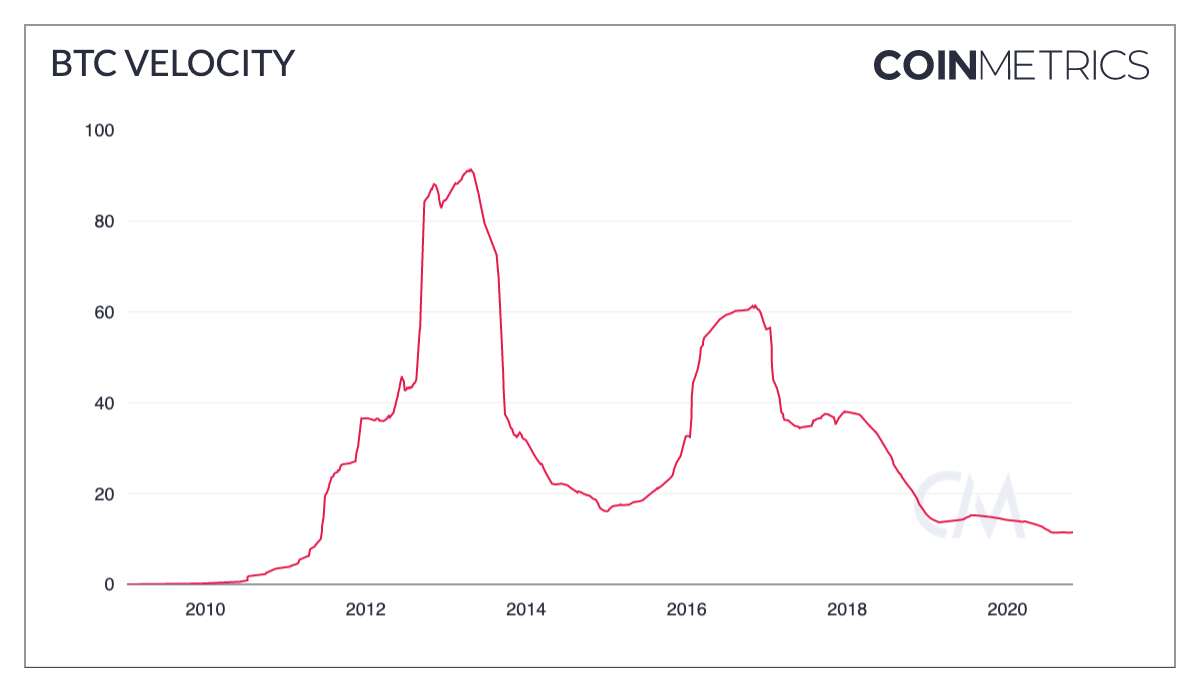

Coin Metrics also point to a drop in coin turnover to lows since 2011. This metric supports the hypothesis that bitcoin is perceived as a store of capital rather than as a medium of exchange.

Dynamics of the bitcoin turnover indicator. Source: Coin Metrics.

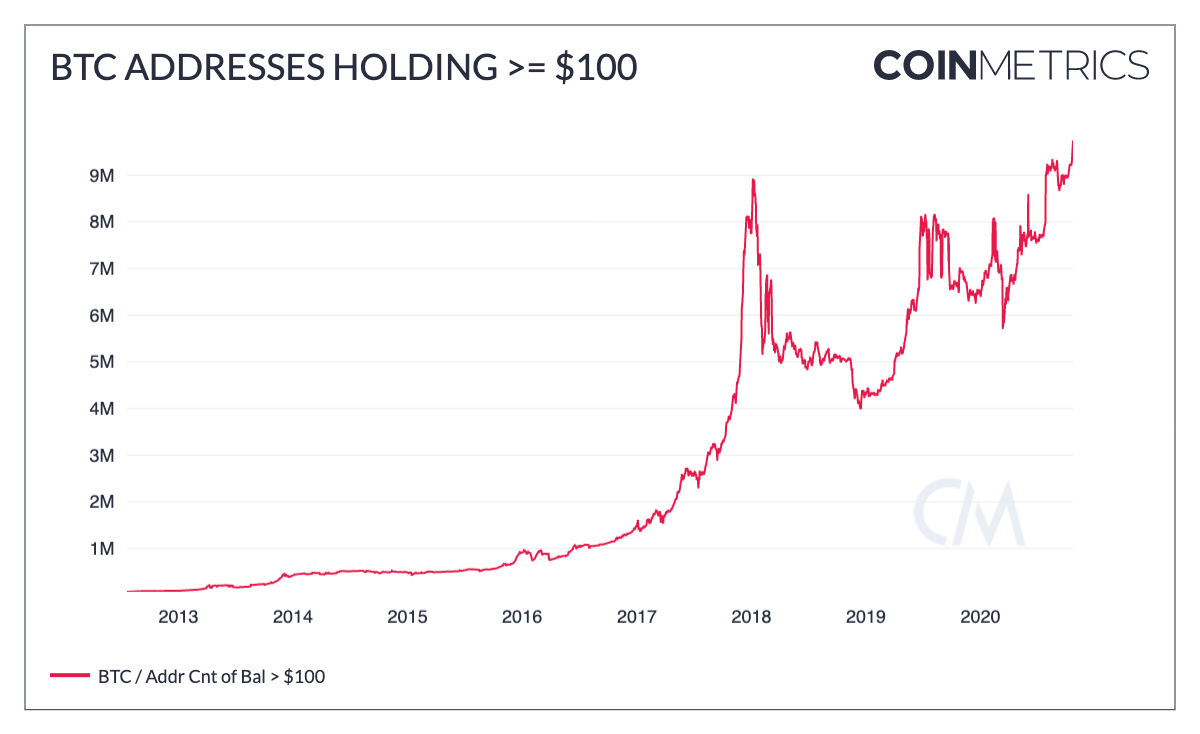

Analysts estimate that by now the number of addresses that store more than $ 100 has reached a new record (9.74 million). This positive momentum signals the long-term adoption of the first cryptocurrency.

Dynamics of Bitcoin addresses containing more than 100 BTC. Source: Coin Metrics.

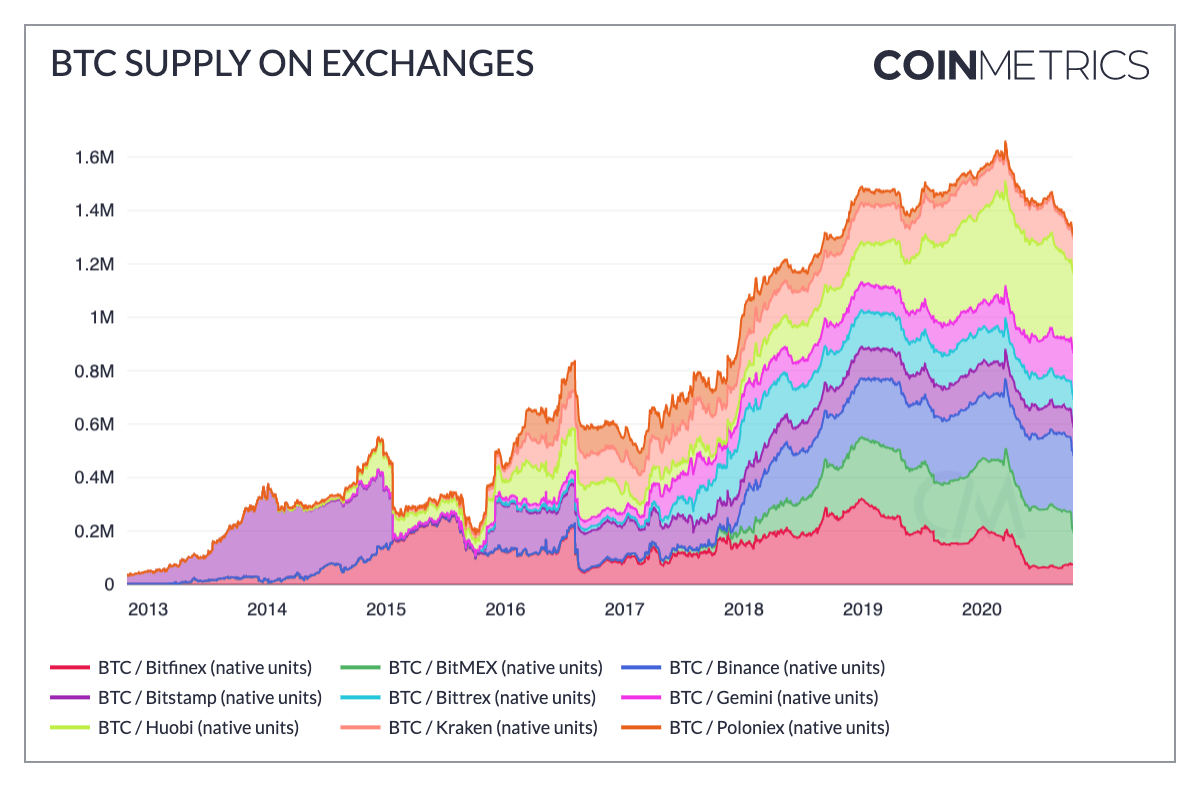

Another metric that researchers have paid attention to is the continuation of the outflow of bitcoin from centralized exchanges. This is partly due to the desire of users to independently store the first cryptocurrency, focusing on long-term prospects.

The dynamics of the number of bitcoins on the wallets of centralized exchanges. Source: Coin Metrics.

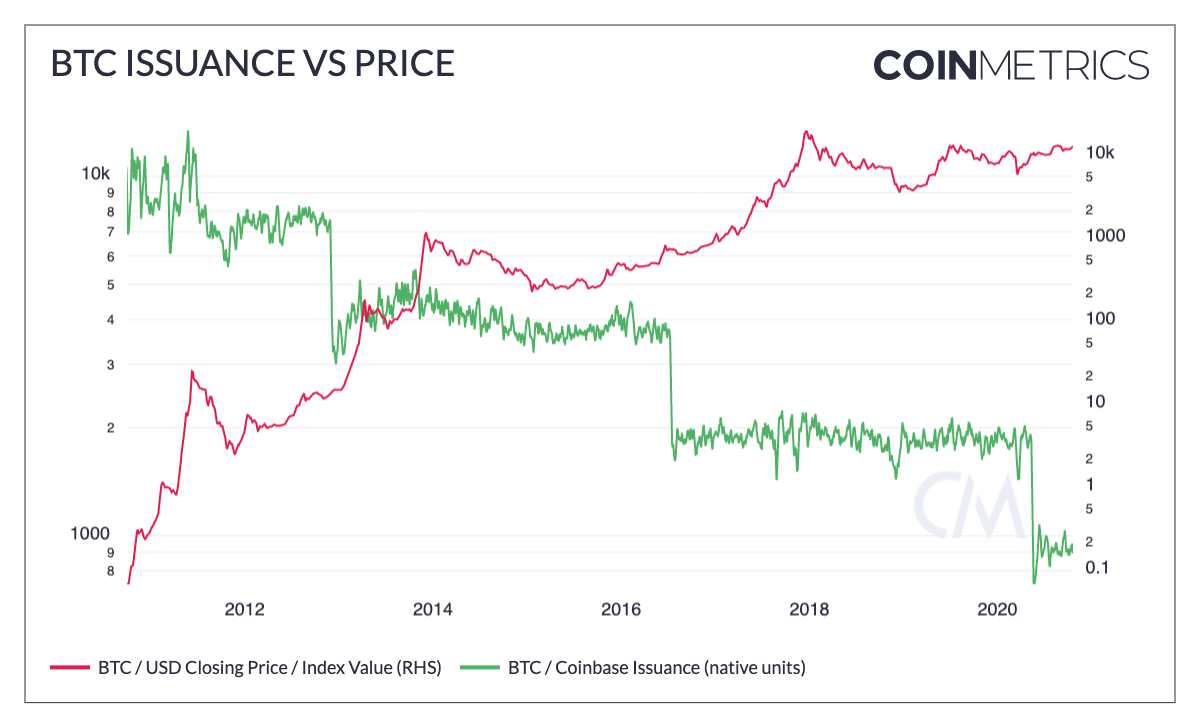

In conclusion, Coin Metrics analysts recalled the third halving that took place in May . The chart below shows changes in the emission and price of Bitcoin.

Dynamics of the price of bitcoins and their emission. Source: Coin Metrics.

“Historically, the price of bitcoin reached a local peak within a year and a half after the halving. The tendency to hold coins is increasing, and only half a year has passed since the miners’ reward was halved. All indications are that bitcoin is ready to take off, ”the authors of the report conclude.

Recall that in recent days, the number of bitcoin addresses from 1000 BTC and more has grown to a new all-time high.

Read also: what does hodl mean in crypto?

Earlier, the founders of the Gemini cryptocurrency exchange, the Winklevoss brothers, confirmed their previous forecast of the growth of the bitcoin rate to $500,000. They also believe that bitcoin is the only long-term protection against inflation.

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.