Bitcoin price is currently enjoying most bullish rally of 2019, seeing that its price has now risen above $5,000 for the first time since 2018. Is the crypto winter over? What next can you expect?

On Tuesday, April 2, the crypto market experienced dramatic movements in the prices of digital coins that exceeded the expectations of many traders and cryptocurrency investors. In the wee hours of Tuesday morning, Bitcoin (BTC) price broke the all-important $4,200 resistance level and then surged close to $5,000 mark in the span of just one hour and for the first time since 2018.

In retrospect, Bitcoin price made such a significant bullish rally of $1,000 in a day in April 2018, exactly one year ago, when the price climbed from $7,000 to $8,000. But the question on the lips of everyone is why Bitcoin price jumped higher? Will the upward trend continue? Read on!

Anyone keeping an eye on Bitcoin futures will be acutely aware that it had a strong start on Tuesday as the April contracts of the Cboe and CME increased by over 16% to $4,805.

#Bitcoin futures soaring 16 percent to their highest levels since November pic.twitter.com/WLW4yDumYv

— CNBC Futures Outlook (@FuturesOutlook) April 2, 2019

Regarding the reason why the price of the flagship cryptocurrency soared, the digital asset strategist at VanEck, Gabor Gurbacs stated that he believes the recent Bitcoin price rally to its highest level since the explosive spike of November 2017 was triggered by the futures market. In a note to Barron’s, Gurbacs says;

“CME Bitcoin futures expired last Friday. A large chunk of positions were rolled (buying) into the new front month BTC futures contract. Over the weekend, heavy spot Bitcoin and over-the-counter buying followed the Bitcoin futures contract expiration pushing BTC price up slowly and gradually. As the price moved up in increments, over $500 million shorts have been liquidated on leveraged crypto derivatives trading platforms around the world.”

Meanwhile, part of the upward movement can likely be attributed to the Fear of Missing Out (FOMO) among retail traders and crypto investors and a general pickup in sentiment around the start of every month. Others say that the climb is being pinned on the April Fools’ Joke saying that the SEC has approved Bitcoin Exchange Traded Funds (ETFs).

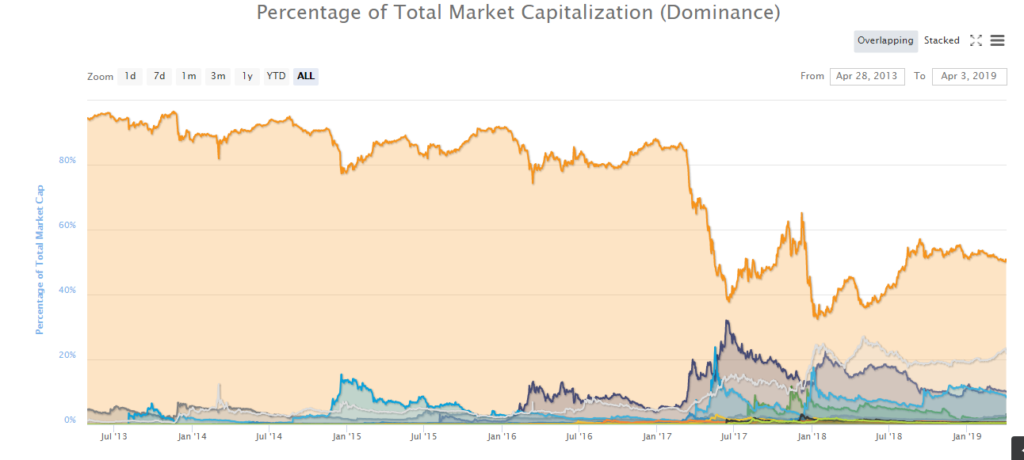

For the first time in months, Bitcoin dominance, which is the BTC share over the crypto markets has risen above 50%. At this point, we are presented with two options – either Bitcoin price will skyrocket or crash severely, causing the price of other altcoins to decline even more. But as you can see, the cryptocurrencies had chosen the first option. At press time, BTC dominance is 51.8%.

At the time of writing, Bitcoin price has spiked to $5,267 as per the data compiled by CoinMarketCap. Could the bearish market sentiment that plagued the crypto markets for the better part of 2018 be finally over?

Earlier this week, Alex Kruger, an economist and global markets analyst said that he believes Bitcoin price movement above the $4,200 level will mark the end of the bear trend beginning January 2018, lasting 16 months. He has been quoted as saying in a tweet:

“This is not a call. Not a matter of aging well or not. A break above $4,200 technically ends the bear trend that started Jan 2018. Facts don’t care about opinions. If strong selling resumes later, that would represent a different trend.”

Kruger’s comment is very encouraging for the crypto market’s prospects. So what can you expect? The price of Bitcoin is now approaching the $5,500 level and if the bulls are able to sustain the current upward trend, they might likely face resistance above the $6,000 price level.

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.