What is Bitcoin?

Bitcoin is the first and biggest resource in the developing classification of cryptocurrency also called computerized cash. It was initially planned as a source of trade that is made and held electronically. Bitcoin was the first, yet there are many computerized digital currencies. Here we have to focus on how digital currency works. Be that as it may, the essential blockchain technology is similar to other digital currencies in the market, including Ethereum, Bitcoin Cash, and Litecoin. For additional on blockchain, see beneath.

Who creates Bitcoin?

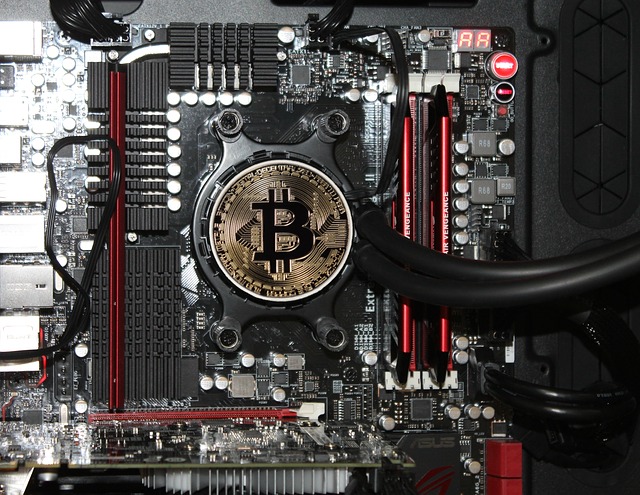

Bitcoins aren’t printed by an administration association like the US Treasury does with dollars. All things considered, they’re delivered by individuals and organizations running PCs all around the globe, utilizing programming that takes care of an extremely complicated mathematical problem. The numerical recipe is uninhibitedly accessible so that anybody can check it, however, you’ll require a truly powerful set of PCs to tackle the issue.

Who controls Bitcoin?

One of the significant focuses is that no single individual, element, or association controls Bitcoin. The way that Bitcoin isn’t controlled or directed by a huge bank or government element is essential for its appeal to many people—yet that additionally makes it harder to comprehend.

Can I tell who owns Bitcoin?

Bitcoins are once in a while viewed as mysterious. They are put away in computerized wallets—basically electronic vaults—which can have public electronic locations related to them. Yet, they aren’t connected to names, home or work locales, or other specifically distinguishing data.

How is the value of Bitcoin determined?

Digital currency works uniquely in contrast to conventional cash. The cost of a Bitcoin is controlled by the market interest on the trades where it exchanges, while the purchasing influence of conventional cash is affected by variables, for example, the national bank money-related approach, expansion, and foreign currency trade rates.

How do you transact with Bitcoin?

Exchanges with Bitcoin can be finished without delegates like banks or MasterCard organizations. At the point when you execute with the Bitcoin pro app, it is an immediate exchange between the sender and beneficiary of the Bitcoins. A Transaction can be made on the web or through a cell phone application—like making an electronic exchange with customary cash.

What are the pluses and minuses of transacting with Bitcoin?

For some, the benefits of Bitcoin are quick, unknown, straightforward, and minimal effort exchanges. However, the framework and selection by organizations to help these exchanges are as yet in the beginning phases. Defenders of advanced money think this capacity to effortlessly move an incentive from individual to individual all through the world will unavoidably prompt an expansion in the utilization of digital currencies. Then again, the hyper-unpredictability of significant worth and vulnerability of guidelines could deter organizations from accepting digital currencies.

Can I buy cryptocurrencies at Fidelity?

Retail financier clients can’t accept or sell any cryptocurrencies at Fidelity. In any case, the individuals who have a Coinbase digital currency record can mastermind to see those adjustments on Fidelity.com. Although Bitcoin prospects are presently accessible for exchanging on the CBOE and CME, Fidelity doesn’t right now have any designs to bring to the table Bitcoin fates exchanging for its retail financier clients.

What are some of the risks of investing in Bitcoin?

A few examiners have been attracted to Bitcoin exchanging as an approach to make a fast benefit. In any case, just like the case with most speculative ventures, you should be cautious. Purchasing, selling, and utilizing Bitcoins convey various dangers. Among them:

Disclaimer: This is a paid article. KryptoMoney does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to the company. KryptoMoney is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned in the article.

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.