Bitcoin and the rest of the crypto market faced significant selling pressure in the prior week. The choppy price action across the market was driven largely by a rapid increase in the US 10-year Treasury note yield. The recent drop marks Bitcoin’s second significant correction since breaking the $20k all-time-high in December 2020.

Most analysts view significant market corrections as a positive reset in that they wipe out speculation, leverage, weak hands, and test holder conviction. During Bitcoin’s recent correction, several market indicators reset including futures open interest, futures funding rates, and the Grayscale GBTC product.

Perpetual futures funding rates reset close to zero while the Grayscale ‘premium’ also hit a negative low of -3.77%, driven by the recent correction and competition from BTC ETFs.

Since the beginning of March, Bitcoin’s short-term bull case strengthened amid the weakening dollar and positive sentiment surrounding the upcoming $1.9 trillion U.S. stimulus package. Bitcoin is presently trading up at $51,425 after reaching intraday highs of $52,666.

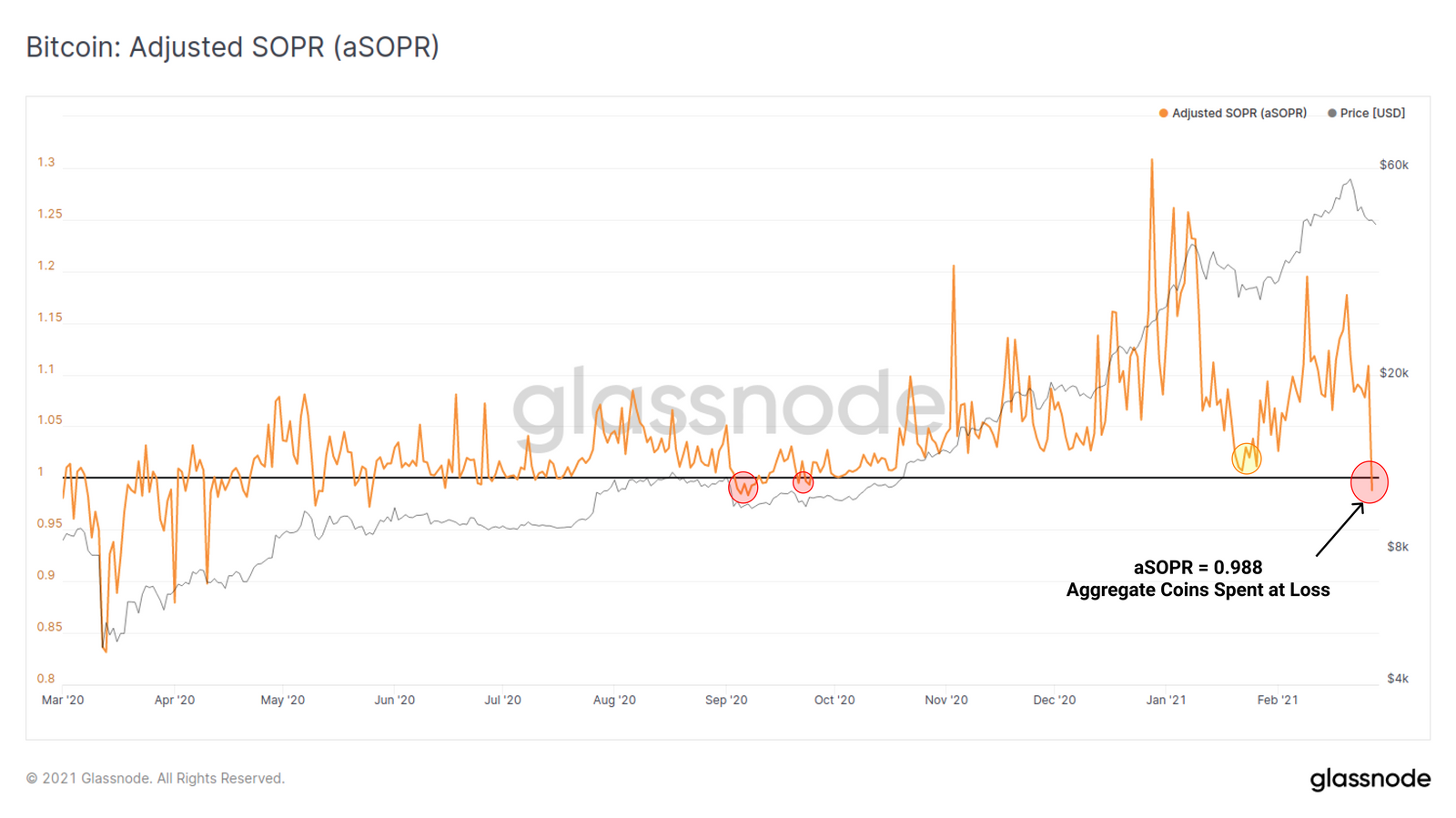

Key on-chain metrics indicate that long-term BTC holders were not fazed by the recent correction. The aSOPR metric gauges the quantity of all coins spent that day and calculates the degree of profit or loss compared to when they were last moved.

According to Glassnode, the Adjusted Spent Outputs Profit Ratio (aSOPR) declined beneath 1.0 for the first time in this bull market, reaching a value of 0.988. When the aSOPR is less than 1.0, it means quantitatively, coins moved that day were at a loss. Low aSOPR values, especially when reset below 1.0, also mean fewer old and profitable coins were spent. This suggests confidence and HODLing strength remain for long-term holders.

The drastic plunge in aSOPR may point to ‘panic selling’ by new entrants, given the data-driven evidence that the Bitcoin market has seen an influx of new retail investors.

Another on-chain metric, the Net Unrealized Profit and Loss (NUPL) metric saw sideways ranging and choppy behavior during Bitcoin’s two corrections. Despite this, NUPL is yet to decline to its typical bull market support value of 0.5 so far. This may indicate that buyers are stepping in sooner and fewer HODLers are letting go of their coins this cycle.

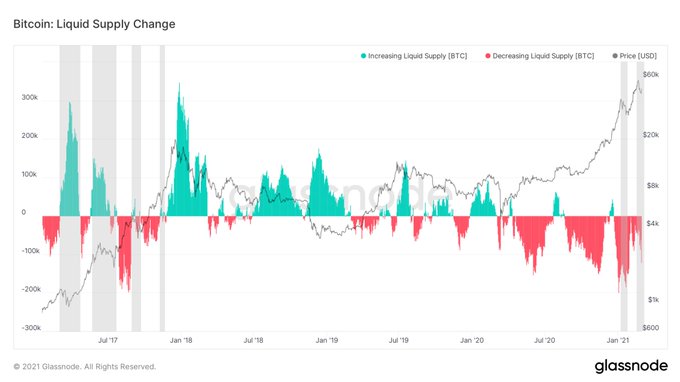

Since March 12th, 2020, the sustained trend and volume of coins being withdrawn into illiquid status continues. The trend of coins being withdrawn and locked away into long-term holding patterns provides strong evidence that Bitcoin is now viewed as an important macro asset.

Twitter analyst, Jan & Yann noted:

Liquid #Bitcoin Supply Change during major pullbacks this bull run vs 2017…

Float in the network keeps decreasing, no matter if the price goes up or down – this just indicates the insane amount of hodling and confidence right now

Image Credit: Glassnode, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.