It is a green day for the crypto market as most digital assets are trading in the positive after massive declines earlier in the week.

Bitcoin is however consolidating gains, trading at $58,330 at the time of writing. Bitcoin’s consolidation is giving many Altcoins ample room to run. This happens because some traders and investors try to rotate into Altcoins when Bitcoin is consolidating, in pursuit of potentially higher returns.

Notable gainers in the last 24 hours are BitTorrent (+45.16%), Holo’s HOT (+12.13%), Digibyte (+11.14%), UniSwap (+9.92%), Crypto.com coin (+9.46% ), Avalanche (+11.22%), Helium (+23.94%), Pundi X NPXS (+50.50%). Helium (HNT) subsequently rose to set new all-time highs of $9.31 on Mar. 19.

NPXS/USD Daily Chart

NPXS/USD Daily ChartThe US 10-year Treasury note yield surged on Friday to highs last seen in January 2020, after the Federal Reserve signaled Wednesday it would keep loose monetary policy for the foreseeable future. The Bitcoin price rose in tandem with the U.S. Treasury bond yields, clocking highs of $59,146 on Mar. 19.

Given the direct correlation with Bitcoin price, investors are watching out for potential correction on the U.S. Treasury bond yields which may pose downside risks for Bitcoin and stocks.

Patrick Heusser, head of trading at Swiss-based Crypto Finance AG, from his observation of BTC price charts noticed that a rising wedge which depicts uptrend fatigue has started taking shape.

He stated “My concern is growing that we might run into a rising wedge scenario,” while calling for a tinge of caution in Bitcoin trading.

According to Heusser, a breakdown beneath $54,000 would confirm the rising wedge scenario and open the doors for a drop to $47,000. The immediate bias will remain bullish while the wedge support is held intact.

Also, rising U.S. Treasury bond yields could create extra selling pressure for Bitcoin along with stocks. Joel Kruger, cryptocurrency strategist at LMAX Digital spoke along this line ‘If rates go higher, it will force investors to rethink their long equity exposure and could open a big sell-off in stocks and as things stand in the short term because Bitcoin is still a maturing asset, it still shares correlations with risk sentiment. So Bitcoin would be somewhat exposed if something like this played out’.

Analysts at Cryptowatch of Kraken exchange indicated that the market is reaching an overbought condition signaling that BTC may be running out of steam.

Conversely, the Fed’s reaffirmation to uphold its stance on monetary policy should benefit Bitcoin’s price in the short term.

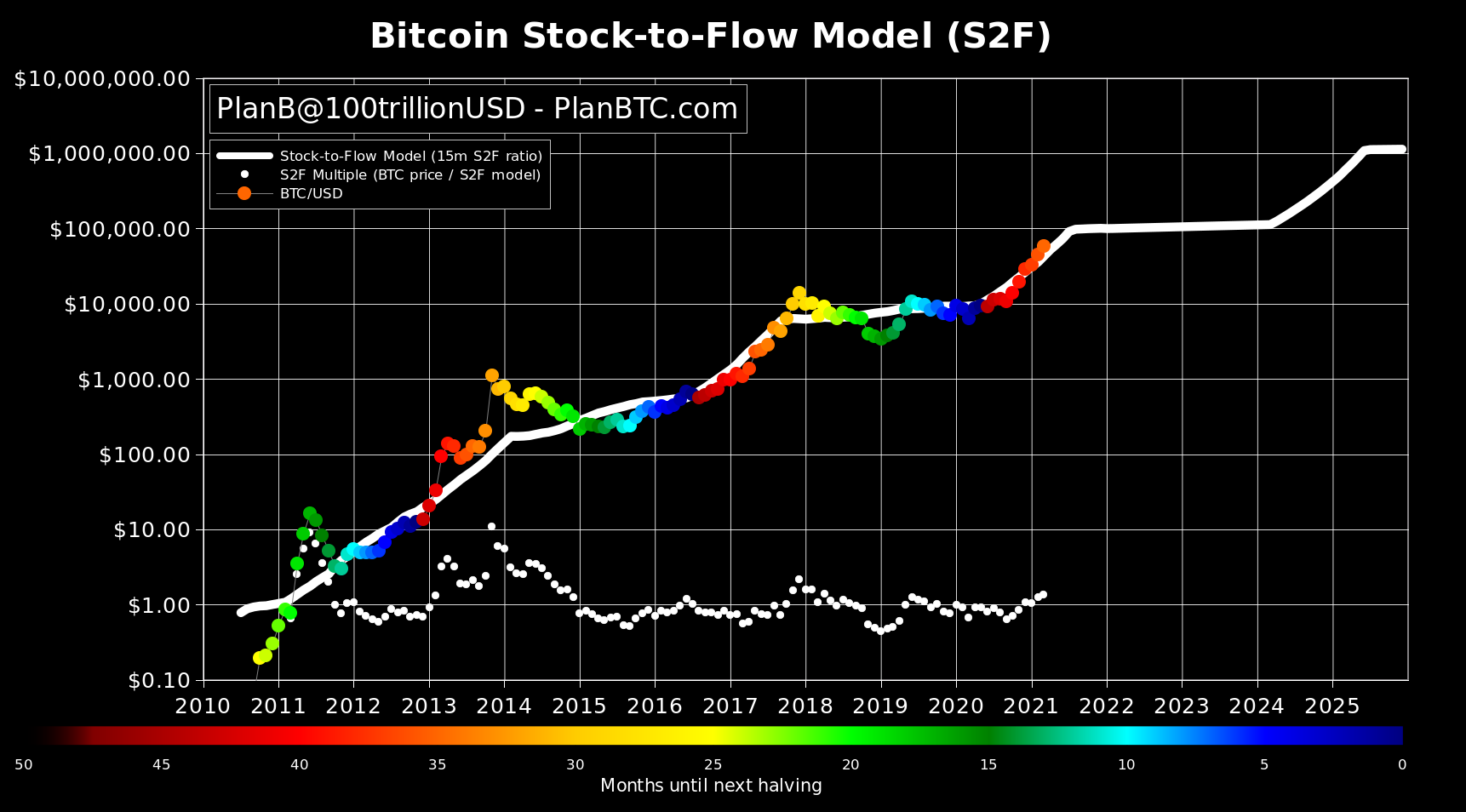

Bitcoin Stock-2-Flow Model: PlanB/Twitter

Bitcoin Stock-2-Flow Model: PlanB/TwitterEconomists also postulate an increase in inflation due to the coronavirus vaccine optimism. A growing belief among investors that Bitcoin might act as a hedge against inflation may prop Bitcoin price in the medium term.

Amid all these, stock to flow creator PlanB maintains his bullish Bitcoin prediction, stating on Mar .17 ‘We are only 3.5 months into the #Bitcoin bull market. IMO BTC will not stop at $100K and will continue to S2FX $288K average price level (ATH will be higher)’.

Image Credit: PlanB/Twitter, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.