The entire crypto market tumbled in response to an adverse bearish wave in early Sunday trading. Bitcoin plunged steeply to lows of $51,300 while Altcoins marked double-digit losses. Ethereum led the Altcoin market in the widespread declines, down spiraling to lows of $2000 to mark its 3rd day of consecutive losses. Other crypto assets mostly affected include XRP (-17.05%, Polkadot (-15.84%), Litecoin (-13.40%), Bitcoin Cash (-11.66%) and more.

The market mood changed dramatically after rumors that the U.S. Treasury was planning to charge several financial institutions for money laundering using cryptocurrencies filtered into the airwaves.

Solana (SOL), Nano (NANO), Dogecoin (DOGE) were hit by the bearish wave but it appears that the three crypto-assets were able to shake it off a bit. As of the time of writing, NANO, Solana, and Dogecoin were among the very few assets trading in the green on a 24-hour basis as per Coinmarketcap data.

SOL/USD Daily Chart

SOL/USD Daily ChartNano and Solana’s resolve were quite impressive. NANO trades at $12.33, up by 17.05% in the last 24 hours and 105.26% weekly. Solana is up by 14.67% in the last 24 hours and 7.81% weekly at a present price of $30.68.

Nano claims to be “digital money for the modern world,” a lightweight cryptocurrency that is designed to facilitate secure, practically instant payments, without fees, and addresses some of the major limitations of both legacy financial infrastructure and many modern cryptocurrencies.

This market crash may be a timely reminder of how price action follows certain determinants, especially fundamentals. Bitcoin was trading at $56,224 while Ethereum traded at $2,228 as of press time.

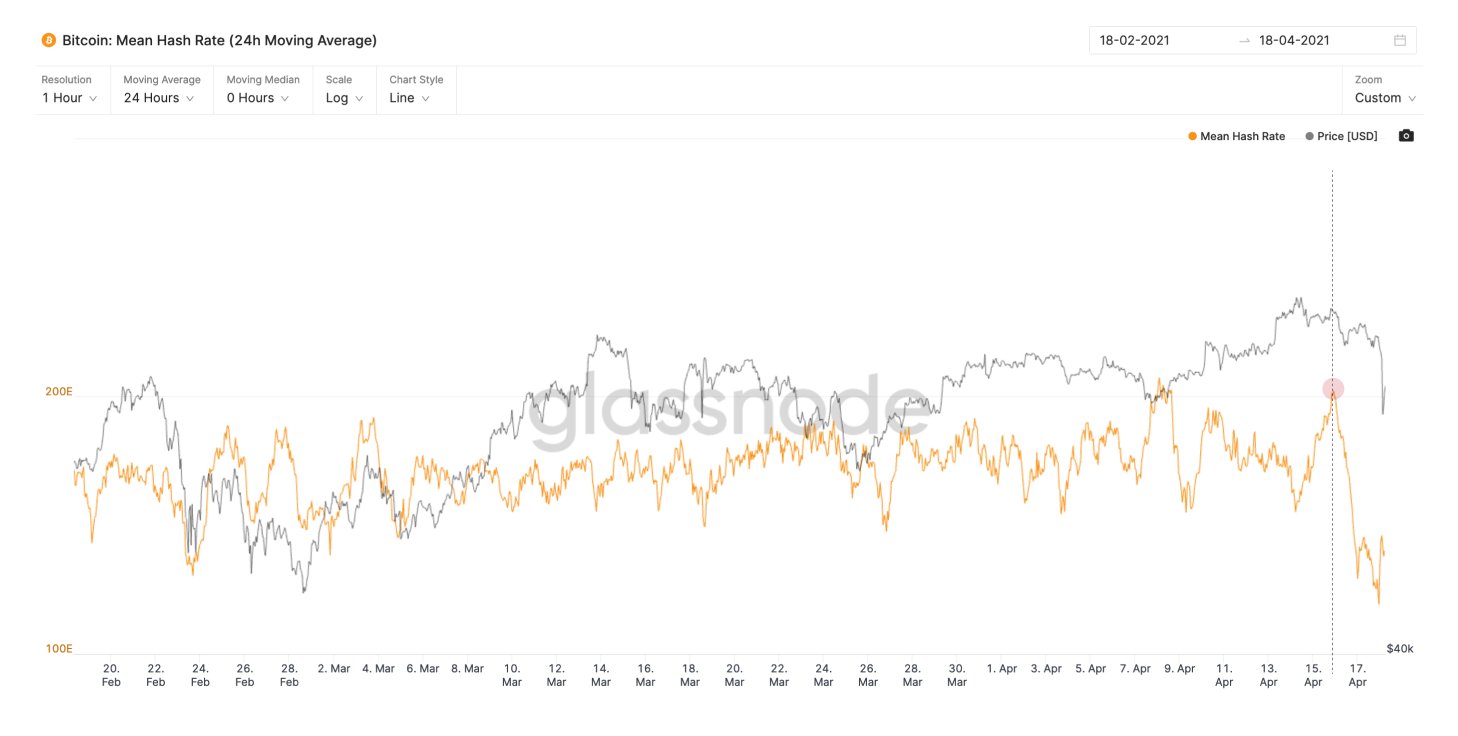

Hashrate May Be an Important Determinant for Bitcoin Price – Hashrate is a general measure of the processing power of the Bitcoin network. Bitcoin mining hash rate dropped by 40% a week after an accident in a Chinese coal mine halted operations in the entire Xinjiang region. The drastic change raised concerns around Chinese dominance over the market, with one region affecting nearly half of the total Hashrate.

Willy Woo, crypto analyst cum economist tweeted in the early hours of Sunday after the crash ‘Price and hash rate has always been correlated’ referencing back to the November 2017 Hashrate plunge. The analyst further stated that today was the single sharpest 1-day drop-in Hashrate since Nov 2017. He dropped the chart below to depict the correlation.

BTC Price vs Today’s Hash Rate Collapse (From the Xinjiang Blackout).

BTC Price vs Today’s Hash Rate Collapse (From the Xinjiang Blackout). The Potential for Pullbacks Is Always Possible – Pullbacks are essential elements of every market bull run, as they offer reset and buy-the-dip opportunities. Mira Christanto, a Messari researcher indicated that today’s fall marks the largest 1 order liquidation in history on Binance at $68.7million and the largest year to date.

Alex Kruger, cryptoanalyst cum economist compared the crash to that of Mar. 13 stating ‘That likely was the closest to a March 2020 Black Thursday moment we are ever going to get again’

‘Buy the News, Sell the Rumor’– the Potential of Just One Tweet – An unconfirmed tweet about the U.S. Treasury charging several financial institutions with cryptocurrency money laundering wreaked havoc across the cryptocurrency market, with billions of dollars in position liquidated. The fact that a baseless tweet could wipe off 9.19% of the global market cap has exposed the volatility of the crypto market, which remains highly sensitive to such rumors.

Rumors of a sell-off of COIN shares by Coinbase executives on Saturday had also weakened the market’s spirits, which was ironically heightened last week for the same reason. However, financial experts have weighed up the claims and guessed that a mix-up of forms and failure to differentiate between actual shares and options contracts led to the misunderstanding.

Image Credit: Willy Woo Charts/Twitter, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.