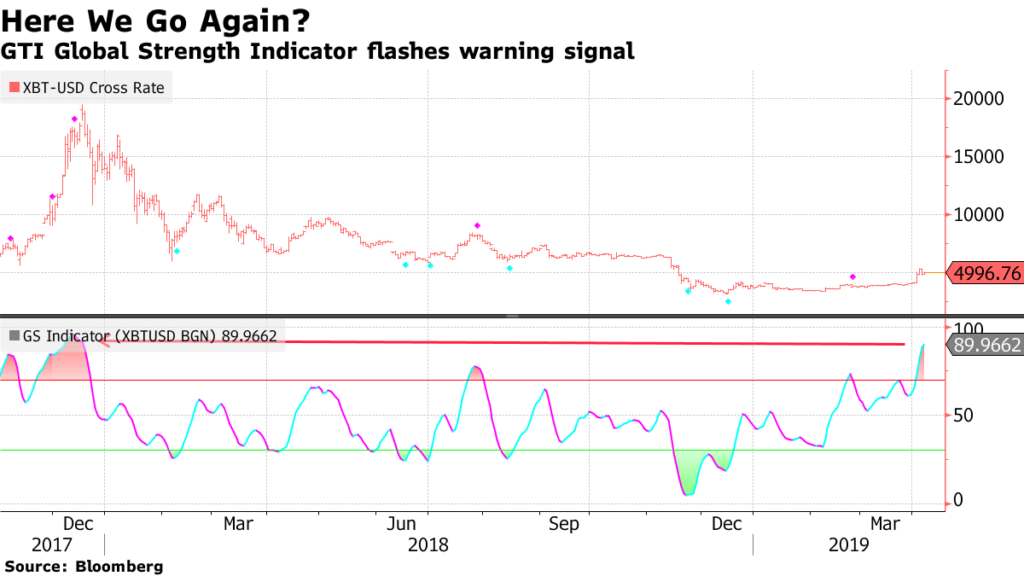

The GTI Global Strength Indicator, a technical analysis tool that gauges intraday volatility suggests that Bitcoin (BTC) is in overbought territory, as reported by Bloomberg on April 5.

Earlier this week,patterns in the past posted a warning towards multi-week downturns.

Market Correction

Mike McGlone, Bloomberg’s Intelligence analyst states that he’s looking to see the reaction of traders, whether they sell or plan to hodl after the recent rally.

“The market got so compressed, volatility was so low, it just went poof! It broke out. It was released from the cage. Now it’s a question of duration and I suspect when you have such a massive bubble, you’ll always have an overhang of people who need to sell.”

“We continue to expect another leg downward. It’s nice to see a positive move as opposed to a negative move, certainly. But at the same time, for investor purposes, it’s not a particularly comforting move. Certainly, an investor would much rather see a gradual rise with constant floors in terms of downside being established, as opposed to a very, very quick run-up. It could easily be easy come, easy go.”

CEO of cryptocurrency exchange Zebpay, Ajeet Khurana agrees and asserts that the market sentiment is sitting on a razor-thin wall.

“We are at a unique point when the bets in the Bitcoin market are almost evenly split, with half of the money expecting an imminent doubling of price, and the other half a halving.”