Bitcoin halving, in which block reward mining will be halved from 12.5 BTC to 6.5 BTC is just a few days away. Ahead of this most anticipated event, buying pressure has significantly increased for the flagship asset as Bitcoin bulls aggressively broke $9,500 key level, gaining 7% while racing towards $10,000.

Recent data from on-chain analytics, Glassnode as quoted by a crypto analyst, Willy Woo revealing that the number of big Bitcoin holders, which refers to those in possession of a thousand coins and above has risen significantly from January 2020 lows.

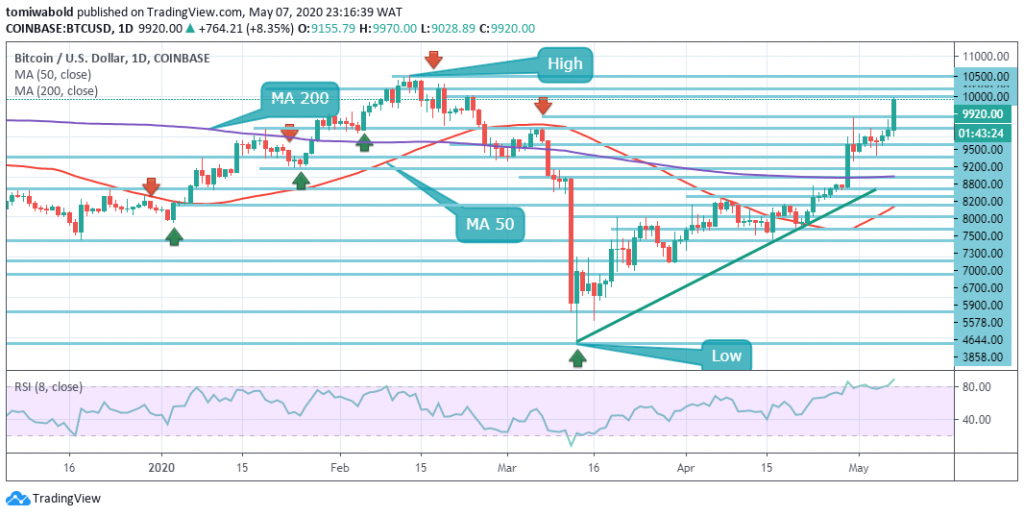

BTC/USD Daily Chart

BTC/USD Daily ChartAhead of the halving event, Bitcoin glitz has risen ostentatiously as Google Trends Data revealed a growing global interest in search queries related to “Bitcoin halving”, “Bitcoin” and “Buy Bitcoin”.

Whale population had grown enormously since January even amid the coronavirus pandemic, noted the analyst who saw a significant increase in the number of large Bitcoin holders. The newest on the list is Macro investor and hedge fund manager, Paul Tudor Jones who is buying Bitcoin (BTC) as a hedge to curb the inflation he foresees ahead of central bank money printing spree while referring back to the part safe-haven gold performed in the 70s.

The CEO of Tudor Investment Corp likened it to the fastest horse using the best profit-maximizing strategy, this he stated in a market outlook note he published recently. In the news wake, Bitcoin reportedly rose from $9,500 to $9,900.

At the time of writing, Bitcoin is exchanging hands at $9,920, setting a local high it never reached since March market carnage while up by 4% within a 24-hour range.

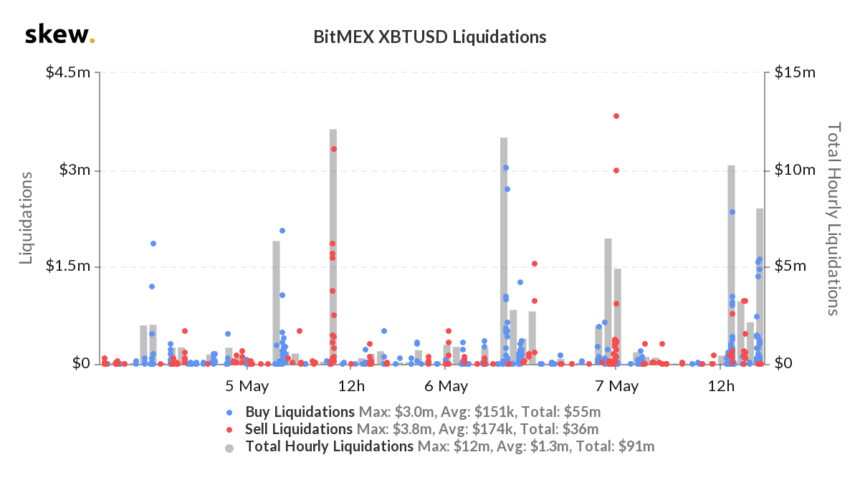

Due to the significance of the $9,500 key resistance level, millions of BitMEX positions were liquidated as a result.

Courtesy: Skew.com

Courtesy: Skew.comSkew.com, a derivatives data tracker, indicated that nearly $23 million worth of BitMEX short positions, some long positions inclusive have been liquidated in the past 4 hours when Bitcoin rose from $9,400 region to $9,900 levels where it stands at the moment.

Analysts foresee more bullish moves ahead of the flagship asset as a well-known trader sees Bitcoin (BTC) hitting $10,500 days ahead as a potential rally exists after the $9,500 key resistance level. The reported spike in the number of Bitcoin whales is also seen as a bullish sign.

Image Credit: Skew.com, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.