Bitcoin (BTC) price may have fallen to lows of $31,160 on June 22, the alternative cryptocurrency (Altcoin) market was even hit harder, with several tokens posting double-digit losses. At the time of writing, Cardano (ADA, -15.42%), XRP (-14.87%), Dogecoin (DOGE, -26.05%), Polkadot (DOT, -14.97%), Litecoin (LTC, -11.20%), Polygon (MATIC, -15.04%), Solana (SOL, -20.37%), VeChain (VET, -18.50%), Theta Fuel (TFUEL,-21.80%), Kusama (KSM, -20.68%) were recording significant declines whereas Bitcoin traded down by 3.20% in the last 24 hours.

An outlier to the market scenario remains Dero (DERO) which was up 60.50%.

Hunain Naseer, senior editor at OKEx Insights noted “Notably, most major Altcoins suffered relatively higher losses in the last 24 hours when compared with Bitcoin, and we may, very soon, see a switch from Alts to Bitcoin in terms of capital flows,” Bitcoin’s sell-off on June 21 follows after China’s central bank announced that it had recently summoned several banks and payment firms to ramp up their crackdown on cryptocurrency trading.

In separate news on the regulatory crackdown, Bybit Fintech, the second-largest futures trading platform by open interest, was accused of operating an unregistered cryptocurrency trading platform in Ontario, according to a statement of allegations published by the Canadian province’s Ontario Securities Commission.

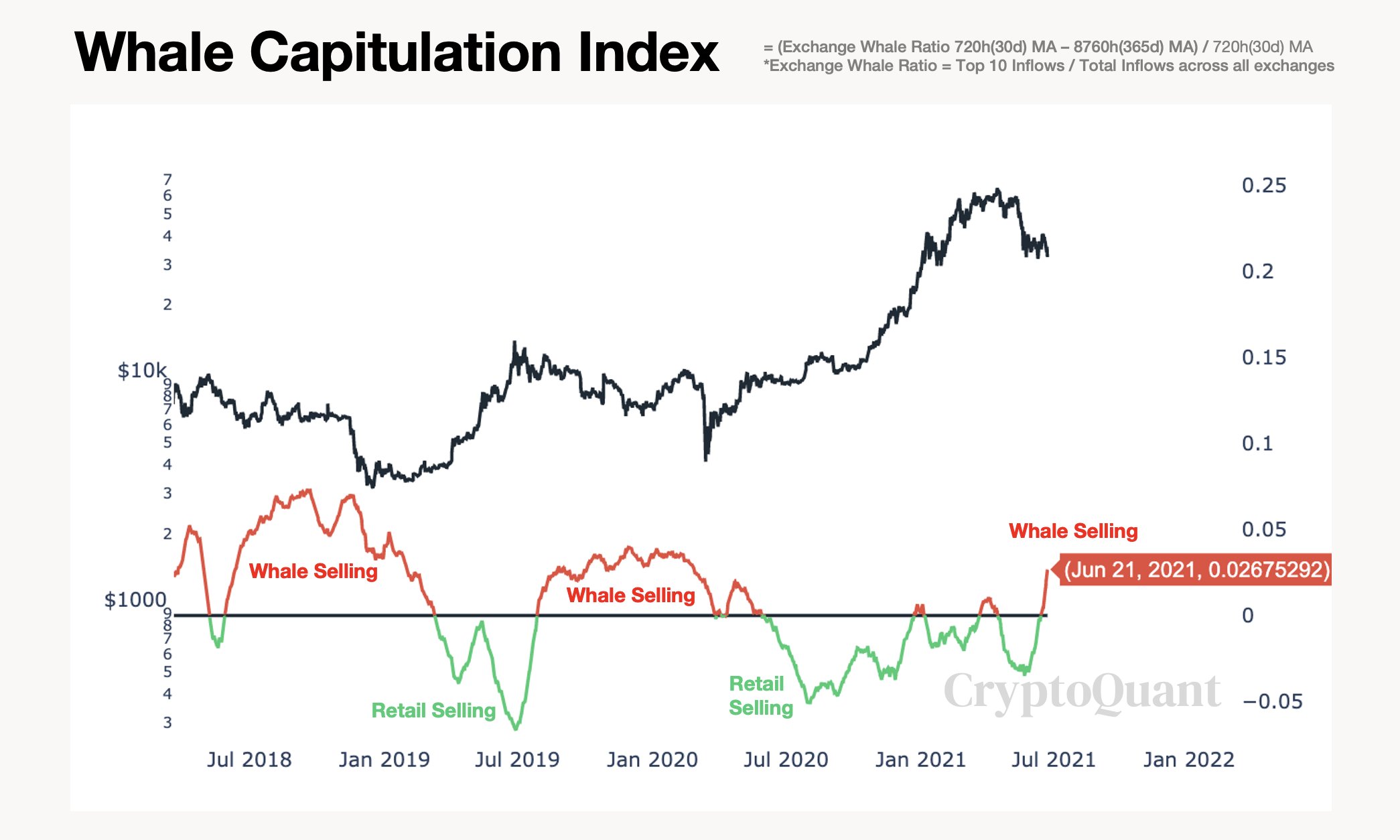

Notably, BTC inflows to exchanges have risen as the ”FUD” continues. Ki-Young Ju, crypto quant CEO spoke along these lines while indicating the likely chances of a Bitcoin bear market. He stated ”I hate to say this, but it seems like the $BTC bear market confirmed. Too many whales are sending $BTC to exchanges”.

He further stressed the levels of uncertainty in the market at the moment while putting what seems to be like a word of caution for traders:

”The market is very uncertain right now. Whale selling indicates a bear/fake-bull market, and retail selling implies a bull market. We’re in neutral now. Stop trade, be patient and wait for the next volatility”.

Bitcoin bears seemingly took a breather with price stabilizing at $31,431 (as of press time) after the news of MicroStrategy purchasing another $489M of Bitcoin broke off. The business intelligence software company stated that as of June 21 it holds more than 105,000 Bitcoins. Where the market may trend next and when to buy the dip may be a pertinent question, however, some market participants remain bullish on the long-term cryptocurrency trend.

Jason Yanowith, a market participant believes that ”The Chinese mining ban is great for Bitcoin in the long run” while highlighting four reasons why: 1) Decentralizes Hashrate 2) Chinese mining FUD is no longer a risk 3) China loses control on the most important economic asset of our lifetime 4) Mining will move to areas more focused on renewable energy”

Another market participant stated ”China FUD is getting old” while noting the fact that Bitcoin always rallied after each FUD. He stated conclusively ”I feel like it’s the strongest buy signal now”

Digital Currency Group (DCG), the parent company of crypto-asset manager Grayscale Investments, said it plans to purchase up to $50 million in shares of the latter’s Ethereum Classic Trust. In a June 21 announcement, DCG stated it will fund the purchases with cash on hand and make them on the open market.

Ethereum Classic (ETC), a hard fork of Ethereum had tripled in May to attain an all-time high of $175 before shedding nearly 70%. As of press time, ETC was trading at $36.85.

Image Credit: Cryptoquant, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.