Decentralized finance (DeFi) tokens all across the cryptocurrency market are ballooning. In the previous week, the DeFi sector was seen to amass gains of almost 14%. Notable DeFi tokens such as Maker (MKR), Aave (LEND), Synthetix Network Token (SNX), and THORChain (RUNE) could be said to have contributed immensely to the sector’s gain.

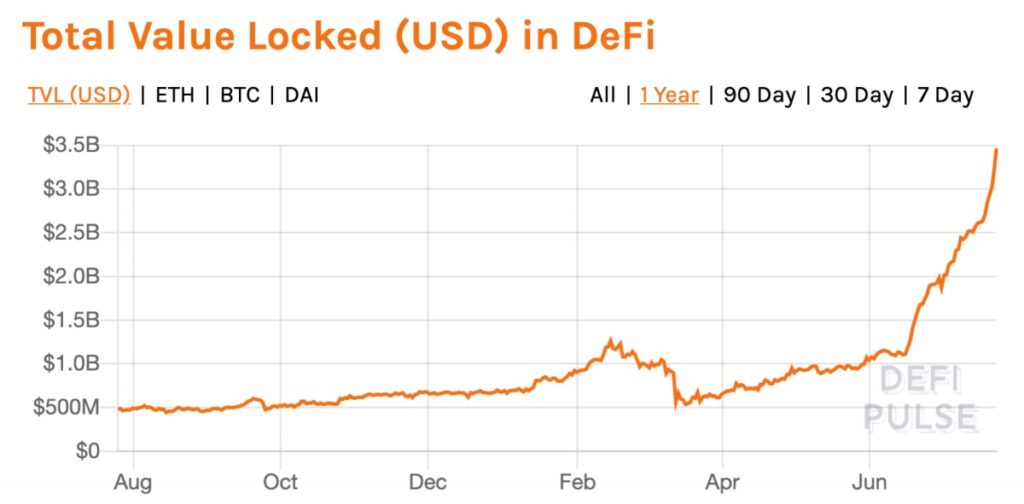

On July 21st, the total value locked in decentralized finance (DeFi) exceeded the $3 billion mark to stand at the time of writing at $3.37 billion. This value is five times the increase that was seen at the beginning of the year.

Data aggregator, DeFi Pulse lists out the top 5 DeFi players to be Maker (MKR) which is at the forefront with $718 million in value locked. Aave (LEND), $560 million, Compound (COMP) $547 million, Synthetix, $483 million locked, and Curve, with $342 million locked in decentralized finance.

This could be seen as in over the last 48 hours, Maker (MKR) has been making many investors gleeful with nearly 40% rally. However, this bullish momentum quickly reversed leaving about just 10% gains. Howbeit, this two-day rally is seen by analysts as a strong performance.

Aave (LEND), a protocol aimed at providing interest in lending crypto assets has been in a steady, explosive uptrend over the last two months with barely any significant pullbacks of note. In less than two full months, the Altcoin grew by over 675%. In July alone, which is only three weeks in, Aave is up over 180%.

Compound (COMP) came into the spotlight with yield farming which let investors lend out crypto tokens for a return in interest. The asset was listed on Coinbase in June and within days had the largest quota of total value locked up in DeFi in a pump.

However, as soon as the hype started wearing off, traders turned bearish on the Altcoin. Aave (LEND) stole the spotlight from Compound (COMP) consequently. Compound however is pumping yet again.

Meanwhile, in the face of Ethereum-based DeFi surge, Bitcoin (BTC) remains stagnated within its consolidation range of $9000 to $10000. This has prompted questions asking if it is the culmination of Bitcoin’s dominance and the emergence of DeFi’s dominance.

Notable crypto enthusiasts are seen to have referred to DeFi as the ‘new vista’ or ‘real revolution’ while maintaining Bitcoin’s moniker as ‘pet rock’.

A venture capitalist cum crypto analyst sees a tie-up between Bitcoin and DeFi stating that he expects the duo to grow in “lockstep”. He also believes that Bitcoin’s dominance hasn’t come to a close.

Value Locked in DeFi the Past Year. Source: DeFi Pulse

Value Locked in DeFi the Past Year. Source: DeFi PulseVenture capitalist, Imran Khan of crypto-centric Volt Capital, and a strong DeFi supporter sees a tie-up between Bitcoin and DeFi in terms of growth. He stated:

“Bitcoin and DeFi will grow in lockstep, I foresee the macro changes push Bitcoin’s flywheel aggressively. While DeFi being a sub flywheel,”.

This meant that Bitcoin’s growth will ultimately increase DeFi utility and funding since the underlying basis of the two ecosystems being currency and finance are intrinsically linked to one another.

Bitcoin was created to dethrone monetary sovereignty while DeFi was created to overthrow traditional banking with both having two different “final bosses”, he stated. Therefore, growth in one ecosystem will steer the other, referencing United States currency and banking sector intertwined growth. However, for Bitcoin to grow concurrently with DeFi and also likewise, there has to be a move to link the two sectors. At present, Bitcoin is standing aloof from the Defi sector.

Khan sees immense growth if the reserve currency of crypto which is Bitcoin is connected to the Wall Street of crypto referring to DeFi.

Steven Becker, MakerDAO head, in a Bloomberg interview stated that connecting Bitcoin and Ethereum-DeFi is a brilliant idea which may serve to create the on-chain economy desired.

However, this writer believes Bitcoin and the DeFi link up will only materialize in the long term with the need to catch the right trend and risk-on at the right moment.

Image Credit: DeFi Pulse, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.