Litecoin (LTC), launched in October 2011 is an open-source software project released under the MIT/X11 license. Notably, Litecoin was an early Bitcoin spinoff, also regarded as the ‘first Altcoin’.

Ranking 7th leading by market cap, Litecoin (LTC), and Bitcoin (BTC) share a lot in common prompting many in the crypto market to suggest Litecoin as a Bitcoin imitator. Litecoin’s developers have long stated that they intend to create the “Silver” to Bitcoin’s “Gold”.

However, the differences between Litecoin and Bitcoin lie in their market capitalization, the total number of coins that each cryptocurrency can produce, and a different hashing algorithm. Litecoin also has a smaller block interval and a comparably faster transaction speed.

The differences are listed thus-first, Bitcoin’s market cap of $209 billion is almost 50 times larger than that of Litecoin which stands at $3.78 billion. Second, the Bitcoin network has a pegged supply of 21 million while Litecoin can accommodate up to 84 million coins. Third, Bitcoin makes use of the SHA-256 algorithm, whereas Litecoin makes use of a relatively new algorithm, Scrypt.

Despite these factors which may be psychological boons for the investor, Litecoin’s price and usability stay largely unaffected by this.

In recent times, Litecoin and Bitcoin have seen a tie-up in their trading activity. Just like Bitcoin, Litecoin had been stuck in consolidation since April. Bitcoin’s breakthrough to $11,000 saw Litecoin bulls pushing the price up to highs of $59.22.

Founder Charlie Lee pointed out recently the similarities between BTC and LTC when both traded in green when other ‘Altcoins’ were crushed. A prominent analyst, Willy Woo stated in a tweet that “LTC has a habit of leading BTC”.

Litecoin (LTC) is seen to embark on an uptrend in the last seven days, extending its bullish momentum at every count while pushing towards key resistance of $60.

LTC/USD Daily Chart

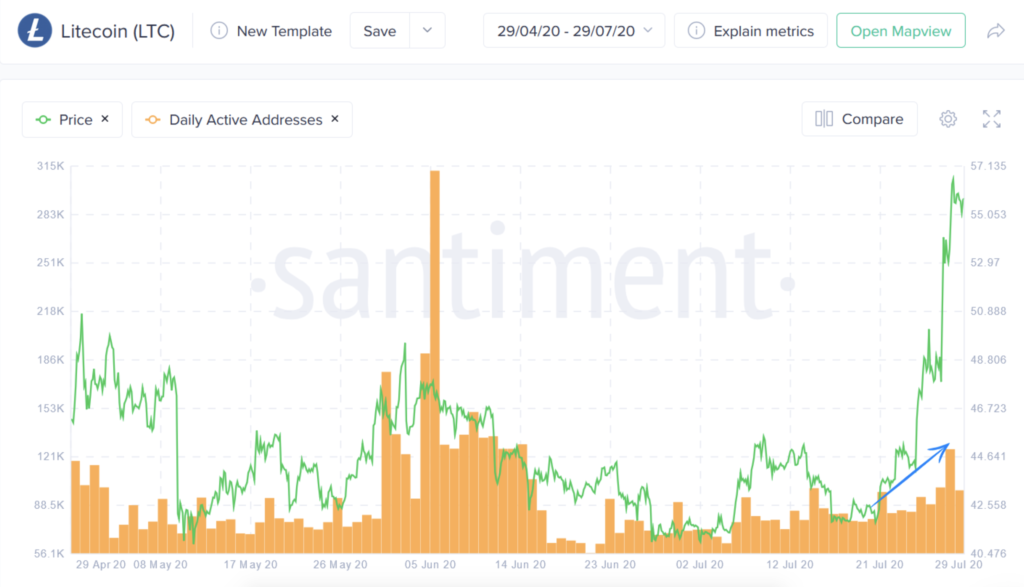

LTC/USD Daily ChartDespite, the technical strength Litecoin is incurring, however, these two key pointers keep flashing alert signals. Litecoin’s daily active address count and its network volume are still struggling to match up with its recent price surge.

At the moment, Litecoin (LTC) is increasing in value at $58.43, setting an intraday high of $59.22 gaining 3.10% since the day’s start.

At the moment, Litecoin is seen in a bid to “pump into deflating fundamentals” taking a look at Litecoin’s network volume, this metric is yet to match up with its latest price surge.

Past uncertainties regarding Litecoin’s future caused investors to lose interest which was reflected in LTC trading volume as well as its on-chain and trading metrics. Earlier in the month, Litecoin trading volume fell to a 2-year low.

LTC’s mean fees per transaction also fell to $0.011 to mark lows recorded since October 2015. Low usage is often seen to translate into small fees with Miners’ interest significantly reduced.

On-chain analytics, Santiment also noted that apart from the aforementioned, another fundamental metric to pay keen attention to which seems to be against the peer-to-peer cryptocurrency is the number of daily active addresses.

Courtesy: Santiment

Courtesy: SantimentSantiment noted a sharp drop in the number of addresses transacting the crypto asset, depicting less investor activity to bolster the price surge. This it said recently:

“Keep an eye on Litecoin’s daily active addresses in the next couple of days — after a few strong days correlating with the price action, the number of addresses sending or receiving LTC dropped by -15% compared to the day prior.”

On the positivity side, in early July, Litecoin hodl hit all-time highs as 63.8% of Litecoin supply was seen to have remained untouched in the past 12 months.

Litecoin integration with Cardano (ADA) if holds, maybe another bullish factor for Litecoin.

In the event of a bull run, Litecoin might face increased odds of large pumps as long-term investors tend to be less tempted to sell at the first price move.

Image Credit: Santiment, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.