Presently, conversations across the crypto sector and social media have been that of the Twitter takeover by Tesla CEO, Elon Musk. The rise of dog-themed coins in the last 24 hours has been majorly inspired by the recent development with Dogecoin surging over 25% within hours of the takeover confirmation.

Dogecoin also returned among the top ten cryptocurrencies by market capitalization and also the most purchased asset for Binance whales tracked by crypto data tracker, WhaleStats.

Dogelon Mars (ELON), a coin based on Elon Musk, and his love for space travel spiked 15%, rising from lows of $0.0000009 to highs of $0.00000012 today. As of press time, ELON/USD was valued at $0.00000011 on Gemini Exchange.

Meme cryptocurrency, Shiba Inu was also up 5% in the last 24 hours, inspired by the recent success of the Shiba Inu burn portal. At the time of publication, a whopping 12 billion SHIB has been burned just 24 hours after the portal went live. Other Doggone Doggerel Tokens namely Floki Inu, Dogey Inu, and Dogecash were up as much as 5% in the last 24 hours per coinmarketcap data.

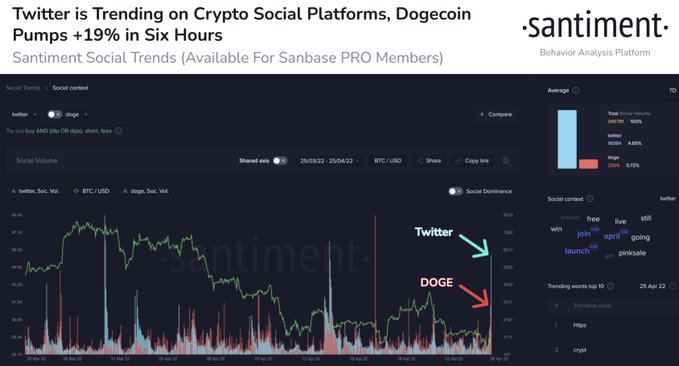

Courtesy: Santiment

Courtesy: SantimentOnchain analytics firm, Santiment reveals that meme coins typically benefit from Elon musk developments based on historical data, thus they are worth a watch in the time being. ”Potentially related to the news of #ElonMusk’s nearly formalized purchase of #Twitter today, #Dogecoin has pumped +19% over the past six hours. We have historically seen that #memecoins benefit from #Musk developments, & we’ll monitor this situation”.

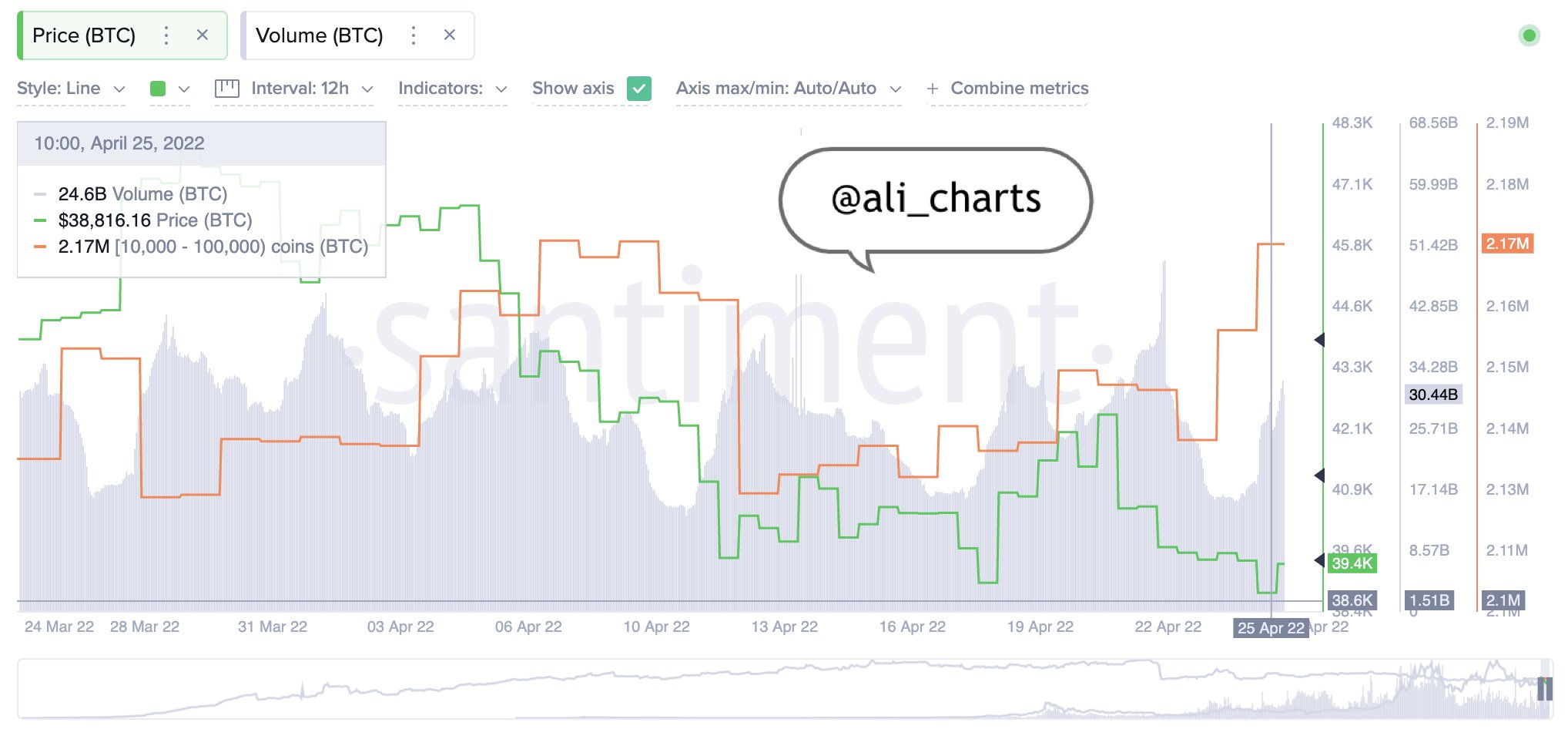

Bitcoin dipped to intraday lows of $38,202 before rebounding to highs of $40,372 seen at press time. Bitcoin trades slightly up at $40,131. Whales or large investors typically use periods of dip or consolidation to accumulate more. this time around, Bitcoin whales took advantage of the recent downswing to buy 40,000 $BTC, worth $1.6 billion.

Data from Santiment shows that addresses with 10,000 to 100,000 BTC increased their holdings by nearly 2%, while prices dropped from $39,900 to $38,200, cryptoanalyst Ali Martinez reports.

Image Credit: Shutterstock, Santiment

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.