Bitcoin (BTC) price fell to as low as $32,111 on July 8 before BTC buyers drove prices to an intraday high of $33,699 seen at the time of writing. BTC is currently changing hands at $33,508, up 1.92% on the day, according to tradingview data. Two key factors alluded to Bitcoin’s price drop first were fresh regulatory concerns stemming from China’s central bank’s warning about Stablecoin risk. The second was an assumed sudden short selling by an entity on Bitfinex.

Bitcoin’s recent rebound coincides with the announcement that payment gateway Square would be developing a “mainstream” cryptocurrency hardware wallet. Bitcoin shortly entered sideways trade after reaching the said intraday highs which opened the door for select Altcoins to rally higher.

EOS (EOS, +15.78%), Terra (LUNA, +18.28%), Synthetix (SNX, +15.59%), kuCoin Token (KCS, +8.75%), Axie infinity (AXS, +14.62%) remain some top movers in the Altcoin market over the past 24 hours.

Axie Infinity (AXS) is a blockchain-based trading and battling game that allows players to collect, breed, raise battle, and trade token-based creatures known as Axies. AXS has been climbing higher after a technical breakout since June 27. At a present price of $14.46, Axie Infinity has gained 131.04% over a 7-day basis, while making an entrant into the top 100 by market capitalization.

Synthetix (SNX) remains another top weekly gainer. At a present price of $11.77, the price of SNX has rallied 73.35% on a 7-day basis and 15.59% over the last 24 hours. One likely factor which contributed to the rise of Synthetix over the past week is the 39.3% APY offered to SNX stakers, which may have resulted in the current increase in volume and subsequently led to an increase in the TVL (total value locked) on the Synthetix protocol.

On July 7, on-chain analytics firm Santiment indicated a declining trend in the number of Bitcoin traders who continue to buy the dip as social volume toward BTC remains low and FUD posts on Twitter escalate. Further stating that ”Typically, this doubt and disinterest is a positive sign of an upcoming turnaround.”

The FUD (Fear, uncertainty, doubt) posts are not less expected amid a widely cited JPMorgan report, suggesting that the GBTC “unlocks” might lead to “downward pressure on GBTC prices and on Bitcoin markets more generally.” In July, it is believed that close to 40,000 BTC worth of GBTC shares will see an unlocking phase.

However, a growing number of cryptocurrency analysts and investors, including Amber Group Arca Funds and Kraken Exchange, have suggested that the GBTC unlockings might be good for Bitcoin prices.

This prediction seems to align with data from analytics firm, Cryptoquant which indicated that Bitcoin price may be flat, however, BTC Netflows remain negative. Stating,

”Since the 15th of June, BTC price is flat while the Bitcoin Netflow (30DMA) is negative. Negative BTC Netflows means BTC get withdrawn from exchanges, which usually leads to a price increase.”

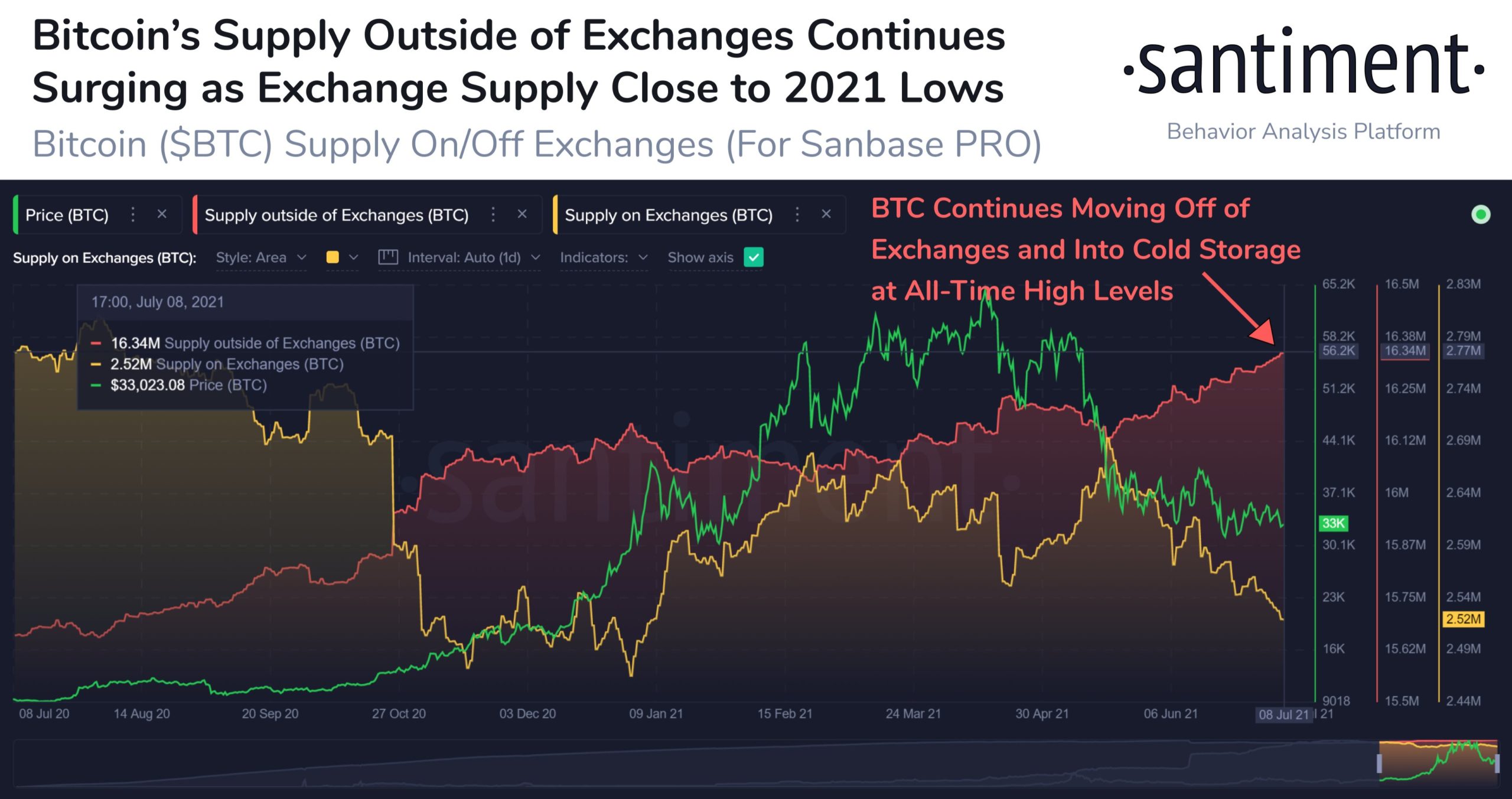

Bitcoin ($BTC) Supply On/Off Exchanges

Bitcoin ($BTC) Supply On/Off ExchangesSantiment also noticed that the present supply on exchanges was close to the lowest amount of BTC seen in 2021. Meanwhile, the supply being moved outside of exchanges matched levels last seen in November 2018.

It states ”This is encouraging due to the implication of less selloff risk.” It also noted

”One of Bitcoin’s key long-term indicators is on the brink of dipping into a buy zone, based on history. When $BTC’s MVRV long/short difference veers negative, it means a combination of short-term and long-term traders are underwater on their investments. When this occurs, Bitcoin is more likely to see an increase in market price”

The inference being drawn from the on-chain data so far is that a volatile move may be imminent for Bitcoin BTC, in the coming days. Cryptocurrency trader and analyst Rekt Capital predicts “A volatile move for BTC is coming in the next few days”

Image Credit: Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.