A fresh selling wave swept across the Crypto market on Friday with Bitcoin price falling to lows of $31,025. The majority of Altcoins traded in red as of the time of writing as Bitcoin’s selling pressure spilled into the Altcoin market.

Despite the struggles facing the cryptocurrency market at large, selected Altcoins such as Hedera Hashgraph (HBAR, + 7.41%), NEM (XEM, +20.77%), Cosmos (ATOM, +12.17%), UMA (UMA, +10.63%), Basic Attention Token (BAT, +12.43%), Ravencoin (RVN,+ 9.00%), Augur (REP,+19.93%) managed to sustain amid the market dip while trading in the green as of press time.

Hedera Hashgraph is marking the second consecutive day in the green amid bullish use cases. On July 15, the Hedera network announced a collaboration between Hedera Hashgraph and EverywareUK on the storage and distribution of vaccinations, stating “In the UK, Hedera Hashgraph and EverywareUK have been working with the NHSuk on its storage and distribution of these vaccinations.”

As of press time, Bitcoin had slightly rebounded to $31,795 amid speculations that Bank of America, the second-largest bank in the U.S., has approved the trading of Bitcoin futures for some clients.

Grayscale Bitcoin Trust is the largest traded crypto fund in the world, owned by leading crypto asset manager Grayscale Investments, LLC. The investment vehicle allows both individual and institutional investors to engage in Bitcoin trading without having direct exposure to the crypto asset.

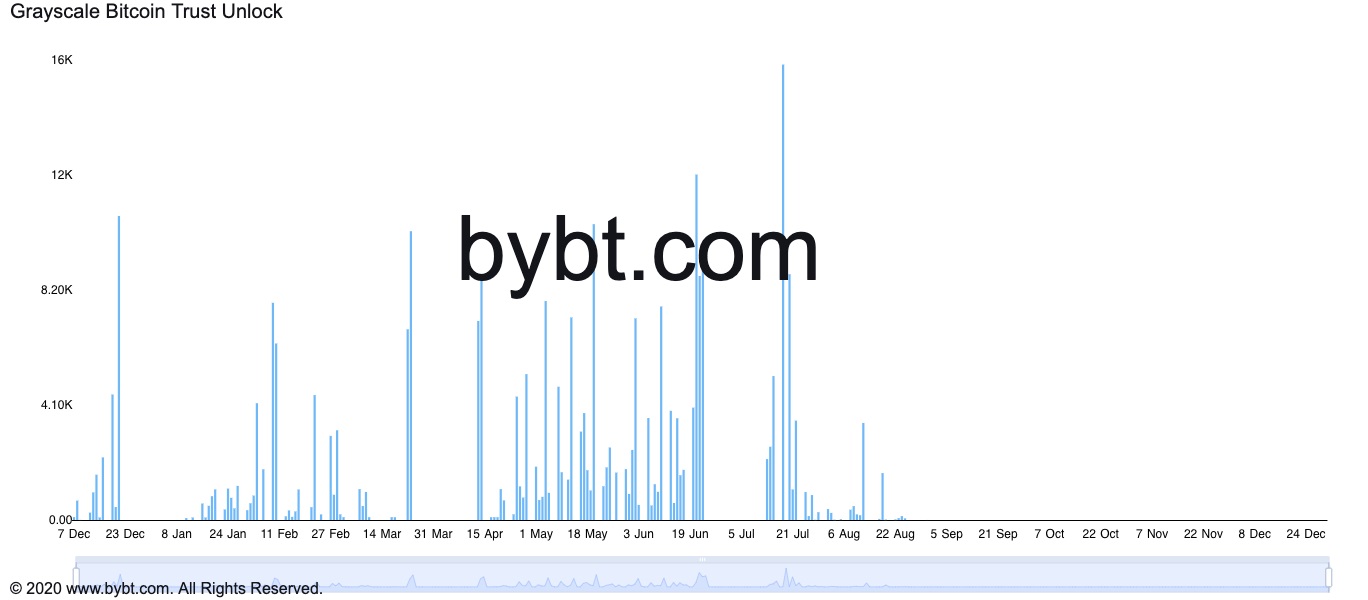

The Grayscale Bitcoin Fund (GBTC) is due to release over 40,000 BTC in July, having been subject to a six-month lock-up period. Sunday, July 18, is of particular interest, with that day’s unlocking worth just over 16,000 BTC.

Grayscale Bitcoin Trust Unlock dates. Courtesy: Bybt.com

Grayscale Bitcoin Trust Unlock dates. Courtesy: Bybt.comAs the Grayscale Bitcoin Trust runs through one of its last scheduled unlocks on July 18, opinions differ about its market impact. Some are worried that selling pressure might increase to drastically reduce once the unlockings are over, while others believe that the broader markets will be largely unaffected.

Kraken Intelligence is of the latter school of thought, stating “Despite 40K BTC worth of GBTC shares unlocking in July, the market structure suggests that the unlock will not weigh materially on BTC spot markets anytime soon, if at all like some have claimed”.

Michael Sonnenshein, the chief executive of Grayscale, believes that investors buy the GBTC shares with a medium-to-long-term outlook. So they might not want to dump their holdings immediately upon its unlocking. Sonnenshein stated:

“I would generally say that investors certainly are going to think about where the price of the shares is, relative to net asset value or relative to Bitcoin before they would think about getting any liquidity.”

Image Credit: Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.