The second-largest cryptocurrency Ethereum (ETH) price was traded to a new record high of $1,763 during Friday trading. ETH/USD started a fresh increase, inching closer to the much-coveted $2,000 level. Ethereum’s present price stands at $1,708, as at press time.

Asides from Ethereum rallying into record highs, ETH transaction fees also skyrocketed to new highs forcing some exchanges to halt ETH withdrawals. Many decentralized finance protocols were also rendered unusable for casual investors due to high gas fees.

The average ETH transaction fee clocked $23.27 on Feb. 4 as indicated by recent data from YCharts while the fees associated with using some complex DeFi protocols increased above $1,000. Bitcoin’s average fees also surpassed $14.

ETH/USD Daily Chart

ETH/USD Daily ChartIn spite of the huge costs associated with utilizing the Bitcoin and Ethereum networks, founder of Mythos capital and crypto investor, Ryan Sean Adams believes that high gas fees in relation to the present Ethereum price could actually be a bullish sign. He is not the only one on this ship as other traders seem vehemently bullish on Ethereum price action.

Chandler Song, Ankr Network CEO recently described the crypto bull run as “expos[ing] a lot of vulnerabilities of the Ethereum network, which most DeFi projects are built upon.”

Enormous efforts are going into reducing ETH transaction fees with Eth2, layer-two scaling, and the Ethereum Improvement Proposal EIP-1559 proposed by Vitalik Buterin and Eric Conner in 2019, recommending the introduction of a burn mechanism to reduce fee volatility. However, with the proposal reducing Miners’ revenues to small tips sent alongside a burned base fee, EIP-1559 has been met with significant resistance from Ethereum’s mining community.

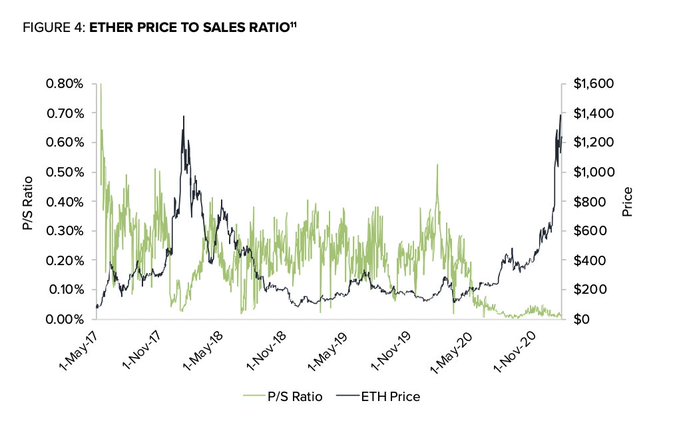

In a Grayscale research paper titled ‘Valuing Ethereum’ founder of Mythos capital and crypto investor, Ryan Sean Adams highlighted how high gas fees in relation to the current Ether price may be a bullish sign.

The CEO tweeted on Feb. 4 that Ethereum is “actually getting cheaper” from a price to sale ratio aspect. ETH price to sales ratio (P/S) could be calculated by taking Ethereum’s present market cap of $195 billion and dividing it by the total revenue derived from transaction fees. The lower the P/S ratio, the more attractive the investment (although this may be subject to debate). It was deduced that Ethereum’s P/S ratio at the beginning of 2021 stood at a nearly three years low at approximately 0.02.

High transaction fees may also be suggestive of high demand on the network, which implies bullishness for Miners and for those planning to hodl ETH into the long term.

The Grayscale research stated conclusively “We can observe from the data that the price of Ether tends to move with underlying activity on the network […] multiple metrics are reaching new highs, including active addresses, hash rate, and network fees – a positive sign for investors.”

Image Credit: Ryan Sean Adams Twitter, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.