Tether, leading Stablecoin and 3rd largest cryptocurrency by market cap, converts cash into digital currency, to anchor or tether the value to the price of national currencies like the US dollar, the Euro, and the offshore Chinese yuan.

During the March market carnage which Bitcoin saw a 50% drop in its value, the amount of Tether’s USDT in circulation increased significantly.

Tether (USDT) has been on the rise ever since. Recently, Tether market cap hit the $10 billion, two times increase that which was seen at the year’s start, touting the record of being the first Stablecoin to reach such a milestone. Concurrently, the worth of economic value enabled through the blockchain dollar surged significantly.

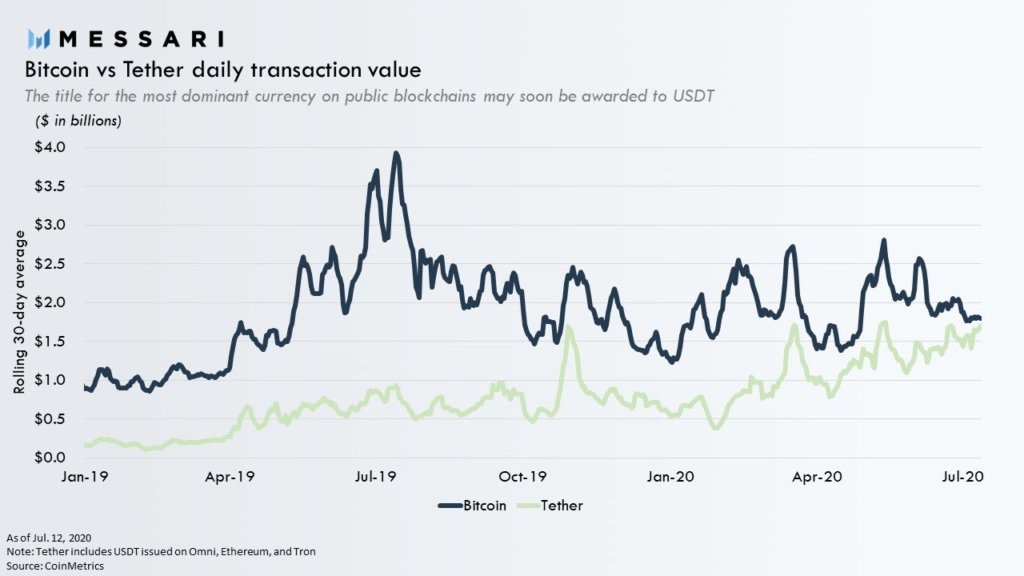

Another key metric, Tether’s daily transaction count rose significantly, almost surpassing that of Bitcoin (BTC). When viewed in an active 30-day window, Tether daily transaction count sits slightly beneath $1.75 billion while Bitcoin is just a little above this figure.

Three key drivers have been attributed to Tether’s significant growth. First, investors’ run to safety indicated by global demand for US dollars, second is the recent DeFi explosion. Third, investors seeking to hedge their Bitcoin and crypto investments through Stablecoins.

Recently the net worth of the Stablecoin market is standing at over $12 billion following an adoption rise.

This ongoing Tether (USDT) growth has spurred questions as to what this may pose for the largest crypto asset by market cap, Bitcoin, and the aggregated crypto market. An early Bitcoin financier stated that Tether is now banking the crypto space.

Another school of thought believes USDT could rank as the reserve currency of the crypto market, not Bitcoin. However, a fact which cant be waved aside is that Tether USDT is of key importance to the aggregated cryptocurrency market.

Bitcoin (BTC) largest crypto asset by market cap has been stagnated for weeks around $9,000 and $10,000 consolidation range and currently trades at $9,725.

First, analysts see Tether (USDT) surpassing Bitcoin to rank as the most dominant currency on a public blockchain. An analyst was quoted to say “USDT may soon surpass Bitcoin as the dominant currency on public blockchains.”

Recent Bitcoin Daily Transaction Volume As of July 20. (Courtesy: Messari)

Recent Bitcoin Daily Transaction Volume As of July 20. (Courtesy: Messari)This could be explained thus-Bitcoin indecisive trading is leading up to a decline in its daily transaction value while USDT is seeing a rise in user inflows due to the “yield farming” trend. This increases the likely chances of Tether (USDT) surpassing Bitcoin in this key metric.

Second, on how Tether’s growth might affect Bitcoin’s price, Charles Edwards, a digital asset manager in an earlier tweet said: “major changes in Tether’s market capitalization have led Bitcoin’s price over the last 1.5 years.” If history rhymes then Bitcoin bulls may soon resume an uptrend as key metrics climb.

Another question that has propped up is if Tether (USDT) is a better store of value than Bitcoin (BTC). An analyst expounds on this.

Willy Woo, a popular Bitcoin analyst opined that there is a likely chance of Tether storing more value than Bitcoin (BTC). Bearing in mind that Tether (USDT) is 1-to-1 pegged to the dollar.

When comparing the two crypto assets market cap, Bitcoin’s leading market cap is way higher, up to 2000% ahead of Tether (USDT). So how could this be?

Woo expounded that based on the 2018 findings of analysts like Thomas Lee of Fundstrat in which it was deduced that every $1 put into Bitcoin matches with a $25 increase in market cap.

If this analysis holds, then one might say Bitcoin’s “real market cap” based on this deduction is near $7 million. However, Bitcoin’s market cap seen at the moment stands at $178,039,286,875.

Woo attributed the discrepancy between Bitcoin “real market cap” and that which is seen to “fiat amplifier” resulting from the liquidity of the crypto market.

Alex Kruger, a crypto analyst expatiated on “fiat amplifier” stating:

“Invest a relatively large sum in a small asset (in $ terms), where additionally a significant fraction is not liquid (i.e. does not trade, sits off exchanges) => prices skyrocket. Fixed supply compounds the impact.”

Though Tether USDT may have a relatively low market cap, its importance is seen in its trading volume which surpasses that of Bitcoin within a range. Tether 24-hour trading volume stands at $23.76 billion while Bitcoin’s trading volume has been $16.13 billion.

Image Credit: Messari, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.