The first and largest cryptocurrency, Bitcoin (BTC) aroused investors’ interest in cryptocurrencies no doubt. The public’s perception of Bitcoin has changed dramatically since the previous year. From record inflows into Grayscale products, Guggenheim’s Securities and Exchange Commission amendment to wall street entry into crypto, the list is quite endless.

Blackrock CEO Larry Fink stated “Bitcoin has caught the attention and the imagination of many people. Still untested, pretty small relative to other markets.”

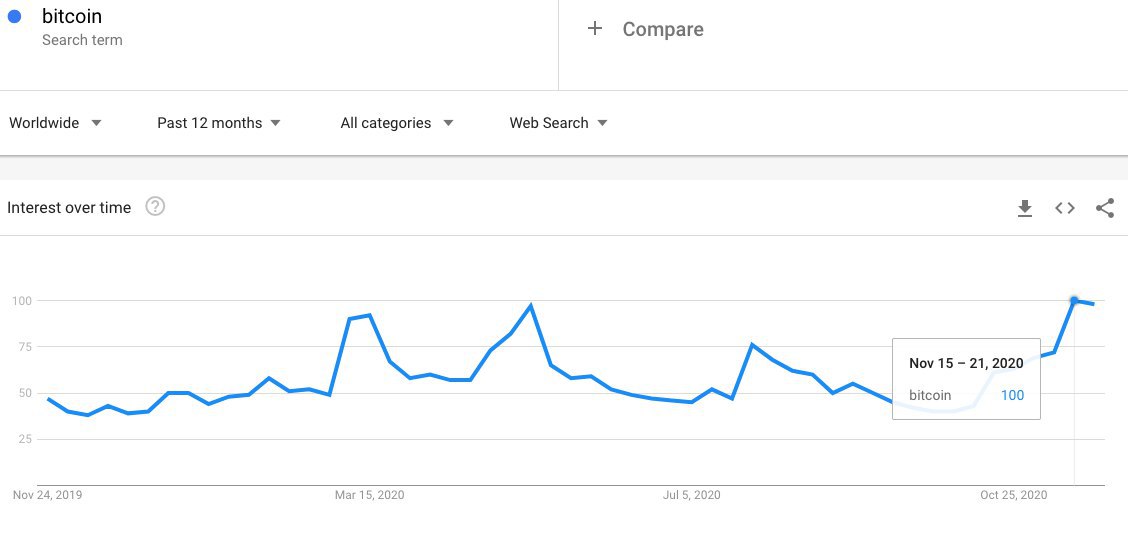

Google Trends data recently indicated that searches for the term “Bitcoin” reached 2020 high the moment its price rallied above $19,000.

Google search for Bitcoin reaches 2020 high. Courtesy: Google Trends

Google search for Bitcoin reaches 2020 high. Courtesy: Google TrendsNot only Bitcoin, the second-largest cryptocurrency by market cap, Ethereum (ETH) has also begun to garner more attention. Grayscale recently noted that its Ethereum Trust has also seen a surge in net inflows. It stated that in Q3 of 2020, weekly inflows into the Grayscale Ethereum Trust averaged $15.6 million. This may suggest a growing appeal in the asset beyond the development community.

Analysts also have emphasized a growing interest across various subsectors within the ETH ecosystem. Mythos Capital co-founder Ryan Sean Adams noted that 1% of all ETH supply is now locked in ETH bonds indicating many individuals are seeking exposure to the Ethereum economy.

This isn’t farfetched as derivatives instruments continue to give Bitcoin and Ethereum a huge competitive advantage for pro investors’ money. Therefore, the likelihood of Bitcoin and Ethereum being overtaken by “killer” blockchain reduces as time goes by.

Besides their dominance in the derivatives markets, Bitcoin and Ethereum having 97% share of Grayscale Investment funds may also support this narrative.

BTC/USD Daily Chart

BTC/USD Daily ChartBitcoin trades at $19,050, Ethereum is at $592 at the time of writing.

Bitcoin and Ethereum may be garnering all the attention, an analyst hints on what investors should watch out for regarding cryptocurrencies, market trends as time unfolds:

Life Expectancy and Network Effect: In 2017, eyes were on some competitor blockchains to be the Bitcoin and Ethereum “killer” based on their throughput or other factors considered as an advantage.

Time proved otherwise that the network effect and life expectancy can’t be overruled. The life expectancy of some technologies has been linked to their age, which is proportional to their survival and how long they can be predicted to exist. If this is true, it may imply that the longer a cryptocurrency stays in the top 10, the higher the chances of its relevance three years after.

Hard Forks and Code-Base Clones: Another thing that investors should watch out for are hard forks and code-base clones. When Bitcoin Cash, Bitcoin Gold (BTG), Ethereum Classic, and Dash forks or code-based clones were launched in 2017. They flourished initially, but a look at their present price and market cap indicates that this seeming success was a facade.

The Total Coin Supply and the Issuance Rate of a Cryptocurrency: These have been linked to a crypto asset’s price performance. Cryptocurrencies with high issuance might experience difficulty catching up in price. XRP, Chainlink (LINK), Polkadot (DOT), Stellar (XLM), Tron (TRX), and Tezos (XTZ) fall under this category.

Although these assets may have numerous convincing use cases and impressive partnerships, their massive coin supply might make sharp, upward price movements difficult.

Crypto Sectors Likely to See Increased Interest: Judging by the use case increase in 2020, the sectors likely to see increased interest include oracles, interconnectivity, decentralized exchange tokens, non-custodial lending, and liquidity provision.

Image Credit: Google Trends, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.