Polkadot is an interoperable blockchain platform that enables cross-blockchain transfers of any type of data or asset, not just tokens.

The Dot token which is the native crypto asset of Polkadot serves three distinct purposes-governance over the network, staking, and bonding. Polkadot is presently ranking 6th largest by market cap at $3.98 billion. This wasn’t the scenario weeks ago as it barely met up with the top 100 cryptocurrencies. Polkadot’s meteoric rise has partly alluded to “redenomination” while experts are insisting that there is more to its rise than this.

“Redenomination” is a process that shares semblance with the stock split, which can push up the value of the asset consequently as it becomes more affordable to smaller investors. This process caused DOT’s circulating supply to be inflated by 100 times.

It all started on August 21 when after a community vote, DOT was redenominated which saw one old DOT split into 100 new ones. As a result, the total supply grew from 10 million tokens at inception to 1 billion.

DOT/USD 4-Hour Chart

DOT/USD 4-Hour ChartPolkadot (DOT) is presently trading at $4.62.

Recent findings indicate that Polkadot’s (DOT) price action has been serving as a predictor of Ethereum price moves in the last few weeks. Analysts noted that DOT’s price movement correlates with the ETH price movement on the 15 minutes and 4 hours time frame. DOT lower trading volumes and the fact that 77% of the total supply is concentrated among 100 wallets partly supports this.

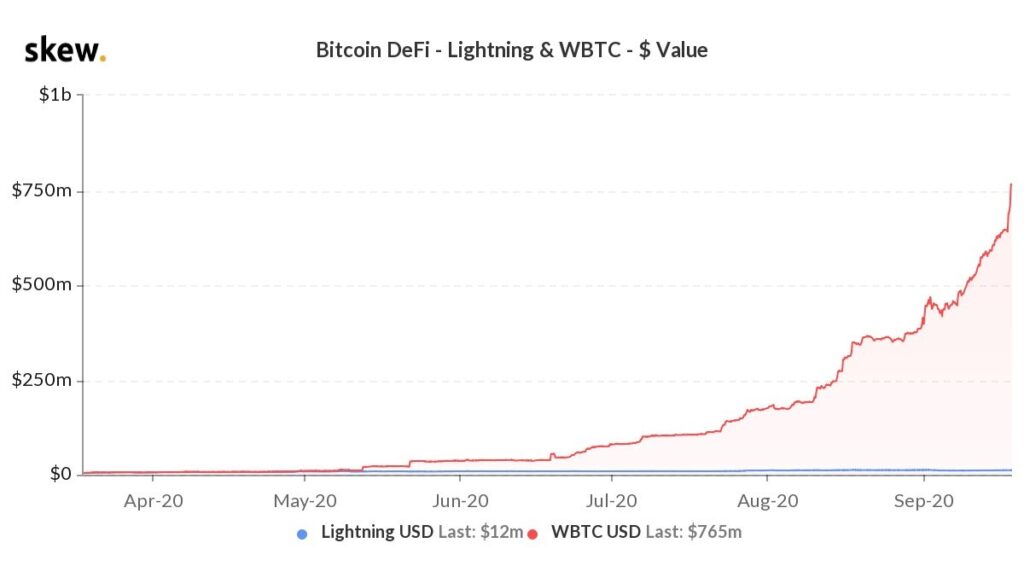

Recent data from Skew noted that the market valuation of wBTC is inching towards $1 billion. The circulating supply of 76,047 wBTC indicates more users are transferring BTC to Ethereum-based DeFi platforms for yield. However it is not possible to transfer Bitcoin to Ethereum, users convert BTC to wBTC, and then use wBTC on DeFi platforms.

The wBTC market cap. Courtesy: Skew

The wBTC market cap. Courtesy: SkewThe Use of wBTC to Gain Exposure to DeFi Platforms and Yield Enables BTC Holders to Achieve This: BTC users can still use DeFi protocols without selling BTC while Bitcoin investors do not miss out on any potential rally from BTC’s price movements.

Since wBTC represents the exact value of 1 BTC, the number of Bitcoin (BTC) addresses holding 1 BTC plunged to a 4-month low today as stated by Glassnode.

Recently, Jack Purdy, Messari researcher stated that the dominance of wBTC would likely persist into the short to medium term. The rising market capitalization of wBTC may also indicate that many BTC users do not want to risk missing out on any potential rally.

Image Credit: Skew, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.