Sri Lanka has announced its plans to create a new know-your-customer (KYC) platform that will be powered by blockchain technology. As seen in an official post, the Central Bank of Sri Lanka has called for interested tech firms who will build a proof-of-concept (PoC) for the KYC system, to be deployed throughout the banking sector.

According to the publication, the central bank is looking to improve the country’s finance industry as much as possible, and wants to take advantage of technology in this regard.

“The increasing demand for digitalized financial services has created an opportunity for Sri Lanka to evaluate the possibility of adopting Blockchain Technology to further advance Sri Lanka’s financial sector.”

The aim of this shared KYC system is to have a general platform that the government of Sri Lanka as well as all commercial banks, will have access to for a fully detailed update of a customer’s information. The system is expected to be a joint effort between the government and the private sector, specifically Sri Lankan tech firms that already have a minimum experience of two years and also a history of creating and launching mobile applications.

The publication also says that the platform will help to improve efficiency in the sector, but also increase the general rate of financial inclusion.

More Central Banks are looking into blockchain and crypto. If a recent IBM Report is anything to go buy, Sri Lanka just might be interested in its own central bank digital currency (CBDC).

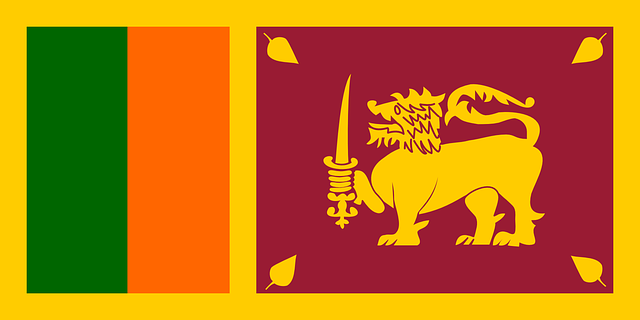

Image Credits: Pixabay

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.