Chainlink, 13th largest cryptocurrency, weeks ago saw a huge jump in its market value. This bull streak made LINK to set fresh all-time highs with the price reaching up to $4.95.

This singular price jump occurred in the news wake of Chainlink (LINK) oracle being integrated by notable firms and blockchains such as Chinese BSN. Recently, Huobi exchange disclosed that it will be leveraging Chainlink nodes by integrating it into its wallet service.

LINK’s underlying strength has coincided with a price increase as seen in its recent price activity.

As of the time of this article, LINK is trading close to its all-time highs, exchanging hands at $4.87 gaining 2.58% since the day’s start.

LINK/USD Daily Chart

LINK/USD Daily ChartHowever, this ongoing rally has met apprehension with LINK holders who seem worried about the sustainability and that an imminent pullback could erase some of the gains amassed.

The worries may be since Chainlink is flashing red signals as recently released data from on-chain analytics, Santiment indicates LINK may experience an imminent pullback. Not only this, but LINK’s technical isn’t also painting a favorable outlook as indicated by a double top formation.

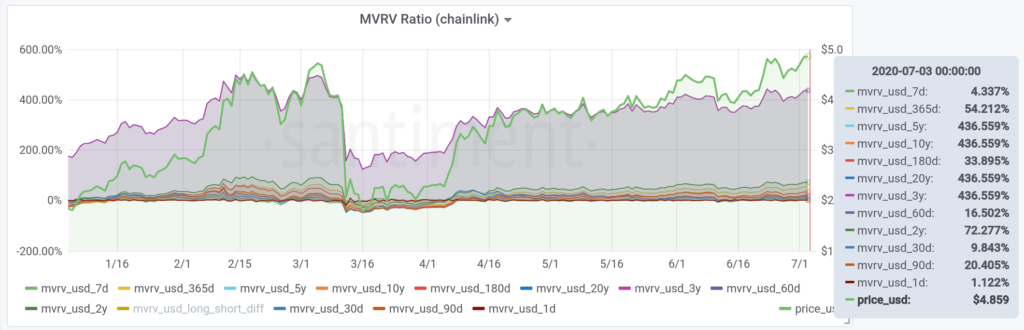

Recently released data from Santiment noted that a Chainlink metric, MVRV ratio which refers to LINK’s market value to realized value just hit all-time highs.

Chainlink MVRV Ratio Given by Santiment. True as of 5 July

Chainlink MVRV Ratio Given by Santiment. True as of 5 JulyThis rather is a red signal because it portrays the fact that every LINK holder is in green. The consequence of this is the potential of a sell-off to increase gains.

LINK technicals also paint a bearish picture as seen in the development of a double top pattern amassing from Chainlink price action over weeks. The double top pattern is considered an extremely bearish reversal pattern.

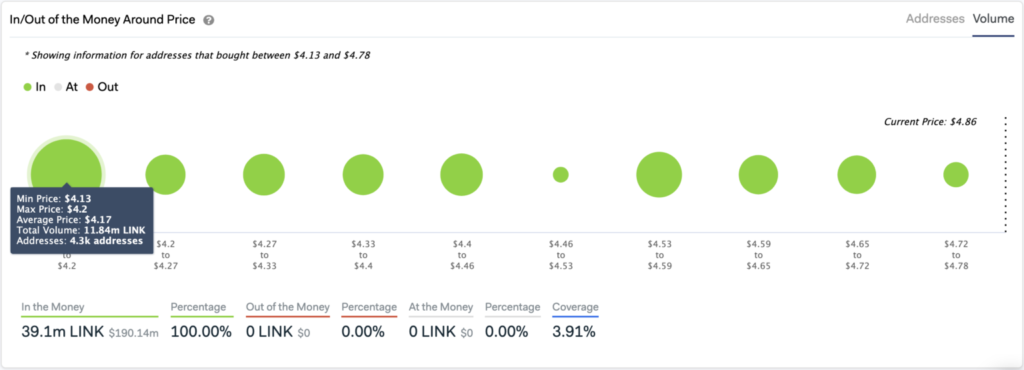

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model indicated the possibility of Chainlink experiencing a slight decline but no further than $4.15 as 4,300 addresses had previously bought nearly 12 million LINK which constitutes strong support capable of pushing LINK back to its all-time highs.

Chainlink Key Essential Support Stays at $4.15 (Source: IntoTheBlock)

Chainlink Key Essential Support Stays at $4.15 (Source: IntoTheBlock)Chainlink NVT which is link’s Network Value to Transactions Ratio is flashing green. NVT offers useful information about LINK’s fair value. A high NVT indicates that network valuation is outpacing the value being sent on the payment network.

At the moment, LINK is seeing a massive token circulation. A trend started in the last 5 months, if it sustains this further, Chainlink bulls may spur self-made uptrends in the days ahead.

Image Credit: Santiment, IntoTheBlock, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.