The first and largest cryptocurrency by market cap, Bitcoin (BTC) achieved a peak of $13,863 on October 28. It however failed to hold above this critical level as it plunged to lows of $12,891 consequently. Since then, Bitcoin’s price action has turned sideways establishing some clearly-defined support and resistance levels around $13,000.

Within this period, many investors and traders are eyeing the $13,500–$14,000 area as crucial as an analyst describes it as the final big hurdle until a potential new all-time high can be hit.

The coming days will see two key events unfold which may impact BTC price action. First, November 3rd forms the date of the 2020 U.S. Presidential elections, an event whose outcome is widely believed to have an immediate impact on macro markets. Second on the same day, November 3rd, Bitcoin will see a difficulty readjustment. This metric is presently down at nearly 10.4%, the biggest plunge recorded since late March.

BTC/USD Daily Chart

BTC/USD Daily ChartDespite the glaring risks which may be posed by these events, analysts have just one prediction: Bitcoin will ultimately win. Bitcoin (BTC) is presently trading at $13,585.

So far it has been a tremendous month for the flagship asset as it will most likely finish October with one of its highest monthly closes on record. Concerning the US upcoming elections, Grayscale CEO Barry Silbert, say both a Trump or a Biden win would buoy BTC. The CEO made his deductions after a recent study by the investment firm highlighted that the potential market for Bitcoin has significantly grown this year 2020.

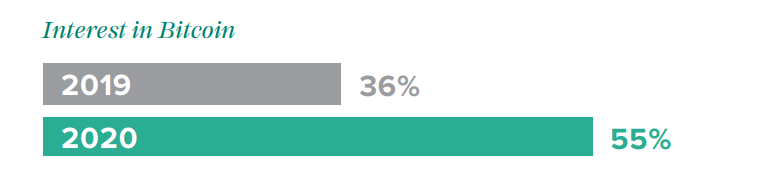

Interest in Bitcoin rises from 36% to 55% in one year. Courtesy: Grayscale

Interest in Bitcoin rises from 36% to 55% in one year. Courtesy: GrayscaleHe also noted that the strong fundamental factors behind Bitcoin and the rapidly growing demand could offset the election risk in the Q4.

Denis Vinokourov, head of research at the Crypto exchange and broker Bequant stated that if Bitcoin surged in October due to the uncertainty surrounding the election, then the post-election cycle could cause BTC to unwind. He also stated that because $13,875 has acted as a multiyear resistance area since 2018, a minor pullback or consolidation phase in the near term may be expected.

Guy Hirsch, managing director of the eToro however believes that a major pullback is unlikely in the near term, stating that the present uptrend of Bitcoin is different from past cycles. He further emphasized that a fall to $12,000 is unlikely, as the “upside momentum” of Bitcoin is simply too strong, with fundamentals backing it up. He noted that the rising institutional adoption of Bitcoin, high network hash rate, and growing daily transaction value on the Bitcoin blockchain all support Bitcoin’s bullish scenario.

Concerning the upcoming BTC difficulty readjustment, a recent report indicated that the outcome should be an easier entry-level for Miners, with a rebound following, noting that fees are currently at their most expensive levels. This is coming out of a deduction that price action may be influenced in line with Miner’s behavior.

In the near term, $13,000 serves as a large whale cluster while $14,000 a key resistance level. An analyst indicated that If the market uncertainty persists after the election, there is a higher probability that BTC may enter an accumulation range between $13,000 to $13,900.

Technically, higher time frame charts of Bitcoin portray a neutral market sentiment in the short term, therefore as long as the price of Bitcoin remains stable above key support levels of $12,700 and $13,000, the overall technical uptrend of BTC remains intact.

Image Credit: Grayscale, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.