Bitcoin (BTC) price recovered in a relief rally after plunging to lows of $28,732. However, the flagship asset was unable to break above the stiff resistance mounted at $33k, trading at $32,114 at press time. Bitcoin bulls held ground at mid $31,000 which acted as formidable support.

Chad Steinglass, head of trading at Cross Tower wrote on the situation:

“We’ll have to wait and see if that wall remains, or if institutions continue to accumulate. If they do, the trend will likely re-establish itself and continue. If they move to the sidelines waiting for more regulatory guidance, then their lack of buy flows will be acutely felt.”

If institutional demand for BTC declines, Bitcoin may be at risk of a prolonged corrective phase in the medium term. Altcoins are also treading in Bitcoin’s footsteps, only selected tokens such as Chainlink and Tezos are posting double-digit gains.

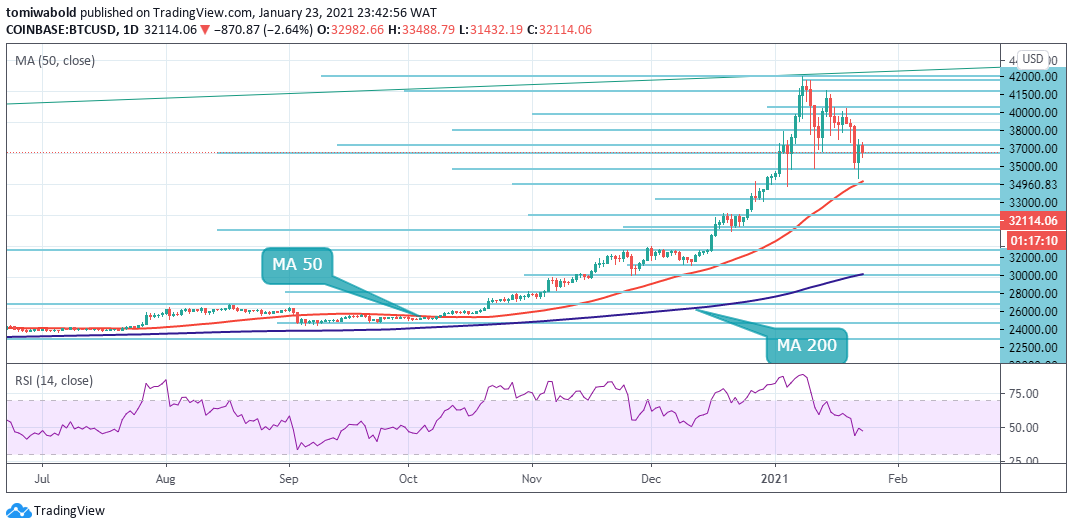

BTC/USD Daily Chart

BTC/USD Daily ChartDuring a bear cycle, Altcoins often see bigger pullbacks compared to BTC due that they are typically less liquid and have a much lower volume than Bitcoin. For a big surge to happen in Altcoin pairings, Bitcoin’s price must remain steady. Otherwise, the volatility in BTC will have an even bigger impact on the less-liquid Altcoins.

However, once Bitcoin finishes its correction and starts to move upward in a slow manner, the likelihood of Altcoins outperforming Bitcoin increases.

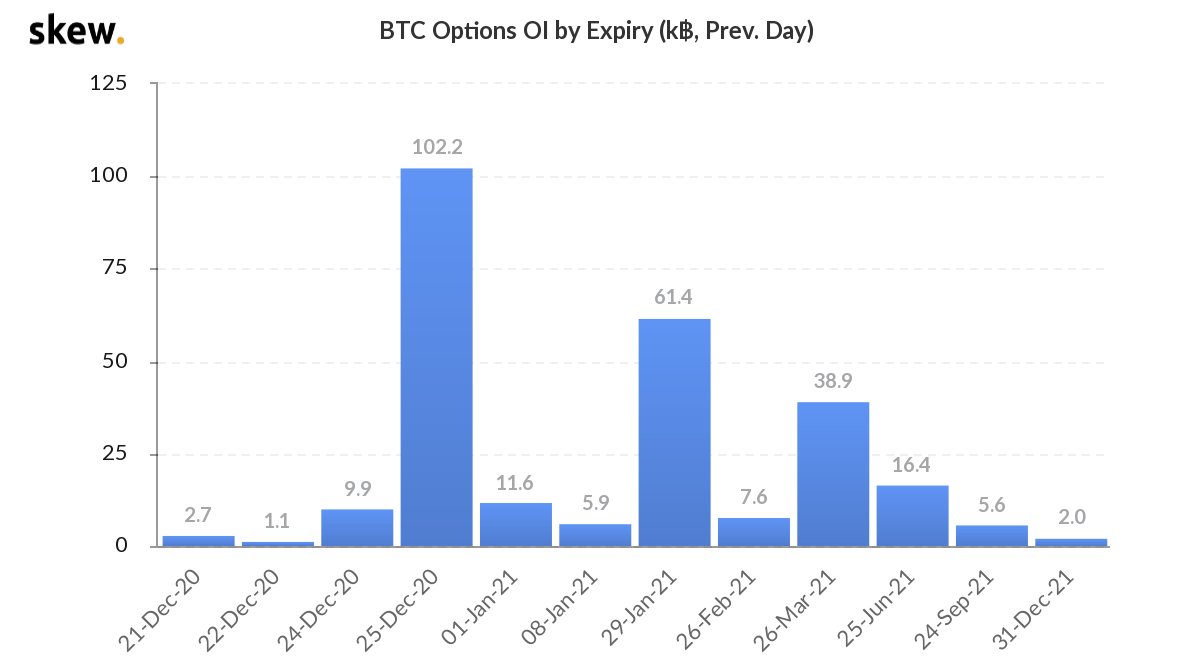

Bitcoin Options Set To Expire on January 29

Exchanges offer monthly expiration dates, although some also offer weekly options for short-term contracts. On December 25, 2020, options contracts worth $2.4 billion expired. Genesis Volatility data shows that Deribit’s expiry calendar for January 29 contains 94,060 BTC, which means that 45% of its contracts expire on January 29.

Options contracts allow holders to buy or sell Bitcoin at a specific price, which is known as the strike price. The expiration date for Bitcoin options contracts is widely regarded as a volatile event because as the expiration date approaches, holders adjust their contracts. Traders who make a profit may also decide to receive a payout and dump the digital asset.

BTC options expiry dates. Courtesy: Skew

BTC options expiry dates. Courtesy: SkewSuch events are known to cause large fluctuations in the value of Bitcoin. Usually, the impact of a contract on the price of BTC becomes more evident about one to two days before its expiration.

Crypto derivatives trading continues to expand as more traders and institutional investors seek additional opportunities to leverage Bitcoin. Both Bitcoin (BTC) and Ethereum (ETH) derivatives have grown steadily throughout 2020, and their futures and options products are available on exchanges such as the Chicago Mercantile Exchange, OKEx, Deribit, and Binance.

While many factors are driving the growth of crypto derivatives, it is safe to say that it was primarily driven by the interest of institutional investors, given that derivatives are complex products that are difficult for the average retail investor to understand.

Verge (XVG) Halving

Verge (XVG) is set to undergo a halving on Jan. 26 when its chain attains a block height of 4,700,000. The current 200 XVG reward issued to Miners every 30 seconds will subsequently be halved to 100 XVG. Halving events are quite an occurrence in the crypto space with traders having expectations that such events usually catalyze price increases.

A cryptocurrency trader who goes by the name, Crypto_michael tweeted ahead of the event:

‘Halving at 26th January, in few days…Gaining volume, more and more Twitter posts, Breakout of bullish flag ahead…2x? 5x? 10x?#’

Verge (XVG) traded at $0.001240 as of press time.

Image Credit: Skew, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.