Bitcoin (BTC), the first and largest cryptocurrency has seen an eventful 2020 so far. From March market crash to Kucoin hack, BitMEX charges by CFTC, Trump’s coronavirus infection, and the recent OKEx withdrawals freeze. It is noteworthy to state that amid all these, Bitcoin set a yearly high of $12,486 in August.

The most impactful of all these incidences have been the March market carnage, dubbed to be ‘the steepest plunge in history’. Bitcoin lost nearly 50% of its value as it cascaded from $7,700 to lows of $3,800.

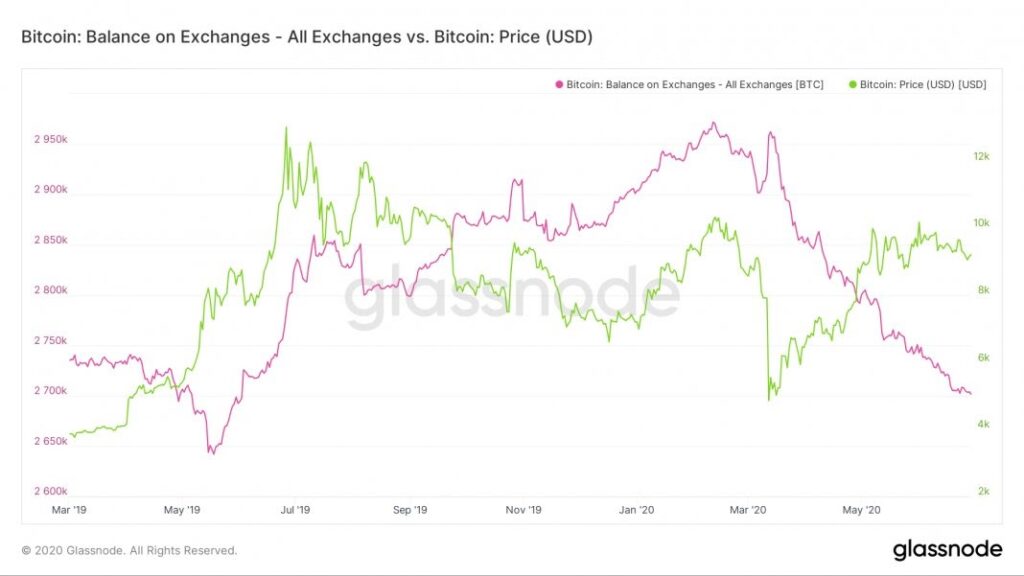

Bitcoin may have recovered from its March lows but two things may never be again. First, the reserves on exchanges have fallen from 2,950,000 BTC to 2,700,000 BTC since the March market carnage.

Second, venture capitalist investor Naval Ravikant believes Bitcoin may never trade again at the $3,000 level lows.

BTC/USD Daily Chart

BTC/USD Daily ChartBitcoin (BTC) is presently consolidating at $11,456, marginally up since the day’s start.

Analysts give the reason for the decline of 250,000 BTC from exchanges to be the consequence of the overall shortage of BTC sellers in the market and reduced trust toward exchanges.

A pseudonymous trader “Oddgems” noted that recent data shows Bitcoin is likely moving from exchanges to non-custodial wallets. He takes this action to imply that investors are transferring their funds to hodl in the longer timeframe.

Bitcoin reserves on exchanges. Courtesy: Glassnode

Bitcoin reserves on exchanges. Courtesy: GlassnodeGlassnode also noted Bitcoin accumulation as seen in hodlers activity has been on a steady uptrend for months. The fact that the overall shortage of sellers is coinciding with institutional demand for BTC may be quite bullish for the crypto asset.

The US-based crypto exchange, Kraken in a recent report stated that Bitcoin may most likely post a stronger performance in October than in September. This is inferred from historical antecedents where eight in nine instances, Bitcoin fared better in October than September. It also predicted that Bitcoin may most likely close October at $11,850 which is a 3% increase from its recent price and an 11% overall monthly gain.

The exchange also noted that Bitcoin has underperformed its monthly average during six of the nine months that have transpired in 2020 so far. Naval Ravikant, a legendary VC believes Bitcoin may never hit $3,000 again. Why he thinks so is due to an increasing number of users and institutional demand.

He also stated that the entrant of macro investor and billionaire hedge fund manager, Paul Tudor Jones into the Bitcoin space is massive.

Image Credit: Glassnode, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.