Bitcoin (BTC) continues to dance between the $34k and $38k range as market participants keep their fingers crossed on the next possible move. A string of mixed news keeps pouring in for the flagship asset, sending the bulls and the bears into a fisticuff.

Good news is coming from India as state officials are reportedly no longer keen on banning Bitcoin and a crypto regulatory bill may be up for discussion during the Monsoon Session of Parliament. Speculations deem it that India may classify Bitcoin as an asset class.

In bullish news, a bill that would have required Miners in New York to halt crypto mining operations for three years based stemming from environmental concerns has been stalled in the state legislature.

Another positivity comes as Taproot, described as the most important Bitcoin network upgrade in four years, is locked in for activation by nodes set for November. Alternatively, In a Friday announcement from the Thai SEC, the regulatory body said that Secretary-General had approved guidelines that ban Thai exchanges from handling meme-based tokens, fan-based tokens, nonfungible tokens (NFTs), and exchange-issued tokens.

Bitcoin (BTC) and Ethereum (ETH)

While some analysts believe Bitcoin may have hit bottom lows during the May 19 market crash, others are warning of another sell-off due to the “Death Cross” pattern that was almost forming.

Rektcapital, a crypto analyst believes that Bitcoin will likely see price compression in the near term as a result of the two converging EMAs which could form a triangular market structure. He predicts that the more likely scenario for Bitcoin leaving this triangle could be sometime in July.

Greg Magadini, CEO of Genesis Volatility noticed a change in the derivatives market that may mean Ethereum and Bitcoin will see downside or sideways conditions in the near term while noting huge drops in implied volatility for both assets. Implied volatility refers to the market’s forecast of a likely movement in a security’s price.

He states: ”We can expect this lull in activity to hold until we trade out of $30,000-$40,000 for Bitcoin, and $2,000-$3,000 for Ether.”

On June 25, Ethereum (ETH) will face its largest options expiry in 2021 as $1.5 billion worth of open interest will be settled. Ethereum had rallied 56% after March’s options expiry, if markets rhyme, then a similar move could be underway for June 25 futures and options expiry.

XRP (XRP)

In the ongoing lawsuit, SEC has requested for two months to turn over the internal BTC, ETH, and XRP documents. Stalling may be the SEC’s strategy to hurt Ripple’s business to a point of reaching their desired settlement conditions.

XRP will mostly consolidate in the near term as market participants keep their fingers crossed on the outcome of the lawsuit. As of press time, XRP traded at $0.843.

SHIBA INU (SHIB)

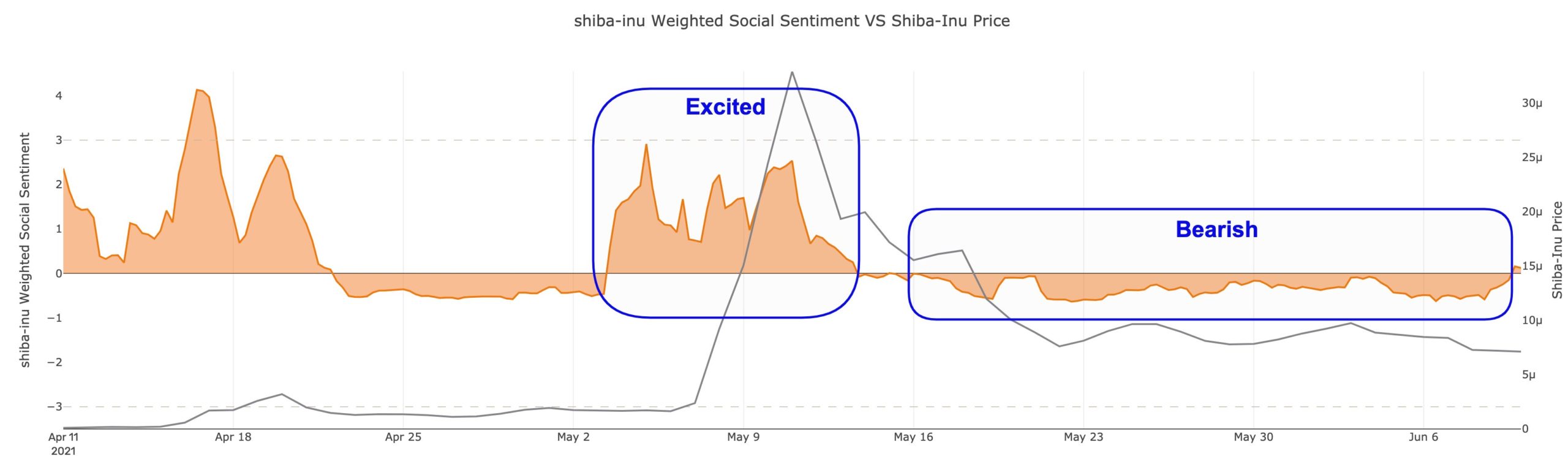

People were expecting SHIB to be a new DOGE in early May. A recent report by santiment suggests that SHIB may have likely reached a local top while the emerging trends indicate a sort of a peak social hype. Price can hardly sustain its rally without increasing hype (or social volume).

Shiba-Inu Weighted Social Sentiment VS Shiba-Inu Price, Courtesy: Santiment

Shiba-Inu Weighted Social Sentiment VS Shiba-Inu Price, Courtesy: SantimentSocial volume alongside active addresses has subsided for the meme crypto although the latter remains quite high. SHIB may most likely consolidate for the time being except as a fundamental catalyst to its price. SHIB presently trades at $0.00000630.

Theta Fuel (TFUEL)

Theta fuel (TFUEL) has been on a general ascent since the start of June following the news of the upcoming mainnet 3.0 launch and TFUEL staking. More gains could be in store for the token as investors pile up accumulation ahead of the launch. As of press time, TFUEL traded at $0.526, up 24.06% on the day.

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR) has gained ground in traceability use. On June 11, the news of Starling combining Hedera HBAR, Adobe Content Authenticity, and Filecoin to create a photographic archive of trust for sensitive docs, such as human rights violations, war crimes & genocide testimony came through.

More consolidation could be in store for HBAR until the market fully recovers. HBAR was trading at $0.187 as of press time.

Image Credit: Santiment, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.