XRP is perhaps one of the most famous crypto projects after Bitcoin and Ethereum as it has a large group of supporters, tagged the XRP army for their willingness to defend the project. XRP’s growth in 2021 was initially slowed by the Ripple SEC lawsuit which led to the delisting of XRP from several cryptocurrency exchanges until a historic reversal of fortune came in April.

In April, XRP price rose to highs of $1.96 which marks the highest level since January 2018. This also brings XRP up by nearly 800% on the year (if taken from its recent price) despite the ongoing Ripple lawsuit. In December 2020, the U.S. Securities and Exchange Commission (SEC) filed a case against Ripple Inc., which uses XRP in its payments network, for raising $1.3 billion by selling the token in unregistered securities offerings.

Trading volume and social activity for XRP rose significantly in early April following the acquisition of a 40% stake in cross-border payments processor Tranglo on April 5 and a recent partnership with Mercury FX on April 9. However, after rallying to $1.96, XRP’s price plunged to lows of $1.40 when DCG Group CEO Barry Silbert stated in an interview that it would be risky for exchanges and companies in the United States to relist XRP ahead of SEC’s clarification.

XRP’s recent climb to $1.96 has been initially based on the victories in Ripple’s legal lawsuit. Ripple was granted access to the US SEC documents “expressing the agency’s interpretation or views” on the subject of crypto assets and more recently, a court denied the disclosure of two Ripple executives’ financial records, including CEO Brad Garlinghouse.

Overall, the actual reason why XRP’s rally stalled at $1.96 remains unknown. XRP was trading at $1.46 as of press time.

After consolidating below $0.68 for the whole of March, XRP started an upside move on April 4. After days of strong bullish action, XRP surged to multiyear highs of $1.96 before pausing the upside structure. Although the strong price action characterized by Higher Highs, Higher Lows, and strong volume may be hinting at a further bullish continuation. However, XRP price may likely consolidate after the immense bullish action, given that the market may take a moment to digest the recent highs.

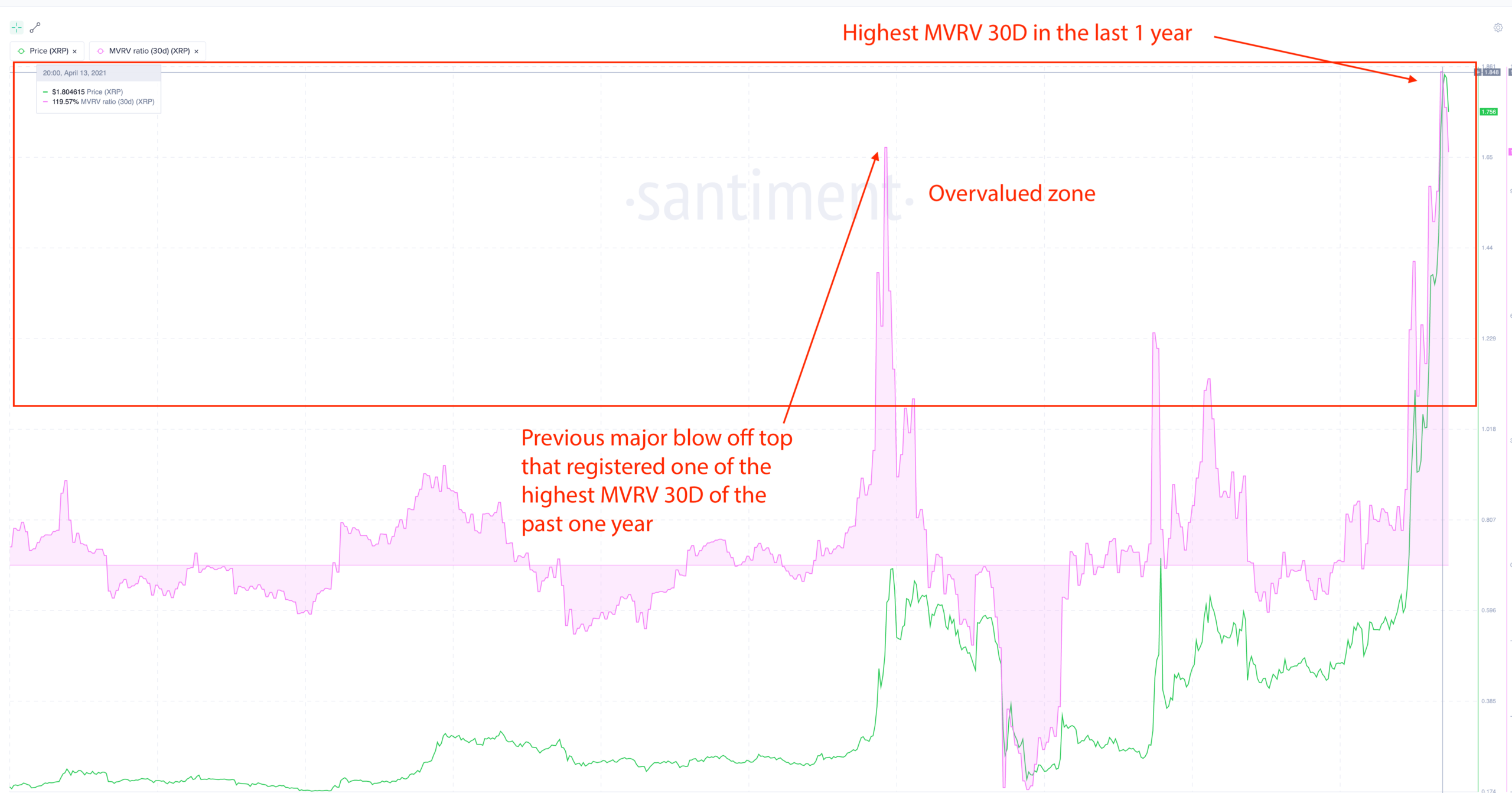

Data from on-chain analytics, Santiment indicates XRP’s MVRV 30D which estimates the average profit or loss of XRP token holders that moved in the last 30 days, based on the price when each token last moved has hit an all-time high for the past 1 year.

This may signal that XRP price has reached upside targets and a Bout of profit takings may ensue after the enormous rally. Analysts at Santiment indicated that ‘If previous MVRV 30D behavior remains true, then we should see a bleed out over the coming weeks.’

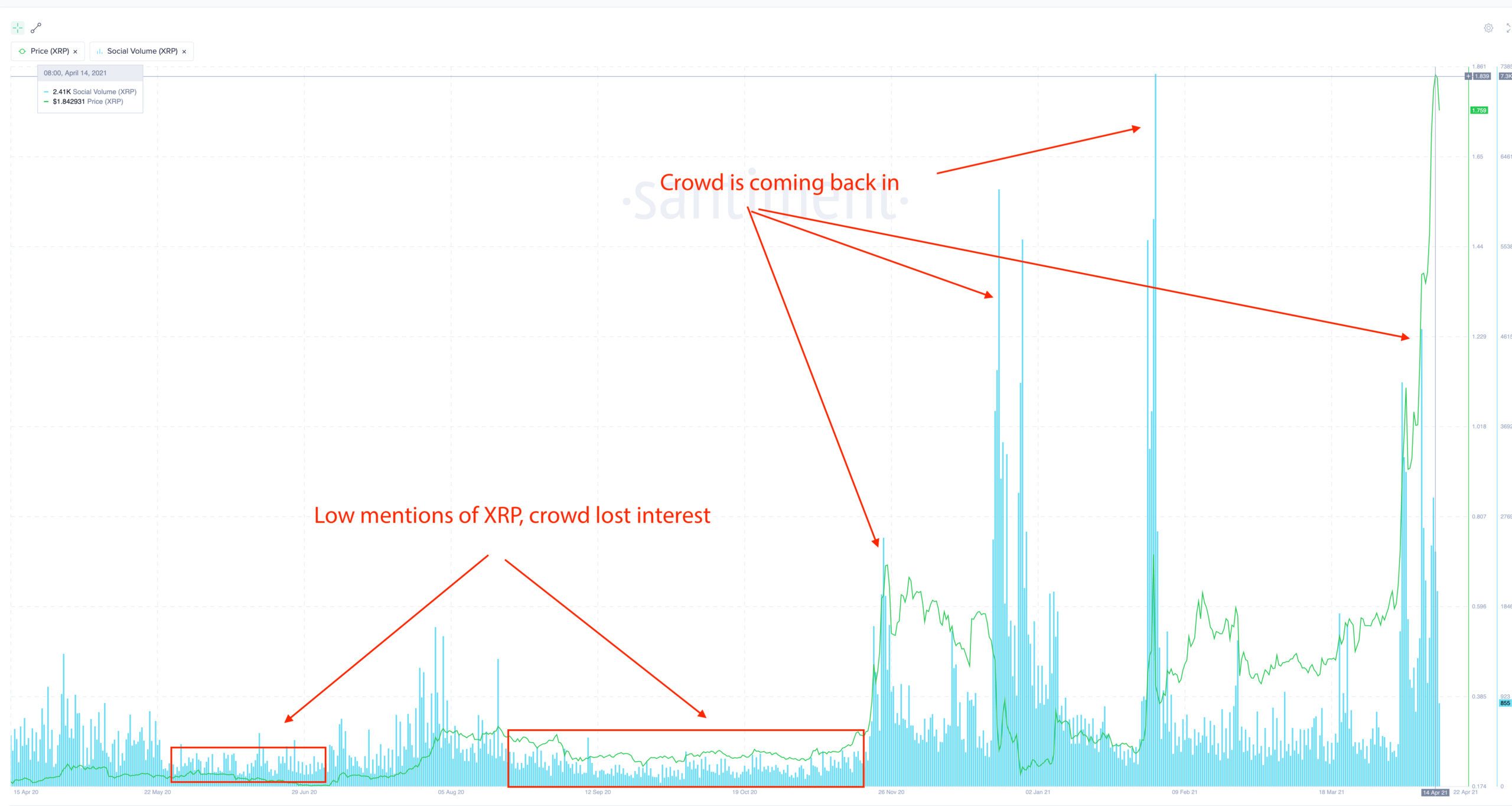

On the contrary, XRP mentions have skyrocketed over the past year and usually coincides with a rally, with one exception when the SEC announced its XRP lawsuit back in December 2020. Since then, Ripple has been scoring legal victories in the case resulting in the uptick in XRP prices.

Gary Gensler’s confirmation as the new chairman of the Securities and Exchange Commission (SEC) on April 14 brings a new twist to the ripple sec spat. In 2018, Gary Gensler called XRP “non-compliant security,” and said other initial coin offerings could violate US securities laws. As chairman of the SEC, Gensler will have the opportunity to shape the regulation governing the cryptocurrency industry or determine how existing regulations should be applied.

If Ripple should reach a consensus with the Gary Gensler-led SEC administration, this will grant the market the impetus to push XRP price upwards.

Image Credit: Santiment, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.