After three years of waiting, the first and largest cryptocurrency by market cap, Bitcoin (BTC) is finally back to the same price range it was in 2017. On December 1, Bitcoin hit fresh all-time highs of $19,915. However, after this feat, Bitcoin became engulfed in a pattern of daily higher lows as bears and bulls tussled for dominance.

Bitcoin (BTC) price seemingly entered a short consolidation bout with its range between $18,300 and $19,500. Bitcoin’s 4-hour chart indicates price compressing into a triangular pennant, if the bulls can turn the $19,500 resistance into support, then Bitcoin might surpass its all-time high.

However, Bitcoin keeps rejecting at $19,500 owing to immense resistance at this level. Recent data indicates that $19,500 is an important area for whales as well as a profit-taking region. Whale inflows to exchanges have been on the rise since when Bitcoin surpassed $19,500. This seems to suggest whales’ induced sell-off at $19,500 and beyond.

BTC/USD Daily Chart

BTC/USD Daily ChartBitcoin Presently Trades at $18,672 Down by 4% on the Day.

Recent data unravel a trend amongst Bitcoin large volume holders – Whales keep selling each time BTC nears $19,500 and beyond. And who are the buyers? BTC whales appear to be selling to institutions.

Data from different sources indicate that while more BTC returned to exchanges, large-scale buyers are increasing BTC demand than what supply can meet.

Recent stats from on-chain analytics service Coin98 noted that Grayscale investments bought twice as much Bitcoin as miners could produce in November. Grayscale is creating a supply imbalance to which a price hike may be the subsequent result.

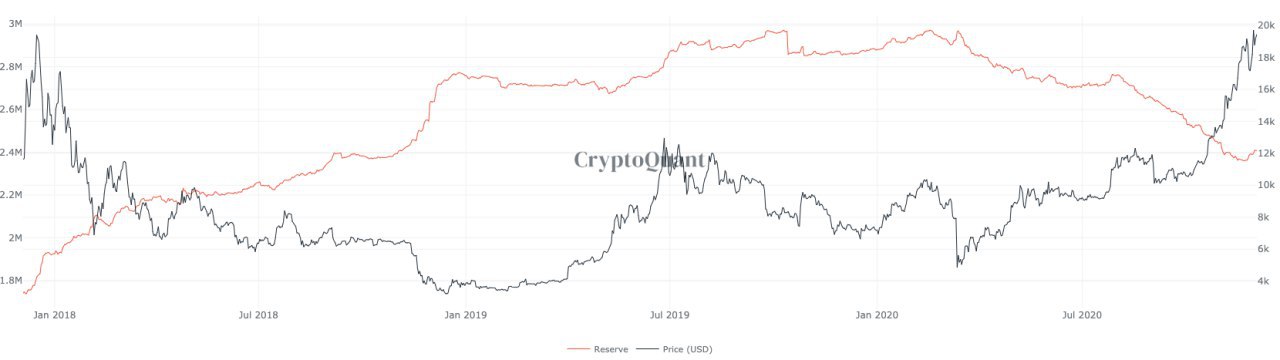

Bitcoin exchange holdings 3-year chart. Course: CryptoQuant

Bitcoin exchange holdings 3-year chart. Course: CryptoQuantKi-Young Ju, the CEO of CryptoQuant noted that Bitcoin whales stopped accumulating Bitcoin at its recent price stating that the timing of BTC’s rally hitting a pause and the sell-off from whales coincides.

CNBC recently indicated that:

“Total accounts buying more than $1 million worth of Bitcoin and then moving it off of exchange has skyrocketed,” which may imply a ‘load up’ by rich investors.

Many analysts opined that phases of consolidation and pullbacks to retest underlying support are crucial to sustaining the strength of an uptrend. If Bitcoin is really in a bull market, investors will see major and minor pullbacks as opportunities to ‘buy the dip’.

In the near term, analysts have a mixed outlook on BTC price. Some say that a major pullback may still occur, especially if BTC continues to reject at the $19,500 level.

Ki-Young Ju, the CEO of CryptoQuant, said he expects BTC to trade sideways or down in the near-term. He stated:

“I’m long-term bullish, but I think it’ll go sideways for a few days or get corrected. I think we can’t break $20K in the short-run. I expect it’ll break 20k at the end of this year.”

Celsius CEO Alex Mashinsky stated:

“We will retest $15-16k before we hit $30k towards the middle or second half of 2021. There is still less supply and more demand, so Bitcoin price has more to do with what the economy, COVID-19, and the USD do than what Bitcoin does”

Image Credit: CryptoQuant, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.