Since Ethereum’s launch in 2015, its use case has witnessed huge growth. A couple of years after the 2nd crypto asset was launched, it was used primarily for ICOs which remained till late 2018 until when a regulatory crackdown on ICOs globally almost quilted the trend.

Stablecoins and Decentralized Finance (DeFi) became popular as Ethereum’s use case in 2019.

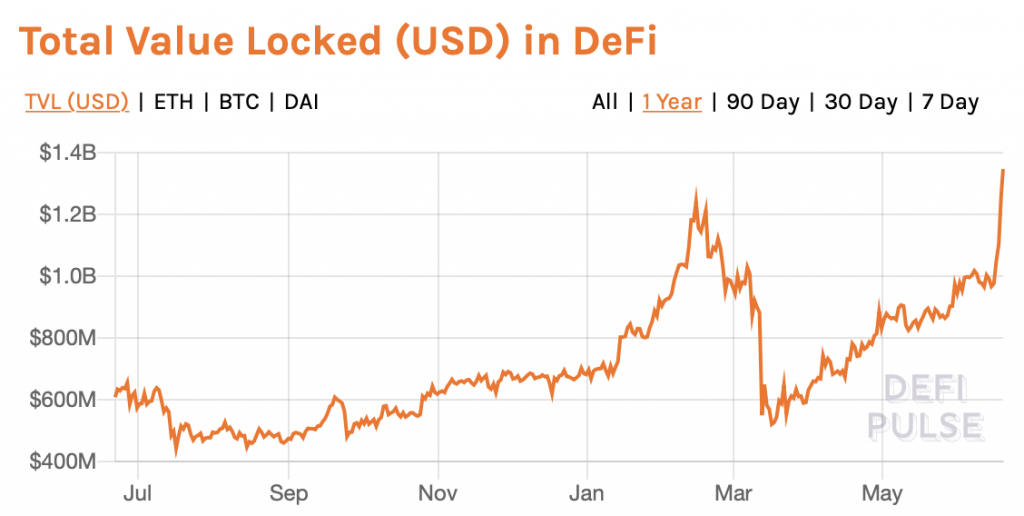

All through 2019, the decentralized finance (DeFi) trend gathered huge momentum, with the total value of ETH locked within collateralized DeFi loans hitting nearly $1 billion by the end of 2019.

This year 2020 saw this value hit the $1 billion mark in January, but following the March market carnage, this figure plunged following liquidations of almost $700 million from collateralized DeFi loans in which a key DeFi market player, Maker Dao considered closedown as a result of the losses incurred.

Image Courtesy of DeFi Pulse

Image Courtesy of DeFi PulseAfter then, the trend has since rebounded and in the past few days and weeks have seen Ethereum’s DeFi erupt higher with the total locked value setting new all-time highs today to nearly $1.4 billion, gaining 40% in the process.

Most analysts are doubtful that DeFi explosive growth will possibly cause ETH rally. Humboldt Capital, a crypto investor stated recently:

“An investment thesis for ETH centered on the continued growth of DeFi, is like advocating to invest in the S&P 500 vs just the Tech sector. So far, the biggest Achilles’ heel for ETH is the fact you don’t need to invest in the protocol layer, you can just invest in the best apps.”

Despite the fundamental strength ETH is portraying from the DeFi explosion and the upcoming launch of the ETH 2.0 Testnet which may be profitable in the long term, it remains in a precarious state in its near term as analyst foresee an imminent break below a key ascending trendline.

Another trader opined that Ethereum is at the moment following a fractal from 2018 which is quite similar to that seen when it fell from all-time highs in 2018.

ETH/USD Daily Chart

ETH/USD Daily ChartEthereum (ETH) is losing value at $226.99, largely unaltered on both a daily basis and from the day’s start.

Blockchain analytics firm Glassnode also noted that 80% of ETH’s total supply is currently in a state of profit, this has always coincided with a price drop.

However, some have maintained bullishness as regarding the impact of the DeFi explosion on ETH price, Su Zhu, the CEO of Three Arrows Capital, in a recent tweet, maintained that it is a bullish catalyst for ETH regardless.

John Todaro of BlockTown Capital stated that Ethereum will in the long run profit from DeFi explosive growth.

However, throughout 2019, analysts have seen a distinct divergence between Ethereum’s utility and ETH price.

Image Credit: DeFi Pulse, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.