The first and largest crypto asset, Bitcoin (BTC) has been one of the best-performing assets on the planet since its launch in 2009. The flagship asset surged by nearly 9 million percent in price between 2010 and 2019. Simply holding or averaging into Bitcoin (BTC) positions yields a certain profit benchmark.

On November 5, Bitcoin (BTC) attained a new yearly high at $15,960 before a retracement. Data aggregator, Messari noted that Bitcoin has now spent more than 20 days above the $15,000 resistance level and 19 days above $15,109. This represents roughly 0.4% of the flagship asset’s life since it was created in 2009.

Following a price rejection at $15,960, BTC price fell to lows of $14,310 on Saturday as Major media outlets declared Joe Biden as the projected winner of the U.S. 2020 election.

The confluence of factors such as a Biden Presidency, the perception of Bitcoin evolving from a risk-on asset to a safe-haven asset, and a post halving historical cycle have spurred analysts to speculate how Bitcoin price may be impacted in 2021.

BTC/USD Daily Chart

BTC/USD Daily ChartBitcoin (BTC) is presently trading at $15,374, up from the prior day’s low of $14,310, gaining nearly 5% on the day.

In May 2020, Bitcoin had its 3rd halving event. The prior halving was recorded in 2016 as this event takes place every four years. From historical cycles, in 2017, Bitcoin attained its all-time highs 15 months after the 2016 halving. Therefore counting 15 months from the latest May halving will imply that the chances of a new peak in mid-2021 remain high.

Meanwhile, analysts expect the BTC rally to extend into early 2021, expecting BTC to enter price discovery and hit new all-time highs. In the long term, cryptocurrency investors and analysts say the perception of Bitcoin as a durable store of value would push its valuation.

Tyler Reynolds said the fixed supply of Bitcoin makes it compelling as a hedge against government spending. This he said:

“As it’s currently shaping up, the next bull run will be led by BTC with the very narrative that OGs have been saying since 2011: Bitcoin’s hard supply cap makes it a durable SoV as governments devalue their fiat currencies to support unconstrained government spending.”

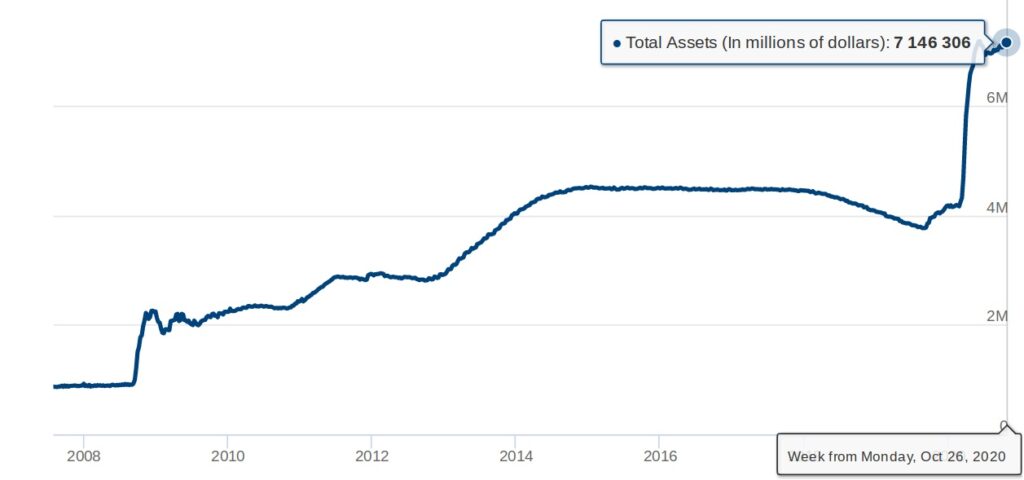

Recent data on Friday indicated that the Fed’s balance sheet stood at $7.14 trillion, nearing record highs. U.S. national debt has peaked at $27.2 trillion, a figure never is seen before in history.

Fed balance sheet since 2007. Courtesy: Federal Reserve

Fed balance sheet since 2007. Courtesy: Federal ReserveMacro investor and fund manager Paul Tudor Jones and other prominent investors call Bitcoin ‘an ideal inflation play’.

The attractiveness of Bitcoin to institutions is because it could act as a hedge within a diversified portfolio and also give investors exposure to its asymmetric risk-reward potential.

The year 2020 saw an increase in governmental action considering BitMEX charges by CFTC and OKEx withdrawal freeze. Sasha Ivanov, CEO, and founder of Waves Platform noted major developments in the forms of CBDCs and tax policies at present while noting that Crypto regulation is still in its infancy. He noted that crypto regulation will be the main focus area in 2021. This he stated:

“Regulation is certainly going to be an area of focus in the crypto space going into this next year. It’s only a matter of time before an increasing number of jurisdictions adhere to regulations. The right kind of regulation a good thing for the crypto space.”

In terms of regulation, Jake Chervinsky of Compound Finance stated that the US President-elect, Joe Biden has not expressed any public stance towards crypto. This he said:

“President-elect Biden hasn’t said anything publicly about his views on crypto. For now, it isn’t a big enough issue to warrant his attention. The next four years of US crypto policy depends on who he appoints to key positions; we’ll know more as the transition gets going.”

The election of Biden brightens the prospect of a stimulus package by the end of 2020 which could positively affect Bitcoin. Although there is a possibility that this coupled with improving investor confidence could initially have a positive impact on the price of Bitcoin, It is also essential to state that over time, a strengthening dollar scenario induced by the stimulus package could apply additional selling pressure on Bitcoin.

Image Credit: Federal Reserve, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.