Bitcoin price fell to fresh lows of $33,347 on June 20 amid fears of potential downside due to a bearish cross formation. The overall Altcoin market trended down with tokens such as Dogecoin (DOGE, -5.32%), XRP (-5.40%), Filecoin (FIL, -5.58%), Monero (XMR, -6.79%), Theta Fuel (TFUEL, -9.56%), NEM (XEM, -6.65%) recording losses.

As of press time, a mild recovery was seen to be taking place across the Altcoin market as tokens like Shiba Inu (SHIB, +3.29%), Waves (WAVES, +10.14%), Thorchain (RUNE, +5.18%), Yearn. finance (YFI, +4.58%), Sushiswap (SUSHI, +8.22%), Arweave (AR, + 8.54%) traded in the green.

The question in the hearts of many seems to be ”is the bull market over now?” as regards this, it may be essential for investors to bear in mind the reality that markets form trends in all time frames, from 1-minute to monthly and yearly views. As a result, bull and bear market trends are relative rather than absolute, making it easier to focus on specific time frames or to consider the sequence of peaks and lows on the price chart.

While there’s no perfect way to label a bull or bear market. It may be quite helpful to consider the classic Dow Theory, stating that higher highs and higher lows describe an uptrend (bull market) while lower highs and lower lows describe a downtrend (bear market). Bitcoin was trading at $35,800 as of press time.

Bitcoin (BTC)

Bitcoin (BTC) price remains in a tussle between bulls and bears, while Bitcoin bears seem to be gaining the upper hand with the formation of a bearish ”death cross” on its daily chart, other factors may be worth considering.

David Lifchitz, Chief investment officer of ExoAlpha believes that for a bullish move to happen, Bitcoin miners would need to exhaust their selling or be convinced that they would later sell their BTC reserves at higher prices. Meanwhile, dip buyers and institutional investors should provide further upside tailwinds while Elon Musk tweet-factor may be worth considering.

Another factor that may determine price trend in the near term bothers around an imminent Grayscale ”unlocking phase”. In the coming weeks, a large number of Grayscale investor funds will be released after a 6-month lock-up period.

This may result in more sell-side pressure on Bitcoin (BTC) as accredited investors seek to recoup some of their losses by selling BTC on the spot market. Unlockings from mid-April to date was suggested as one of the factors that led up to Bitcoin declines since April 14 all-time highs of $64,899.

Analyst Tonald Dusk states “Between mid-April 2021 to today there have been 139.5K BTC (GBTC) in unlockings, I anticipate price to decline again in mid-July as there remains a further 140K GBTC to be unlocked.”

Ethereum

The second-largest cryptocurrency, Ethereum (ETH) faces its largest options expiry ever on June 25 as nearly $1.5 billion out of $3.3 billion notional open interest (OI) in ETH options will expire. The huge expiry amid the ongoing market declines is indicative of increased interest in the ETH derivatives market despite Ethereum’s lackluster trading.

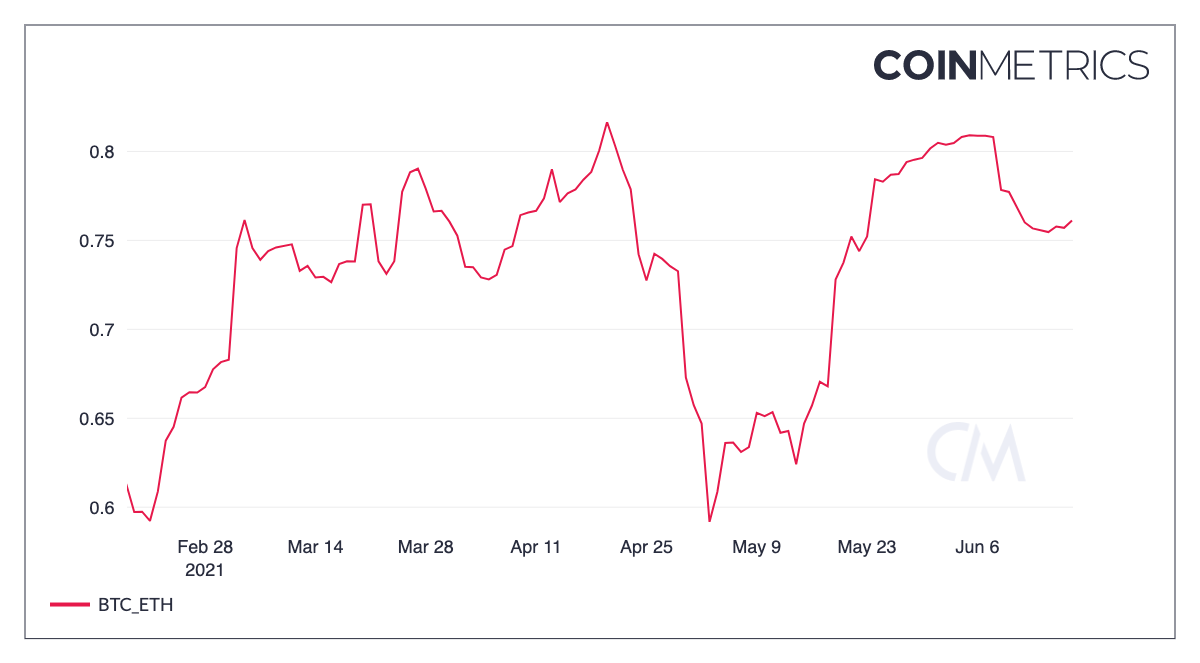

While Ethereum’s ‘London’ hard fork set to go live on Testnets starting June 24 is a positive boost, another factor that may contribute to Ethereum price in the near term remains the Correlation between BTC and ETH which rebounded significantly to 0.9 in early June, holding high levels since.

BTC/ETH 30-day correlation

BTC/ETH 30-day correlationAltcoins

A string of mixed news keeps rocking the Altcoin space, first is Grayscale stating that it was considering 13 more tokens, most of which are DeFi-focused, for potential development into investment products. The tokens include 1inch, Bancor, Curve, Polygon, and 0x, among others.

Another is the Swiss Federal Council enacting a new ordinance to regulate DeFi. The news follows after Mark Cuban called for regulators to determine what constitutes a “Stablecoin.” After losing money from the price crash of DeFi token TITAN.

Altcoins have been posting similar trends alongside Bitcoin recently, while there is no guarantee that this pattern will repeat when Bitcoin fully recovers, it may be essential for investors to pay close attention to market trends to decide the start of the next ”Altseason”.

Image Credit: COINMETRICS, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.