On February 4, Bitcoin (BTC) circled $23,400 as bulls resisted giving up support in after-hours trade. The asset is presently trading at $23,329, a decrease of 0.83% over the previous 24 hours. On Thursday, BTC rocketed to a 6-month high of $24,148 before running into resistance at the price point, causing a subsequent slump below the $24K threshold. A brand-new Bitcoin (BTC) whale recently acquired 13,369 BTC in one transaction, going from having a balance of $0 to $313 million in a single transaction. The transfer is the biggest that has been seen on the Bitcoin network in the previous four weeks. Through its official Twitter account, the on-chain analytics platform Santiment recently made people aware of the development. Santiment continued, “Track this wallet here as prices fluctuate going forward.”

Key Levels

Resistance Levels: $30,000, $27,000, $25,000

Support Levels: $23,500, $21,500, $18,500

BTC/USD Daily Chart

BTC/USD Daily ChartThe daily chart’s Relative Strength Index, which continues a trend in the overbought territory, also might fall beneath 70. BTC/USD trades above the daily 50 and 200 moving averages as its trend remains upbeat. In general, Bitcoin’s bullishness isn’t fully reflected by the trend intensity yet.

The first levels to take into account are $25,000 levels, a transient high of $25,214 levels, and a temporary limit of $27,000 levels that existed in June 2022, right before the Fed rate. The level above here and of $30,000 swing high before the crash in March, offers additional robust resistance.

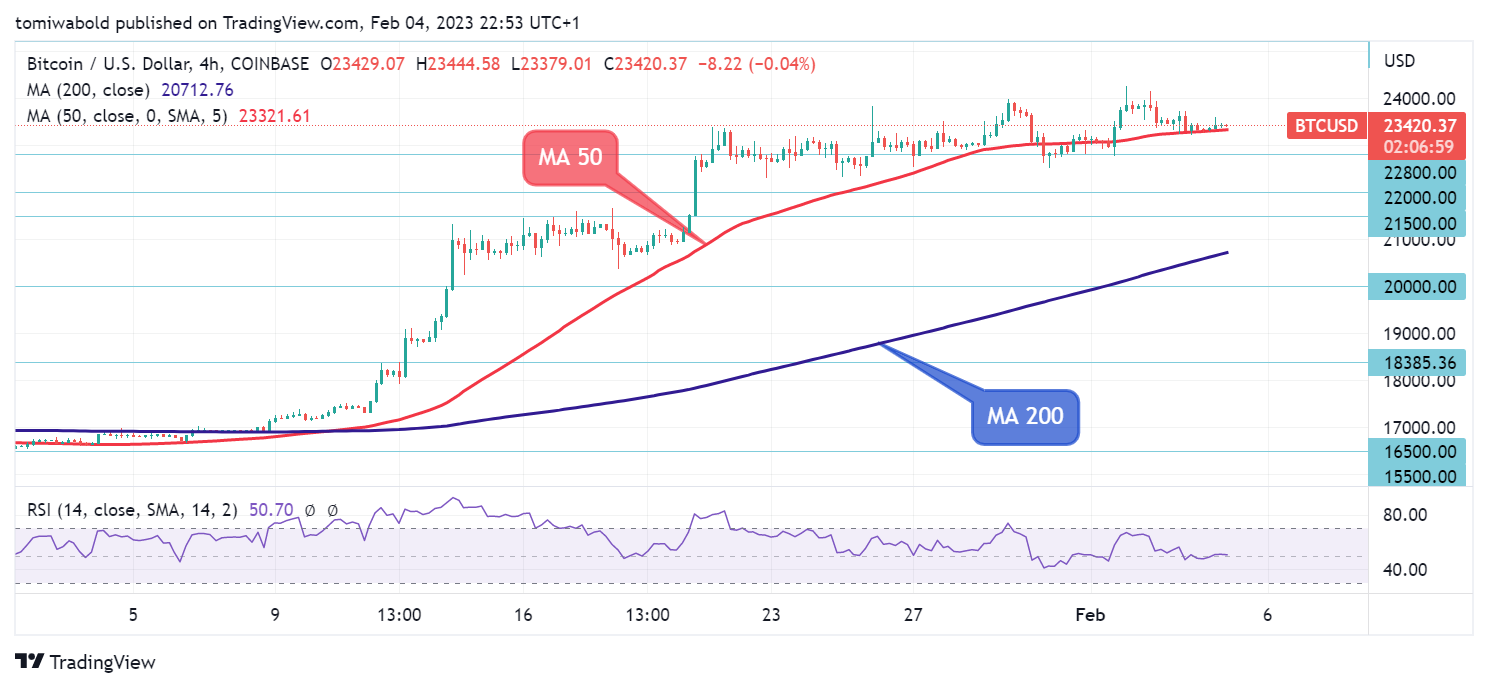

BTC/USD 4-Hour Chart

BTC/USD 4-Hour ChartThe BTC/USD trend remained in an ascending pattern since last week as it continued to consolidate above the $22,000 level. The early bias expected in the new week might remain neutral if this weekend ends positively. However, with the support level at $22,000 intact, a further surge is expected.

If $25,000 is breached on the upside, the surge from the $23,500 level may be extended. However, a break of the $22,000 support level may confirm a short-term topping. The 4-hour moving average (MA 50) and intraday low at $23,500 might continue to hold the bears from shifting the trend back to the downside.

Note: Kryptomoney.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Image Credit: Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.