The cryptocurrency market is in the middle of a recovery phase following Monday’s downslide. Previously, Bitcoin faced multiple waves of corrections after a brief pullback toward the $30K low, the lead crypto recovers and aims to print a new high. The bulls’ efforts pay up in a return rally as BTC/USD grinds past $40,000. BTC opened today’s trading session at $37,393 and rose past $40,000. As the weekend draws nigh, BTC could spike beyond $41,500 again and perhaps set a new record high. The market cap currently stands at $726.24 billion, ranking BTC 1st on the Coinmarketcap table, with $66.36 billion in trading volume over the past 24 hours. The price of Bitcoin (BTC) has extended its recovery at the time of this post to $40,127 high and it’s likely to continue to move higher. Grayscale Bitcoin Trust (GBTC) holdings increased to 608,810 following Grayscale purchase of 2,170 BTC which is $80M worth of Bitcoin. That seems to have somewhat affected Bitcoin’s price as several institutional investors keep stating they’ll enter the Bitcoin space through Grayscale.

*Previously, Bitcoin faced multiple waves of corrections after a brief pullback toward the $30K low

*The bulls efforts pay up in a return rally as BTC/USD grinds past $40,000

*Grayscale Bitcoin Trust (GBTC) holdings increased to 608,810 following Grayscale purchase of 2,170 BTC which is $80M worth of Bitcoin

Key Levels

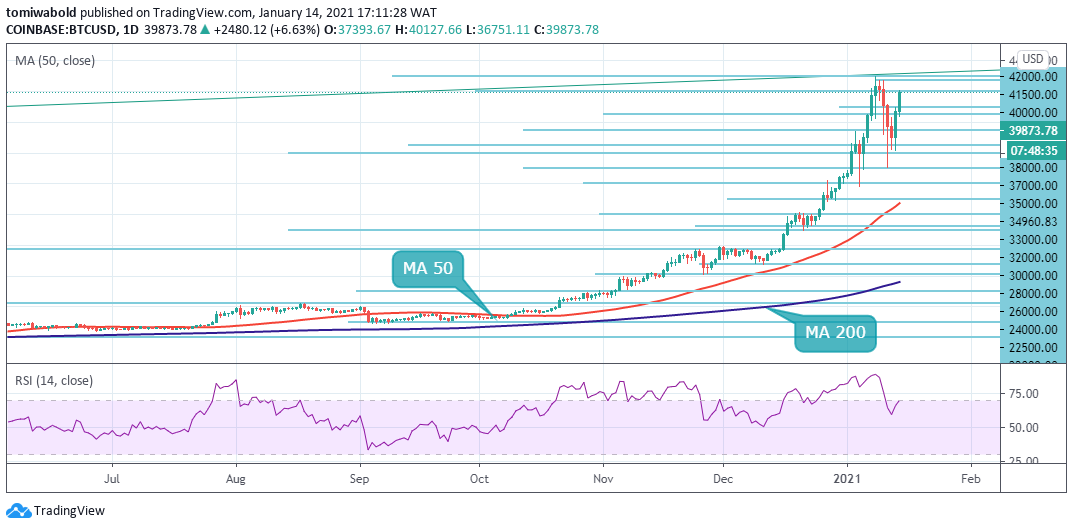

Resistance Levels: $42,000, $41,500, $40,000

Support Levels: $38,000, $37,000, $35,000

BTC/USD Daily Chart

BTC/USD Daily ChartBitcoin has moved fast past the $40,000 after testing $30,000 earlier this week. A daily close past $38,000 may see BTC explode past the $40,500 mark and perhaps reach new record highs. In the meantime, it is unlikely that bears could prevail in the market, and BTC/USD could decline below $30,000 due to the support formed by the weekly low.

On the flip side, the Bitcoin bullish narrative will be thrown out the window if a correction occurs under $38,000. The MA 50 might absorb some of the selling pressure, but some of the most formidable support levels sit at $38,000, $35,000, and $32,000. The level at $30,000 is home to BTC’s primary support.

BTC/USD 4-Hour Chart

BTC/USD 4-Hour ChartBitcoin has broken above the technically important $38,000 mark, meaning that the BTC/USD pair has broken from the $30,000 past the $38,000 trading range. Technical analysis shows that the key former swing-high, close to $42,000, is the next major upside level bulls need to break. A move past the $40,500 level could cause Bitcoin to test towards its all-time price high, around the $42,000 level.

The prospect of further upside towards the $42,000 level remains possible as long bulls continue to defend the psychological $39,000 long. The BTC/USD pair is only bullish while trading above the $38,000 level, key resistance is found at the $40,000 and the $42,000 levels. If the BTCUSD pair trades below the $38,000 level, sellers may test the $37,000 and $35,000 levels.

Note: Kryptomoney.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Image Credit: Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.