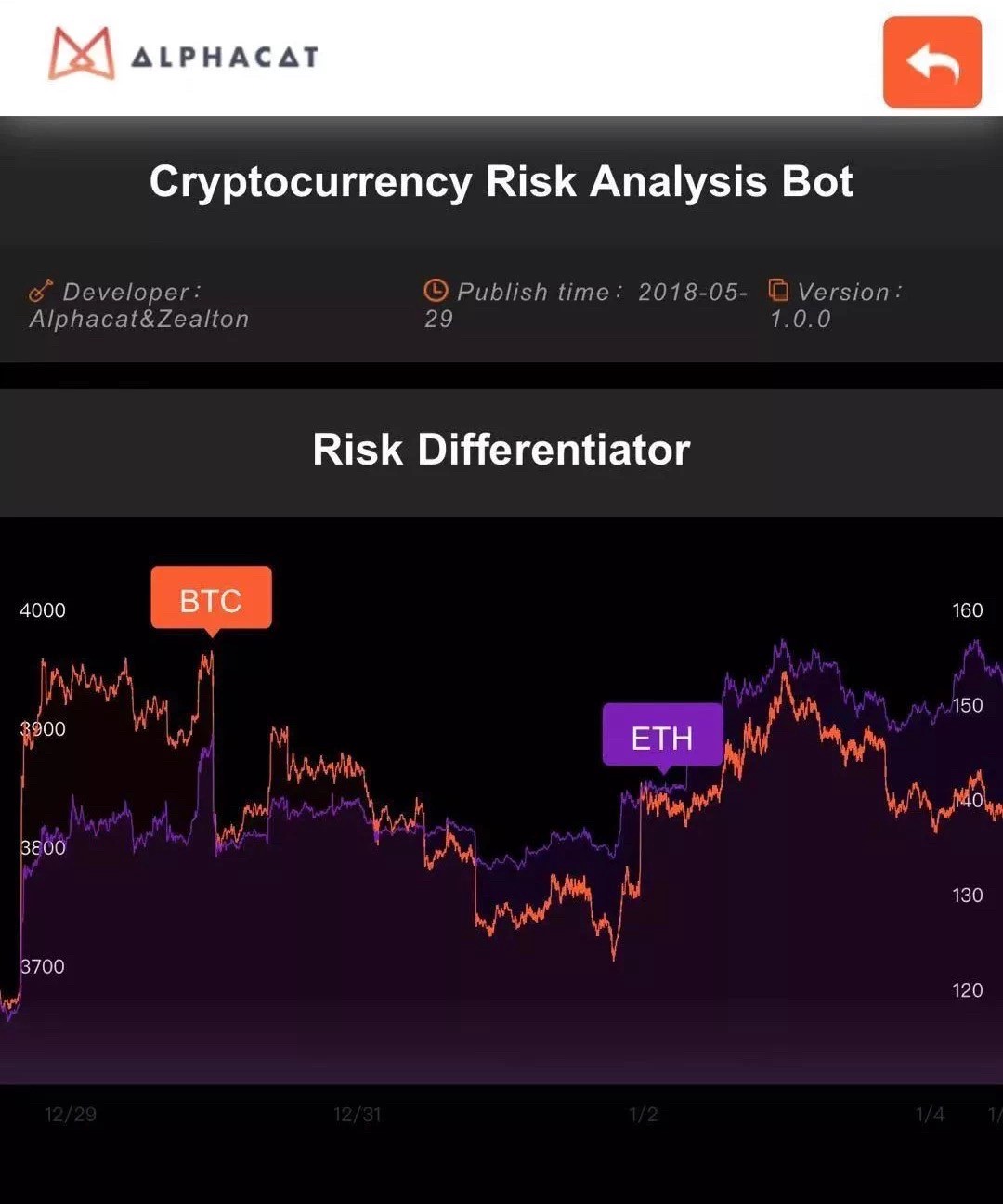

published report further claims that both the new features were developed by the Alphacat team independently. Further elaborating over the Alphacat states that CRAB analyzes the relative risk profile of different cryptocurrencies and will enable the traders to “cultivate a scientific and mature approach to investing.”

The first Risk profiles are created by analyzing the historical trading data of different indexes, this data is then overlaid with technical indicators that measure the index’s volatility, momentum, volume, and other risk correlation factors.

In simpler terms, the bot will enable traders to visualize the risk of different cryptocurrency pairs as an additional indicator that can help them better manage their positions. The traders will also get a feel for the general levels of risk in the market as well as the risk between specific coins by observing the convergence and divergence of the indicator lines.

If the lines converge in the same direction, it implies that no one coin is riskier than the other in the short-term. On the other hand, divergences could indicate technical weakness, leading to a higher relative risk profile for one coin compared to another.

The next feature for the platform, the ACE Top Index, is a weighted cryptocurrency index which will represent the performance of the ten largest cryptocurrencies by market capitalization.

The index claims that it will be updated in real-time and reflect the aggregated value of the largest cryptocurrencies. Similar to the traditional stock market indexes such as S&P 500, cryptocurrency indexes aid the traders to analyze the performance of specific coins against the trend of the market, along with their average price changes.

The index will also serve the traders as an additional investment vehicle if they’d like to open a position on the market as a whole as opposed to individual cryptocurrencies.

In December, Alphacat’s ACAT store listed eleven new applications, bringing its total number of apps to 65. The apps are distributed in the following categories:

The applications have been developed by Alphacat as well as third-party teams. Updates were also made on Alphacat’s real-time forecasting engine to predict the price of cryptocurrencies. Reportedly, the engine went through an algorithm change that reflected a 5% increase in its prediction accuracy. To check out the full report, visit Alphacat’s Medium post.

Read more: Opera Launches Ethereum Blockchain Based Mobile Browser With Inbuilt Ethereum Wallet

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.