The cryptocurrency market furthers its decline for the second consecutive day. Bitcoin traded to lows of $33,650 while Ethereum cascaded down to lows of $2241 during Saturday trading. The global cryptocurrency market cap stood at $1.49 trillion as of press time representing, a 5.32% decrease over the last day.

Amid the widespread cryptomarket declines, selected token such as Horizon (ZEN,+16.58%), Numeraire (NMR,+64.65%), MaidSafeCoin (MAID,+18.34%), Ontology Gas (ONG,+9.30%), Axie Infinity (AXS, +13.59%), CreditCoin (CTC, +18.90%), SingularityNET (AGI,+20.34%) managed to suppress the selling wave by trading in green at the time of writing.

SingularityNET (AGI) a blockchain-powered platform that allows anybody to easily “create, share, and monetize” AI services on its AI marketplace rallied on the news of the AGI protocol undergoing a hard-fork on May 28th to AGIX to add crucial functionality on Ethereum ETH & Cardano (ADA) after which AGI holders will receive a 1:1 airdrop of AGIX.

Horizen (ZEN)

Horizen (ZEN) is a secure, interoperable blockchain ecosystem that enables businesses and developers to build fully customized blockchains and Dapps. On May 28, Horizen had its 4th anniversary which will be celebrated with a Livestream including a speech from Rob Viglione, Co-Founder of Horizenglobal, and also a ZEN airdrop to its users.

An upcoming Zendoo mainnet release is another positivity for ZEN price. At the time of writing, Horizen (ZEN) traded at $114, up 18.20% in the last 24 hours and 16.63% weekly.

Numeraire (NMR)

Numerai is an Ethereum-based platform allowing developers and data scientists to experiment and create machine learning models with improved reliability. The platform’s main goal is to bring decentralization to the data science field and allow developers to compete in creating effective machine learning prediction models.

NMR gained significant ground against Bitcoin while recording a strong breakout in its BTC pairing on May 28. This was reflected in its USD pairing as it surged from lows of $39.74 to intraday highs of $68.86, rallying nearly 73%.

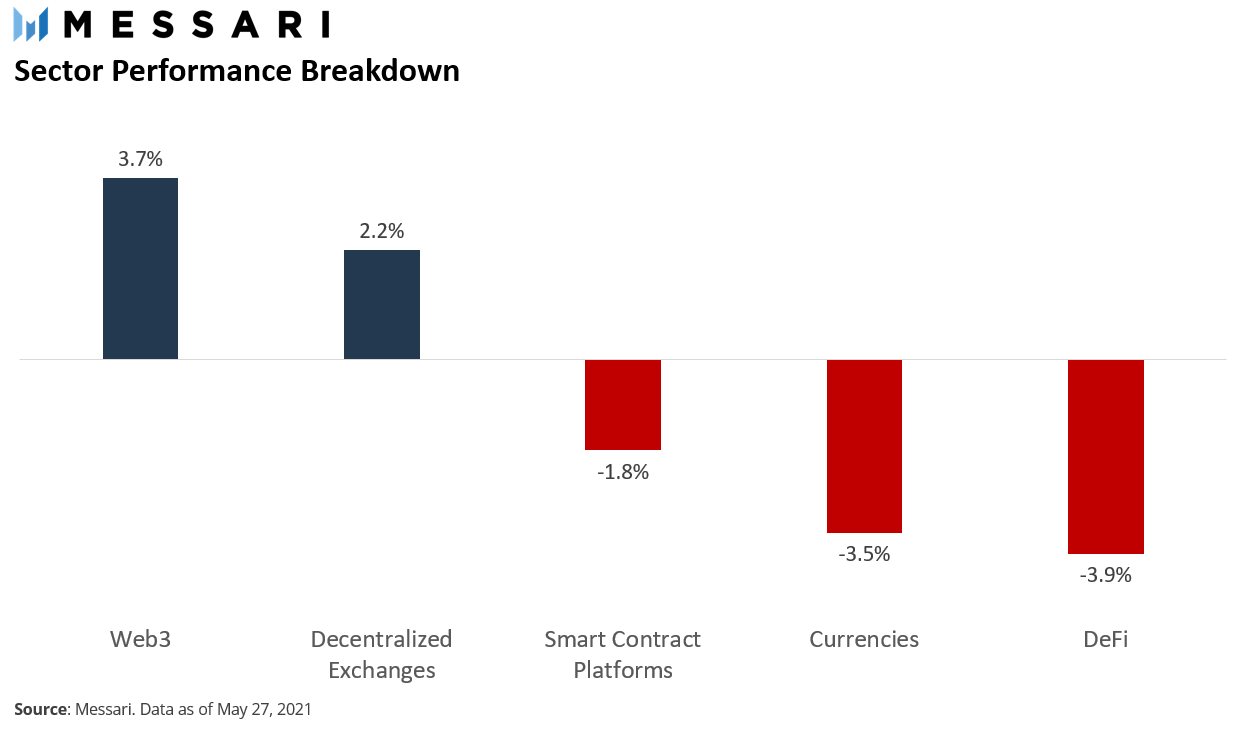

Data aggregator Messari indicated that towards this week ending, the crypto market saw a quick reversal to last week’s market crash.

Giving a brief recap on the weekly performance of various market sectors, it indicated that Web3 (+3.7%) and DEXs (+2.2%) had positive performances while other sectors namely Smart Contract Platforms, -1.8%, Currencies, -3.5%, DeFi, -3.9% posted negative performances.

The data aggregator also noted that cumulative performance across sectors sunk as much as 30% by mid-week but quickly bounced back. Web3 and DEXs finished the week with a 28% return while Smart Contract Platforms ended with a 23% return.

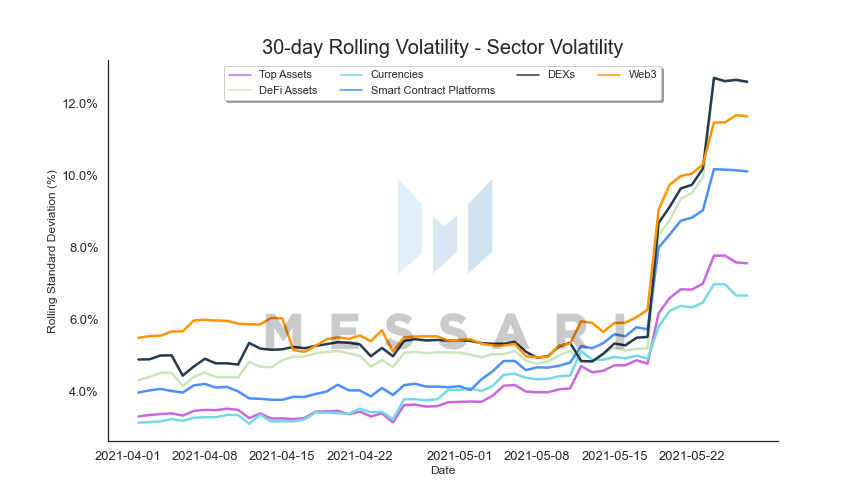

Sector Volatility, Courtesy: Messari

Sector Volatility, Courtesy: MessariMessari indicated a general spike in volatility across the board stating, ”All sector portfolios saw a spike in volatility starting mid-May as the market declined”. Noting that after the crash, DEX portfolios such as Uniswap, PancakeSwap, and THORChain saw the highest increase in volatility from 6% to 12.5% over the past two weeks.

Image Credit: Messari, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.