The first digital asset tends to be synchronized with stock indices, while the markets are cluttered with fear. The cryptocurrency market does not seem to decide where to go. Ever since the start of the week, the first digital asset has been rangebound underneath $9,792; though, the absence of follow-up through frustrated the bulls as the price on BTC/USD retreated from $9,500 following major cryptos sell-off. BTC/USD is floating around $9,285 at the time of posting, down 3.7 percent from the day’s start. Whales have initiated 4 BTC ($287.9 million) totaling 29,986 transactions on Bitcoin blockchain in the last 24 hours. 3 transactions worth BTC 13,049 ($125.7 million) were transferred from Binance to anonymous addresses, 4 transactions worth BTC 10,294 ($99.1 million) were transferred to Binance and OKEx exchanges, and the last transactions were transferred between crypto-currency and custodial services.

*Ever since the start of the week, the first digital asset has been rangebound underneath $9,792

*The absence of follow-up through frustrated the bulls as the price on BTC/USD retreated from $9,500 following major cryptos sell-off

*Whales have initiated 4 BTC ($287.9 million) totaling 29,986 transactions on Bitcoin blockchain in the last 24 hours

Key levels

Resistance Levels: $10,500, $10,000, $9,500

Support levels: $9,200, $8,800, $8,500

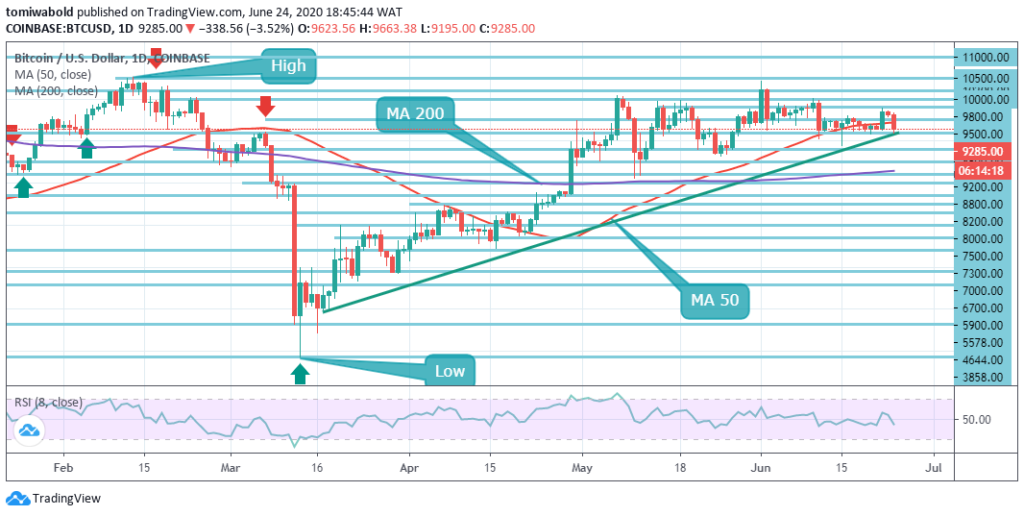

BTC/USD Daily Chart

BTC/USD Daily ChartBTC/USD has slipped beneath daily MA 50 on the daily chart at currently $9,450. The sell-off is likely to gain intensity with the next emphasis on $9,000 (the lower boundary of the ascending trendline) and $8,800, supported by $8,500 (the lowest May 25 level). On the upside, a continual push beyond $9,500 is required to get the rebound back on course. The next local resistance is active at the weekly $9,792 strong level, while the ultimate barrier emerges at $10,000.

Consolidation may keep carrying the day for now until Bitcoin attempts a breakout beyond $9,800 where the right volume may support as well. On the contrary, in the particular instance where sellers gain greater control and dominance in the upcoming sessions, expect support from the horizontal support line at ($8,800), which follows the ascending trendline immediately.

BTC/USD 4-Hour Chart

BTC/USD 4-Hour ChartThe sell-off stalled on the intraday chart after hitting the ascending trendline at around $9,200. Once this is out of the path, the downside is probable to gain momentum at $8,800-$8,500 with the next priority on the consolidation channel’s lower boundary. On the positive, to alleviate the bearish pressure and get the rebound back on track, we’ll need to see a push back beyond $9,200. The next resistance comes at $9,792 high on Monday.

BTC/USD is already shifting at low volatility, despite a short-term bias. The BTC/ USD pair is only bullish whilst also trading beyond the level of $9,500, key resistance is discovered at $10,000, and $10,500. If the BTC/USD pair exchanges beneath the level of $9,200, sellers may test the support levels of $8,800 and $8,500.

Note: Kryptomoney.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Image Credit: Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.