The Maker community seems to be in a fix at the moment. In the last week, top cryptocurrencies had posted serious losses. Top crypto asset, Bitcoin plunged in a market carnage which reached its crescendo on Thursday dragging down its price from $7,700 to sub $6,000 nosediving further to hit the new year low of $3,858. ETH had its share in the market carnage as it recorded a significant drop, plunging from near $194 to as low as $90 and recently $124, where it stands at the moment.

The aggregate dollar value of ETH locked in DeFi protocols nosedived by over 20% as accounted for in US Dollars (dropping from $889 million to $691 million). This erased the recent increase of 200,000 ETH recorded recently in the aggregate value.

An analyst has attributed the sharp drop to users with loans on Maker seeking to jack up their collateralization to prevent liquidation.

MakerDAO, ETH DeFi key player, loans DAI for collateral in the form of Ether. As ETH plunges, MakerDAO’s protocol enters the short sell position automatically.

Following the crypto market meltdown which left the assets in losses, the protocol’s auction couldn’t keep up the pace prompting Maker’s stakeholders to be up to their sleeves in preventing a shutdown of the protocol.

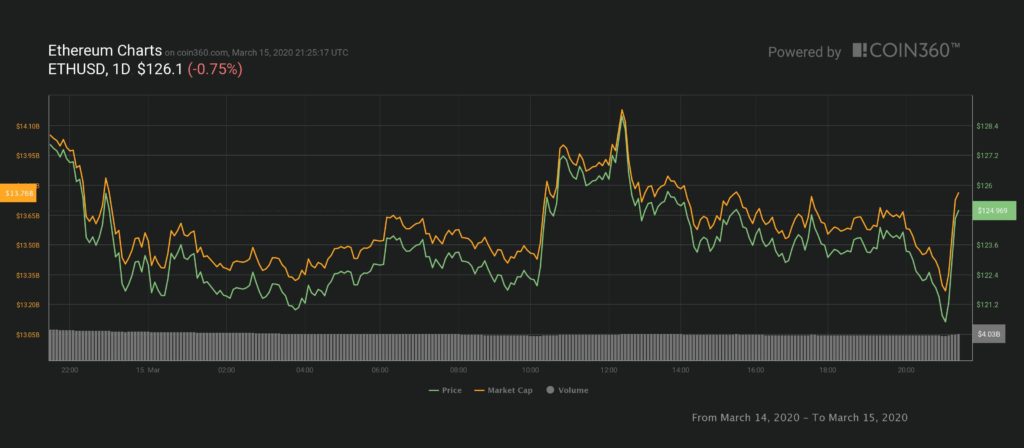

ETH as viewed on Coin360

A developer, Longforwisdom stated that a shutdown may be inescapable if ETH price plunges further to around $80 which is approximately 40% drop, such an option may be considered. For now, stakeholders are putting measures in place to prevent a disabling of the protocol.

A spokesperson from MakerDao hinted on its persistent efforts to surveil, evaluate and settle the recent situation.

In a shutdown scenario, the crypto market will surge with nearly 2.4 million ETH, which will cause the price to plummet. This will result in recent CDPs (Collateralized Debt Positions) being frozen, auctions finalized while the leftover DAI can be redeemed for ETH at a fixed price created at the moment of a shutdown.

Robert Leshner, a DeFi protocol Compound Finance creator, weighed in stating that the shutdown will make DAI redeemable for the Ether backing all of the DAI remaining. It loses its Stablecoin feature and starts operating like Ether, price-wise.

A shutdown, if it happens, will cause DAI holders to take a bath, accepting a valuation or return that is less than optimal. MKR tokens will also follow in this deluge by taking a bath as revealed in MakerDao social contract in the event of a shutdown.

This will have an unplanned outcome for the totality of the ecosystem as it may catch some unaware.

Image Credit: Coin360, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.