In the prior week, the first and largest cryptocurrency, Bitcoin (BTC) price plunged significantly after reaching a peak of $19,500 to lows of $16,200. Bitcoin’s recovery kicked off after it touched down the key support at $16,400 which was noted to be whales cluster region. In a steady rise, Bitcoin tested $18,000 on Nov.29, peaking at $18,248.

Two key trends were also attributed to be fueling the recovery of BTC. First, Guggenheim Investments, a global asset management firm with over $233 billion in assets under management, secured the right to invest $500 million in the Grayscale Bitcoin Trust. Second, high-net-worth investors and whales might be buying the dip.

However, a pseudonymous trader “Crypto Capo” stated that he sees a scenario playing out where BTC rises to $18,000 then falls to the $13,000 region. This brings up the question of whether the correction is over or not.

BTC/USD Daily Chart

BTC/USD Daily ChartBitcoin presently trades at $18,290.

A crypto analyst “CryptoBirb” noted that Bitcoin typically faces two types of correction: 15% and 30%. Stating further that while he is expectant of a 30% correction to $14,000 which remains uncertain, likewise he is expectant of ATH before Christmas. Historically, in the previous bull cycles, BTC plunged 30%–40% before continuing its rally.

Some analysts think that BTC likely bottomed at the weekend due to market trends, but sell-offs during a bull market can become overextended prompting the question of what chances do the bulls have? These two factors may provide some direction:

1. A Sustained Break of $18,000 Is Essential for BTC to Regain Bullish Momentum

In this recent sell-off, an analyst noted on some lower time frame signals that critical resistance levels have begun forming at the $18,000 level. This became obvious when the BTC price touched down at the support level at $17,200, rebounded slightly, but met with rejection at $18,000. It established resistance at this level from its rejection wherewithal. It will need a clear break at $18k therewith to proceed further. The next barrier is found at the $18,600 level, which could not be confirmed as support in the previous uptrend.

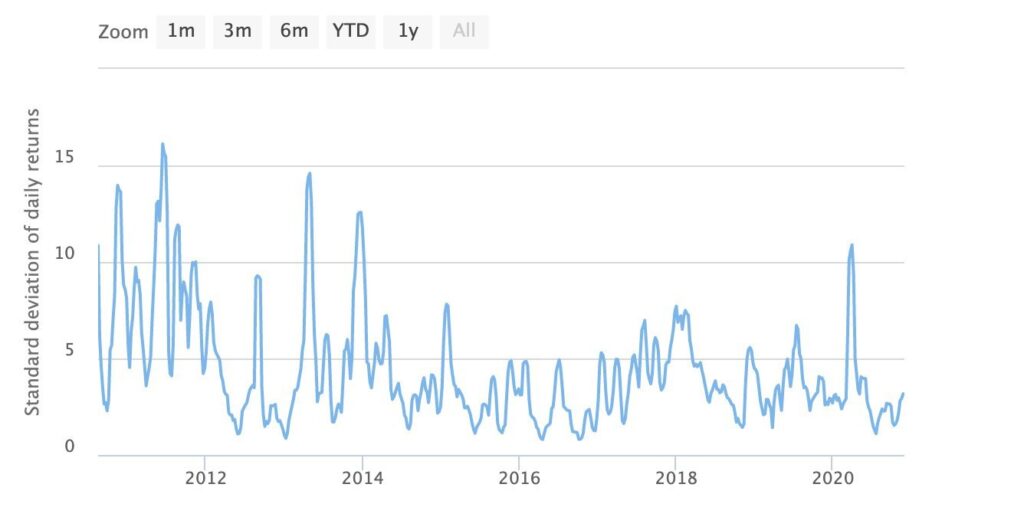

Historical Bitcoin volatility. Courtesy: Highcharts

Historical Bitcoin volatility. Courtesy: HighchartsBitcoin would need to reclaim $18,400 and consolidate above it to confirm the new support levels. If the $18,000 to18,500 breaks, a further sustained rally toward new all-time highs is a very likely outcome. On the contrary, if BTC rejects at $18,400, it would confirm $18k as a lower high thereby creating a new range between $16,000 to $18,000 which may lead to further sell-off. He however ruled out the likelihood of a plunge beneath $14,000 which acted as the top of the bull cycle in June 2019.

If BTC holds above $14,000, the next rally may push BTC to a new ATH of $30,000.

2. Technical Indicators, Bitcoin Bulls Are Saying This

On the lower time frames, various technical indicators signal that Bitcoin is neither overbought nor oversold. On the hourly chart, for instance, the Relative Strength Index (RSI) of BTC is above 60. Avi Felman, the head of trading at BlockTower stated that BTC frequently tends to recover right when traders expect more downside and market sentiment reaches a low point.

He further explained:

“Decent and extended Coinbase selling at the local bottom for the first time, the rally suggests to me that retail is slowly picking up. Fairly obvious transfer from weak hands to strong hands over the last 48hrs. Pullbacks in bull markets always hand you a silver platter of reasons to sell.”

Macro investor Paul Tudor Jones using a fractal pattern hints that Bitcoin price is in an early stage of long-term rally like gold was in the 1970s.

Image Credit: Highcharts, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.