The price of Bitcoin (BTC) has surged in recent months, leading to a new all-time high of $24,300. However, there was a correction in BTC price on December 21 as the stock market also opened in the red. Bitcoin price fell to a low of $21,800 on Monday, while the US dollar (DXY) currency index showed a strong jump.

Bitcoin is returning to its positions before the sell-off, peaking at $24,042 at the time of writing. A combination of macro factors has supported Bitcoin’s appeal, with the U.S. Congress passing another $908 billion in the coronavirus stimulus bill.

Why Bitcoin was rejected at $24,000? Heatmap order book data shows that selling pressure at $24,000 and final resistance at $25,000 have remained, somewhat dampening the outlook for a stronger rally to new all-time highs.

Bitcoin is presently trading at $23,639.

Bitcoin traded to highs of $24,042 before suffering a rejection. Pierce Crossby of Tradingview stated he does not anticipate any negative developments in the near term, which gives rise to a bullish outlook for the future price of BTC. He stated:

”What goes up must come down? Not so fast, Right now, I see very near-term headwinds for Bitcoin,”.

Since the last BTC price increase past $24,000, Bitcoin maintained sideways trading until its recent drop on December 21. Bitcoin may have returned to its previous levels before the sell-off, but it still faces resistance at $24,000. Every time Bitcoin makes an impulse move, investors expect some correction. While such corrections are very common in both bull and bear markets, investors are now regaining their confidence after seeing a consistent rebound from each dip as a bullish sign.

An analyst noted that the Bitcoin price must reject from the previous resistance area to confirm a bearish divergence. If BTC turns down from the $23,400 and $23,600 levels, there will be more opportunities for declines and higher time frame levels will be tested as support. However, if BTC breaks out to the upside from the $23,400 to $23,600 region, a new all-time high will likely be reached before the end of 2020.

Speaking about the possibility of recycling of profits back to Altcoins during the BTC consolidation phase, Crossby stated that he remains unsure about the Altcoin scenario, stating:

“Unfortunately for ‘Alt lovers,’ Bitcoin is on a stronger footing relatively speaking.”

Bitcoin surpassed the top 15 Altcoins last week, which climbed 7.7% on average. More importantly, Altcoin volumes are disappointing compared to the 50% increase in Bitcoin. This reinforces the recent BTC dominance figure of 67.2% as institutional money continues to flow.

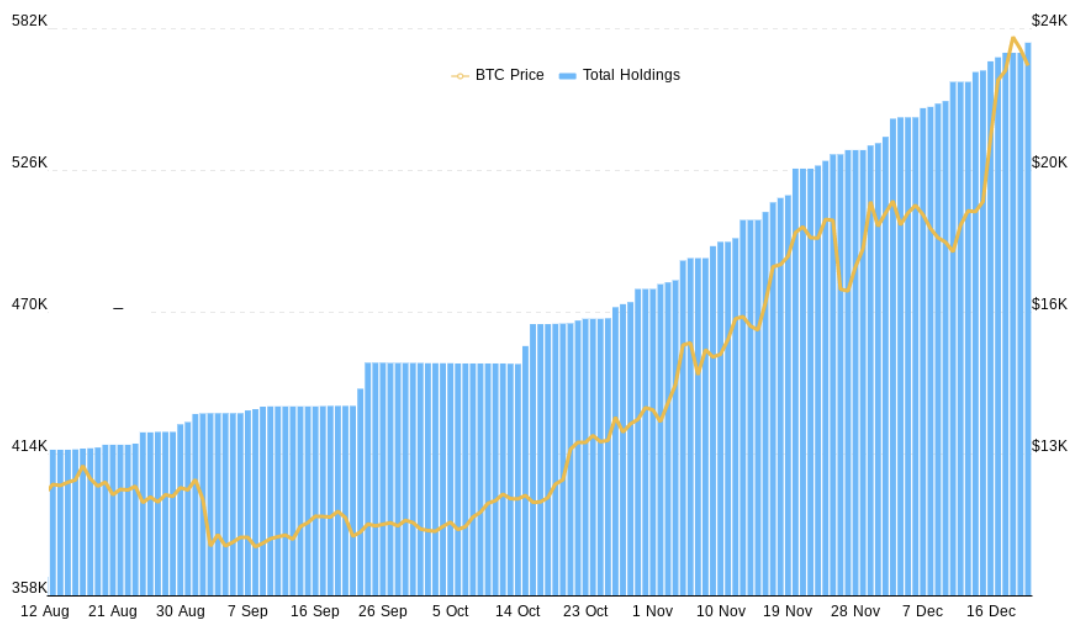

Grayscale Investments BTC holdings. Courtesy: bybt.com

Grayscale Investments BTC holdings. Courtesy: bybt.comMassMutual and MicroStrategy are two examples of major financial institutions jumping on the Bitcoin train and investing large amounts of capital. Rafael Schulze-Kraft, CTO at Glassnode, said in a recent tweet that big buyers MicroStrategy, Grayscale, and others are far from the only ones filling their bags.

Fresh comments from Michael Saylor, CEO of MicroStrategy seem to cast doubt on the notion that the company’s huge buy-ins in Bitcoin drove BTC up last week. The CEO said his purchases were infrequent batches of $1,000 to $2,000 and not in a lump sum.

“I was not a green candle. The green candles were other guys,”

Rafael Schultze-Kraft wrote concerning institutional inflow into the Bitcoin market:

“Expect many more on the move. They’re coming — gradually, then suddenly.”

Despite some well-known critics criticizing Bitcoin in 2020, it seems that the flagship has generated less public skepticism than in previous years.

According to major Bitcoin website 99bitcoins, 2020 was the year with the lowest Bitcoin ”Obituary” rate since 2013. Only seven ”Bitcoin deaths” were reported in the media tracked by 99bitcoins, down from 41 in 2019 and 93 in 2018 while the highest stands at 2017.

Image Credit: Bybyt.com, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.