Bitcoin is steady after prior 24 hours of continuous recovery and had regained the entire decline in a single bullish candlestick that recovered all of the losses and made a new high. The crypto market is steady after the BTC/USD pair’s strong rebound from the recent 9.5 percent lows. Bitcoin has regained 3 percent market share since these swings while increasing in value at $6,780 level. The coin bounces past $6,700 levels during early European hours in a $7,000 level re-attempt but failed to hold the ground. The economic turmoil caused by coronavirus affects miners as they remain cash flow negative, but the forthcoming block rewards halving for Bitcoin offshoots may prompt miners to switch to the BTC network. It is indicated by the recent major shift in the Bitcoin network mining difficulty.

*Bitcoin has regained 3% market share while changing hands at $6,780

*The coin rebounds past $6,700 levels in a re-attempt at $7,000 level

*The forthcoming block rewards halving for Bitcoin offshoots may prompt miners to switch to the BTC network.

Key Levels

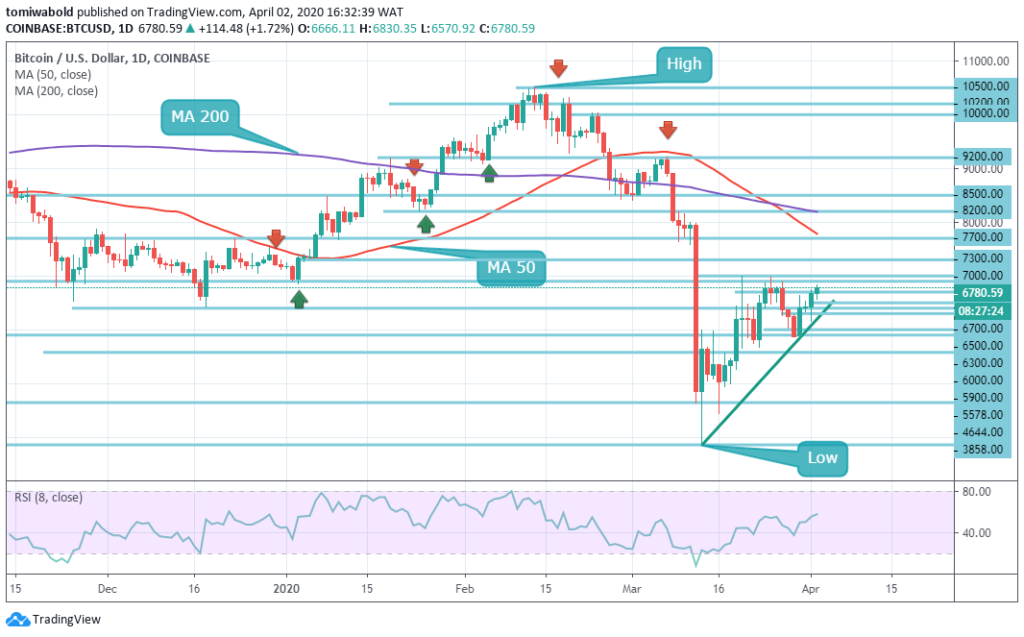

Resistance Levels: $8,500, $7,700, $7,000

Support Levels: $6,500, $6,000, $5,578

Bitcoin made a considerable bullish candlestick that covered the prior eight bearish candles, ripped through the level of $6,500 and made a new high close to $6,800 level. The BTC/USD pair is currently trading at $6,780 price level after struggling to break through the $6,900 price resistance, a level that is increasing to be significant due to the number of instances the BTC/USD has resisted advancement.

Bitcoin made a considerable bullish candlestick that covered the prior eight bearish candles, ripped through the level of $6,500 and made a new high close to $6,800 level. The BTC/USD pair is currently trading at $6,780 price level after struggling to break through the $6,900 price resistance, a level that is increasing to be significant due to the number of instances the BTC/USD has resisted advancement.

The first resistance level is above the market price at $6,900 level, then the second at $7,000 and the third at $7,300 level. The last level of resistance correlates with the ceiling of the long-term downward axis. The first support level is under the market price at $6,500 level, then the second at $6,400 and the third at $6,300 level.

From a technical standpoint, the key target for BTC bulls in the nearest future remains the $7,000 mark. The upper boundary of pennant formation reflects the psychological level. Once the price rejects this barrier, the chances are that the sentiments of the bears may become stronger and BTC/USD may breach its lower boundary and quit the formation.

From a technical standpoint, the key target for BTC bulls in the nearest future remains the $7,000 mark. The upper boundary of pennant formation reflects the psychological level. Once the price rejects this barrier, the chances are that the sentiments of the bears may become stronger and BTC/USD may breach its lower boundary and quit the formation.

In this scenario, a steady shift beneath the level of $6,000 may pave the way to the recent low level of $5,854. On the other hand, Bitcoin is likely to retain a sideways trading move as the RSI, for instance, is holding ground past 70, unconstrained by overbought conditions in the short term. In other words, compared to the sellers, buyers have more control over the price.

Note: Kryptomoney.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Image Credit: Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.